- United States

- /

- Medical Equipment

- /

- NasdaqCM:AXGN

Is FDA Review Delay and Legal Scrutiny Altering the Investment Case for Axogen (AXGN)?

Reviewed by Sasha Jovanovic

- Axogen recently announced that the FDA has extended the Prescription Drug User Fee Act goal date for its Biologics License Application for Avance Nerve Graft by three months to December 5, 2025, and this timeline adjustment has drawn attention from law firms investigating possible securities law violations based on information disclosure.

- This increased legal scrutiny highlights regulatory uncertainty, which could influence investor sentiment and the company’s approach to providing updates on its clinical pipeline.

- We'll examine how the FDA review delay and related legal investigation could impact Axogen's projected growth in nerve repair markets.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Axogen Investment Narrative Recap

To be a shareholder in Axogen right now, an investor needs to believe in the company's ability to lead the nerve repair market, particularly through regulatory approval and broad commercial adoption of Avance Nerve Graft. The recent three-month FDA review extension introduces some delay and regulatory uncertainty but does not fundamentally alter the primary short-term catalyst, the Avance approval itself, or the largest risk, which remains Axogen's heavy reliance on a single biologic-driven product portfolio.

Of the recent company announcements, the FDA's extension of the PDUFA goal date for Avance is most relevant, as approval could secure 12 years of market exclusivity and reinforce Axogen’s growth trajectory. While other product launches like Avive+ Soft Tissue Matrix highlight ongoing innovation, near-term investor focus will remain closely tied to updates on the Avance regulatory timeline and any outcomes from legal scrutiny around information disclosure.

By contrast, investors should be aware that increased regulatory and legal attention may affect the consistency and timing of future company updates...

Read the full narrative on Axogen (it's free!)

Axogen's narrative projects $323.0 million revenue and $25.7 million earnings by 2028. This requires 16.7% yearly revenue growth and a $30.4 million increase in earnings from the current level of -$4.7 million.

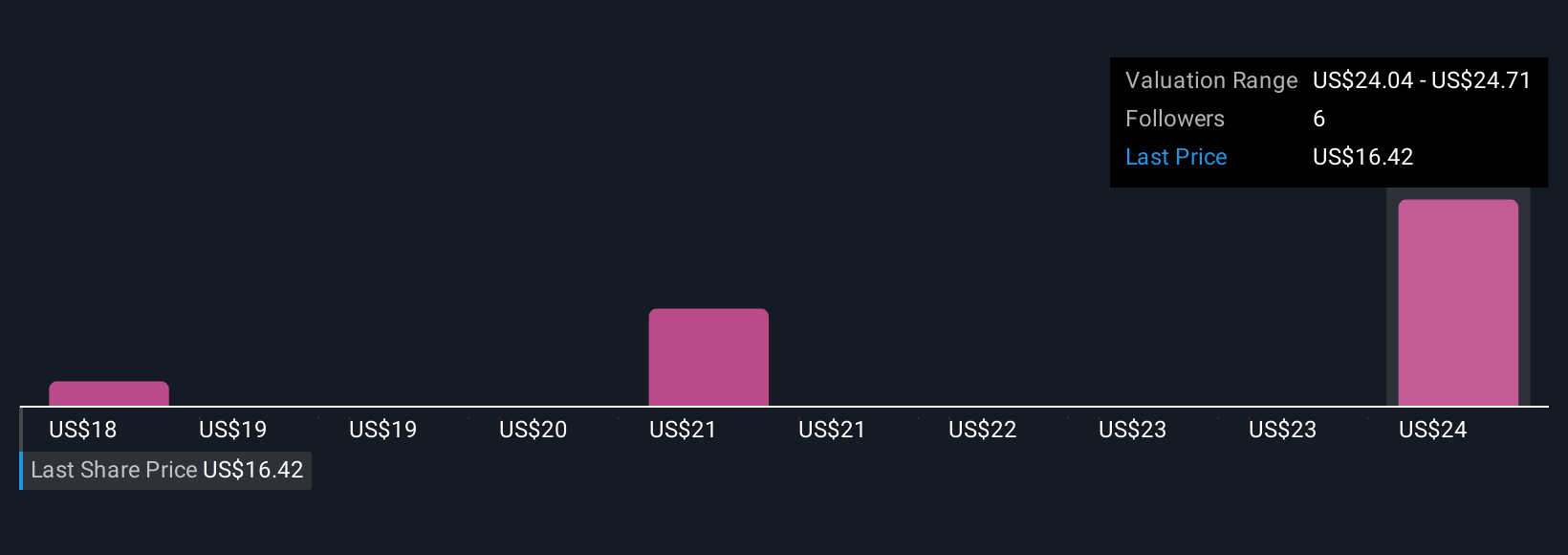

Uncover how Axogen's forecasts yield a $24.71 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Axogen’s fair value between US$17.95 and US$24.71 per share. This compares to consensus analyst views that emphasize Avance’s regulatory risk as a central issue shaping the company’s near-term direction. Explore how your outlook fits among these perspectives.

Explore 3 other fair value estimates on Axogen - why the stock might be worth just $17.95!

Build Your Own Axogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axogen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Axogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axogen's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AXGN

Axogen

Develops and commercializes technologies for peripheral nerve regeneration and repair worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives