- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): Assessing Valuation Following White House Drug-Pricing Breakthrough

Reviewed by Kshitija Bhandaru

BrightSpring Health Services (BTSG) shares caught investor attention after news broke about a potential voluntary drug-pricing agreement under the White House’s “Most Favored Nation” initiative. The agreement appears to have eased regulatory concerns for many healthcare stocks.

See our latest analysis for BrightSpring Health Services.

BrightSpring’s latest price action reflects shifting sentiment across the healthcare sector, as the news around potential drug-pricing reforms appears to have eased some regulatory worries. While the stock’s recent momentum has been steady rather than spectacular, total shareholder return over the past year has nudged just above zero. This hints that investors are cautiously optimistic about longer-term growth prospects.

If BrightSpring’s regulatory turnaround has you curious about what else is shaping healthcare, take the next step and explore See the full list for free.

With BrightSpring’s shares rallying alongside the sector and its fundamentals pointing to robust income growth, the key question now is whether the recent gains leave room for further upside or if the market has already priced in future growth potential.

Most Popular Narrative: 2.6% Undervalued

With BrightSpring Health Services closing at $28.36, the most widely followed narrative pegs its fair value just above at $29.13, hinting at a modest discount amid bullish expectations. Investors are weighing recent momentum and the company’s specialty pharmacy growth story as they assess what is already priced in.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross-selling. These are expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Want to know what is driving this narrative’s confidence? The fair value hinges on bold assumptions about growing profits, wider margins, and significant market trends. Curious how analysts justify this outlook? Unlock the story behind these numbers now.

Result: Fair Value of $29.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming CMS reimbursement cuts and persistent labor cost pressures could quickly shift the outlook for BrightSpring’s growth if these challenges are not managed effectively.

Find out about the key risks to this BrightSpring Health Services narrative.

Another View: Market Multiples Tell a Different Story

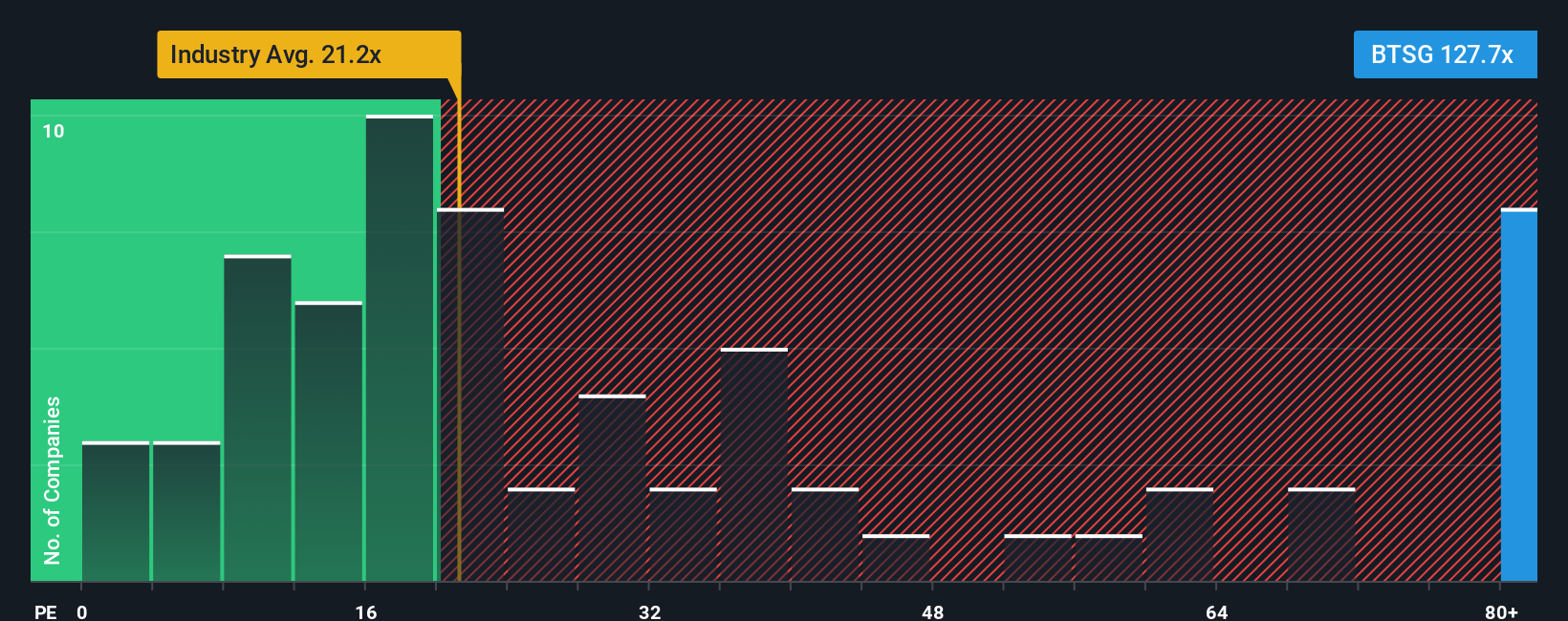

Looking at market ratios, BrightSpring trades at a price-to-earnings multiple of 121.9x. This is significantly higher than both the US Healthcare sector average of 21.4x and the average of its direct peers at 70x. Even compared to its fair ratio of 44.2x, the shares look expensive. This gap suggests greater downside risk if optimism fades. Is the market being too hopeful or is rapid growth about to close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you have a different perspective or want a hands-on look at the numbers, you can craft your own view in just a few minutes with Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the crowd and expand your portfolio with opportunities beyond BrightSpring Health Services. Tap into trends that could redefine your investment future by checking out these hand-picked screens:

- Supercharge your search for future disruptors with these 24 AI penny stocks, which promise major breakthroughs in artificial intelligence and automation.

- Secure potential steady income streams as you review these 19 dividend stocks with yields > 3%, offering attractive yields above 3% and robust financials.

- Position yourself early in the next tech frontier and explore these 26 quantum computing stocks, which are helping to shape the quantum computing revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives