- United States

- /

- Healthcare Services

- /

- NasdaqGS:AVAH

Will Aveanna Healthcare Holdings’ (AVAH) New Equity Offering Reshape Its Capital Flexibility Narrative?

Reviewed by Sasha Jovanovic

- On October 21, 2025, Aveanna Healthcare Holdings Inc. announced a follow-on equity offering, filing to issue 10,000,000 shares of common stock.

- This move increases the company's available capital but also affects its capital structure and could influence existing shareholder value.

- We'll explore how the share offering may shift Aveanna's investment narrative by altering its capital structure and funding flexibility.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aveanna Healthcare Holdings Investment Narrative Recap

To be a shareholder in Aveanna Healthcare Holdings means believing in the ongoing shift toward in-home healthcare and the company’s ability to capture long-term growth from demographic changes and increased service demand. The October 2025 equity offering raises fresh capital that increases financial flexibility but also results in near-term dilution; for now, it does not appear to materially change the immediate catalyst, which remains Aveanna’s execution in growing and retaining its caregiver workforce, nor does it fully resolve the risk from wage inflation and Medicaid/Medicare pressures.

Of recent announcements, Aveanna’s September refinancing of its first lien credit facility stands out. By extending maturities and increasing its revolving line, the company took steps to manage its high leverage, reinforcing financial flexibility in tandem with the new equity raise. The combined effect supports funding for growth, though capital structure risk and sensitivity to interest rates still demand close monitoring.

But beyond the capital raised, investors should be aware of how persistent wage inflation could threaten...

Read the full narrative on Aveanna Healthcare Holdings (it's free!)

Aveanna Healthcare Holdings is projected to reach $2.7 billion in revenue and $156.7 million in earnings by 2028. This outlook assumes annual revenue growth of 7.2% and represents a $138.1 million increase in earnings from the current $18.6 million.

Uncover how Aveanna Healthcare Holdings' forecasts yield a $9.22 fair value, a 10% downside to its current price.

Exploring Other Perspectives

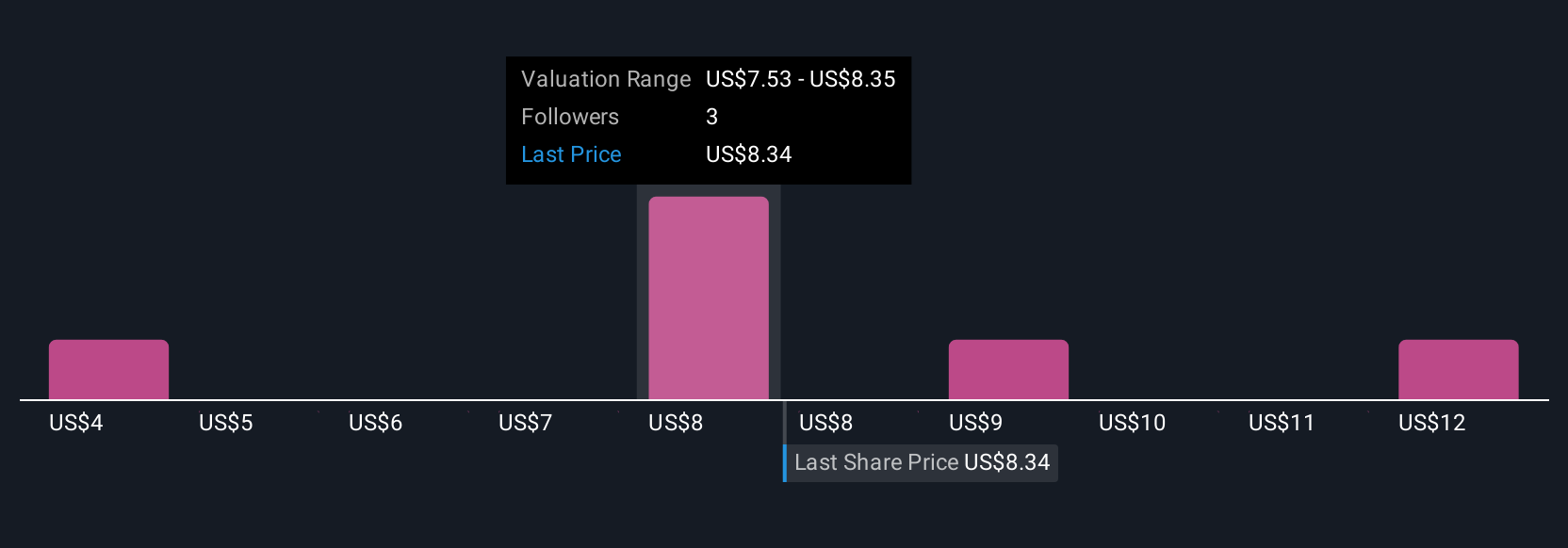

Four Simply Wall St Community members estimate Aveanna’s fair value between US$4.29 and US$12.40 per share. Opinions run the spectrum, while recent events reinforce the importance of capital structure in shaping Aveanna’s future performance; explore several perspectives before making decisions.

Explore 4 other fair value estimates on Aveanna Healthcare Holdings - why the stock might be worth less than half the current price!

Build Your Own Aveanna Healthcare Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aveanna Healthcare Holdings research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Aveanna Healthcare Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aveanna Healthcare Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAH

Aveanna Healthcare Holdings

A diversified home care platform company, provides pediatric and adult healthcare services in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives