- United States

- /

- Healthcare Services

- /

- NasdaqGS:AVAH

Aveanna Healthcare Holdings (AVAH) Is Up 9.0% After Beating Earnings and Raising 2025 Sales Guidance—Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this week, Aveanna Healthcare Holdings reported strong quarterly earnings, beating consensus estimates and raising its fiscal 2025 sales and adjusted EBITDA guidance.

- An unusual surge in earnings outlook, supported by multiple upward revisions and positive operational trends, caught the attention of both analysts and investors.

- We'll review how this upbeat guidance and earnings momentum could influence Aveanna Healthcare's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Aveanna Healthcare Holdings Investment Narrative Recap

To believe in Aveanna Healthcare Holdings, an investor needs confidence in the ongoing shift toward home-based healthcare and the company's ability to capture robust demand from an aging US population. The recent surge in earnings and revised sales guidance reinforces the near-term view that execution on operational efficiency and reimbursement rates may be a key short-term catalyst; however, high leverage and heavy reliance on government reimbursement remain vital risks for Aveanna's financial profile and future margin stability.

The most relevant announcement tied to this development is Aveanna's upward revision of its revenue guidance to over US$2.3 billion for fiscal 2025, reflecting ongoing growth in patient services and robust earnings beats. This aligns with optimism about the expanding addressable market for home health, but also sharpens focus on whether improved results can be sustained if labor or reimbursement pressures intensify.

Yet, while optimism is high, investors should also consider the risks posed by potential state and federal healthcare budget pressures and the proposed Medicare home health cuts in 2026, especially if…

Read the full narrative on Aveanna Healthcare Holdings (it's free!)

Aveanna Healthcare Holdings is projected to reach $2.7 billion in revenue and $156.7 million in earnings by 2028. This outlook reflects an annual revenue growth rate of 7.2% and an increase in earnings of $138.1 million from its current earnings of $18.6 million.

Uncover how Aveanna Healthcare Holdings' forecasts yield a $7.56 fair value, a 4% downside to its current price.

Exploring Other Perspectives

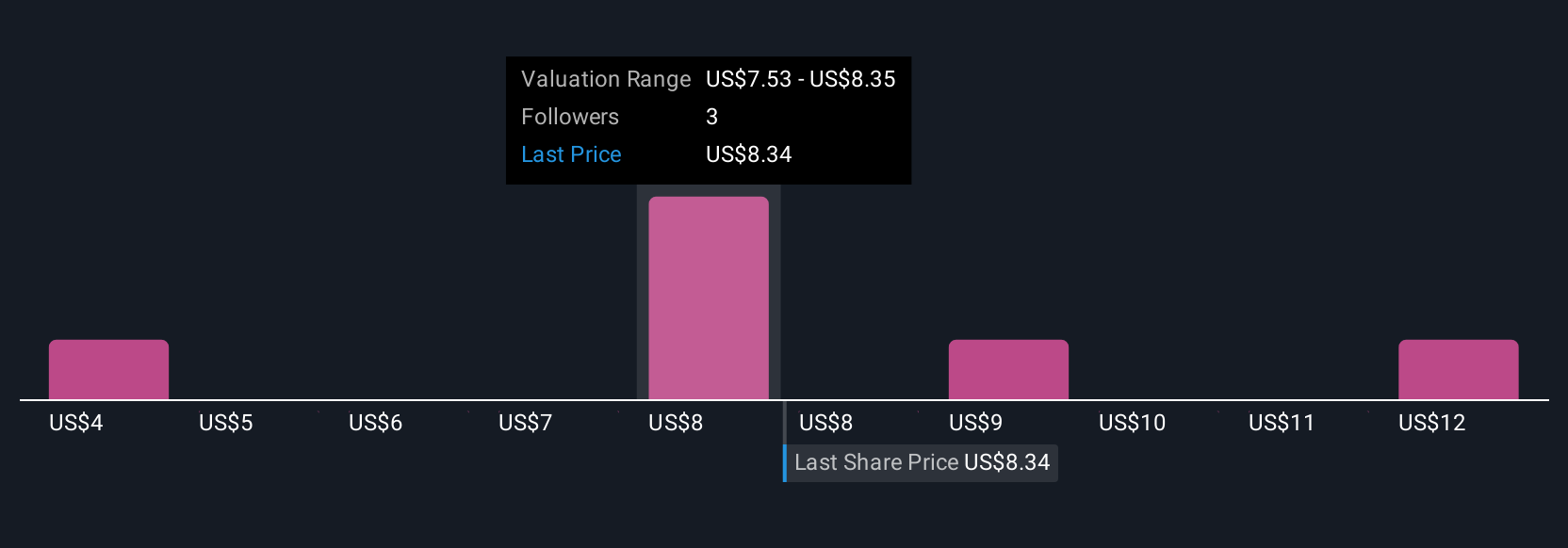

Four members of the Simply Wall St Community estimate Aveanna's fair value between US$4.29 and US$12.40, offering a wide spectrum of independent views. Amid strong operational momentum, financial leverage and reimbursement dependency continue to shape the company's risk and reward balance for investors who want to compare multiple outlooks.

Explore 4 other fair value estimates on Aveanna Healthcare Holdings - why the stock might be worth 45% less than the current price!

Build Your Own Aveanna Healthcare Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aveanna Healthcare Holdings research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Aveanna Healthcare Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aveanna Healthcare Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAH

Aveanna Healthcare Holdings

A diversified home care platform company, provides pediatric and adult healthcare services in the United States.

Moderate risk with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives