- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): Valuation in Focus Following S&P Index Addition and Strong Investor Momentum

Reviewed by Kshitija Bhandaru

BrightSpring Health Services (BTSG) shares climbed following news of its addition to several S&P indices, including the S&P SmallCap 600. Index inclusions often lead to increased buying interest because funds tracking these benchmarks make portfolio adjustments.

See our latest analysis for BrightSpring Health Services.

The index additions have clearly injected momentum into BrightSpring’s shares, with a 1-day share price return of nearly 1%, a 7-day gain of almost 5%, and a striking 71.6% share price return so far this year. That surge reflects both renewed investor attention and recent strong quarterly results, helping fuel an impressive 1-year total shareholder return of nearly 83%. Momentum has been building fast as fundamentals and market interest align.

Curious how other healthcare names are performing in this environment? See the full list of opportunities with our See the full list for free.

With such rapid gains, investors may wonder if BrightSpring’s stock still offers real value at today’s price. They may also question whether expectations for future growth are already fully reflected, leaving little room for a fresh buying opportunity.

Most Popular Narrative: 60% Undervalued

BrightSpring’s most widely followed narrative places its fair value at nearly $30, materially above its last close price of $29.73. This suggests room for further appreciation if projected fundamentals play out. The narrative builds its view on momentum in specialty pharmacy, home health expansion, and powerful demographic trends expected to reshape long-term revenues and margins.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross-selling. These are expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Want to know what sets this valuation apart? The narrative is anchored on surging profit growth, margin upgrades, and a future multiple that may surprise you. The expected earnings transformation and precise financial levers driving this number might upend your view on just how much value is still on the table. Ready to see how bold long-term assumptions are shaping this fair value?

Result: Fair Value of $29.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and any tightening in government reimbursement could quickly challenge these positive growth assumptions and shift sentiment on future gains.

Find out about the key risks to this BrightSpring Health Services narrative.

Another View: Price Ratios Paint a Costly Picture

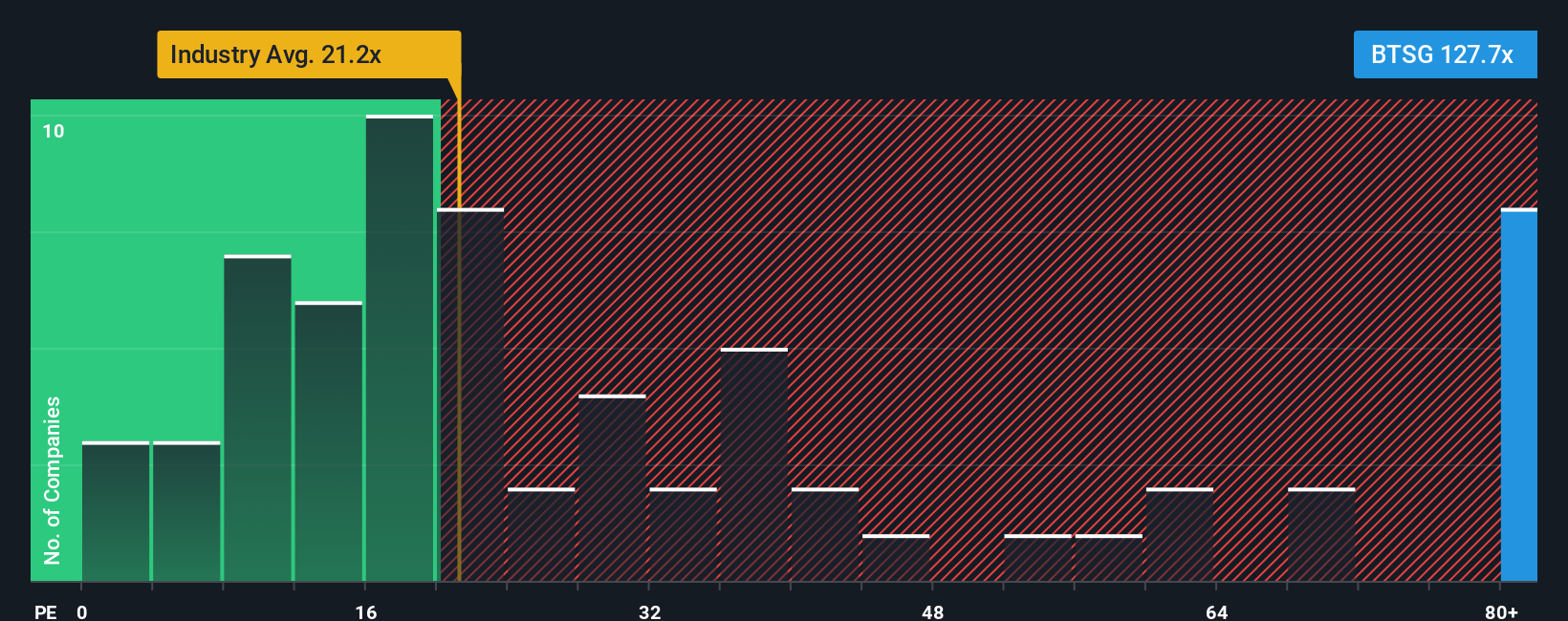

Looking from a different angle, the current price-to-earnings ratio is 127.7x. This is far higher than both the U.S. Healthcare sector average of 21.2x and the peer group average of 22.6x. Even compared to a fair ratio of 44x, BTSG stands out as expensive and highlights significant valuation risk if future growth stalls. Does this sharp premium signal an overheated trade, or does it reflect how much investors are banking on rapid expansion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If these perspectives aren’t quite your own, you can quickly dig into the underlying numbers and put together a personalized view in just minutes. Do it your way

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that timing matters and opportunity waits for no one. Make your money work harder by searching for stocks with explosive growth or unique advantages today. Don’t be the last to spot the next big winner. Take action now!

- Tap into tomorrow’s financial innovation and spot exciting trends by checking out these 79 cryptocurrency and blockchain stocks, shaping the new landscape of digital assets and secure transactions.

- Uncover companies at the forefront of artificial intelligence with these 24 AI penny stocks, where rapid tech adoption and dynamic performance point to substantial returns.

- Accelerate your portfolio with income potential by seeing these 18 dividend stocks with yields > 3%, a curated list of strong-paying dividend stocks with higher yields than most savings accounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives