- United States

- /

- Healthcare Services

- /

- NasdaqGS:BTSG

BrightSpring Health Services (BTSG): A Fresh Look at Valuation After Upward Analyst Earnings Revisions

Reviewed by Simply Wall St

Consensus earnings estimates for BrightSpring Health Services (BTSG) have been revised upward as covering analysts grow more optimistic about the company’s earnings outlook. The company’s strong Zacks Rank reflects this positive momentum.

See our latest analysis for BrightSpring Health Services.

BrightSpring Health Services has been catching attention with its remarkable year-to-date share price return of 108.66%. This reflects growing momentum as optimism about its earnings outlook builds among analysts. This significant rally is backed by the company's improving fundamentals. While the 1-day slip of 0.88% is a minor blip, recent shareholders have seen notable rewards over the longer term.

If healthcare’s wave of innovation and strong returns has you looking for more ideas, don’t miss the chance to discover See the full list for free.

With BrightSpring Health Services having surged more than 100% year to date, investors now face a key question: Is the stock still undervalued, or has the market already priced in expectations for future growth?

Most Popular Narrative: 9.1% Undervalued

BrightSpring Health Services closed at $36.16, while the most popular narrative suggests a fair value of $39.77. This notable difference has investors paying close attention. A fresh look at the company’s prospects puts the share price in sharp context.

“Leadership in specialty pharmacy and rare drug markets, along with exclusive launches, is fueling strong revenue growth and margin expansion. Demographic trends and expanded integrated services are driving market share gains, supporting sustainable long-term topline and earnings growth.”

What is behind this target? There is a secret recipe the narrative is relying on: layers of double-digit growth and a shrinking profit multiple that could reset how the market sees this company. Which assumptions risk making or breaking the valuation? Click and discover the precise financial drivers pushing this fair value above today’s price.

Result: Fair Value of $39.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and mounting regulatory pressures remain critical risks. These factors could quickly shift the company’s momentum and earnings expectations.

Find out about the key risks to this BrightSpring Health Services narrative.

Another View: What About the Earnings Multiple?

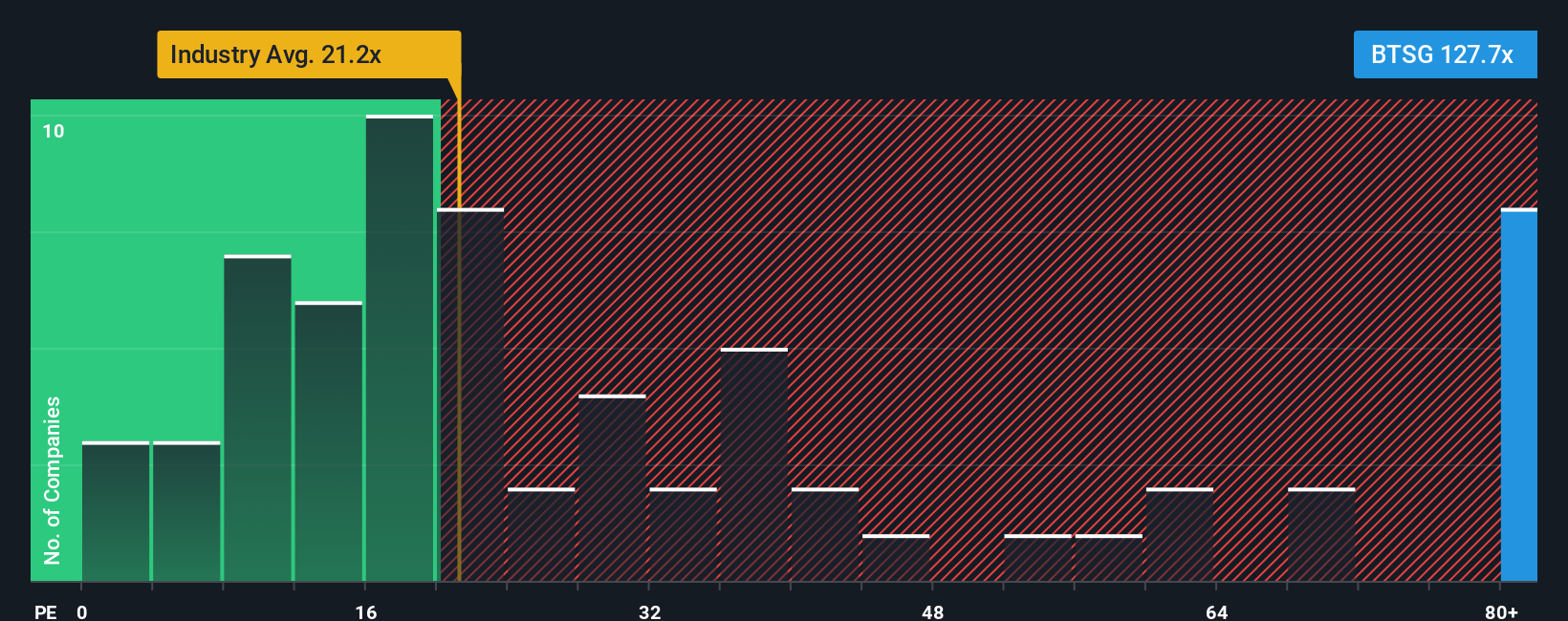

Yet, if we look at things from a different angle and use the price-to-earnings approach, the story shifts. BrightSpring Health Services trades at 67.7 times earnings, which is far higher than the US Healthcare industry average of 22.8 times, the peer average of 23.1 times, and the fair ratio of 38.8 times. This hefty premium raises the question: is the market pricing in too much optimism, or is there more growth ahead to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you see the story differently, or want to dig into the numbers yourself, building your own view takes just a few minutes. Do it your way

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let yourself miss out on other powerful trends and value-packed opportunities across the market. Use these handpicked tools to get ahead today:

- Unlock high potential returns by searching for these 920 undervalued stocks based on cash flows, where market prices may not reflect the true worth of businesses.

- Tap into future digital disruptions with these 81 cryptocurrency and blockchain stocks, which is at the forefront of secure payments and blockchain innovation.

- Benefit from steady income streams by finding these 15 dividend stocks with yields > 3%, offering attractive yields and reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BrightSpring Health Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BTSG

BrightSpring Health Services

Operates as a home and community-based healthcare services platform in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.