- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

Does AtriCure's (ATRC) cryoXT Launch Signal a Shift in Pain Management Innovation?

Reviewed by Simply Wall St

- AtriCure, Inc. recently launched the cryoXT device, an FDA 510(k)-cleared cryoablation technology designed to manage post-operative pain after amputation by ablating peripheral nerves.

- The cryoXT device introduces multi-surface freezing technology to the cryoICE platform, addressing significant clinical needs for patients suffering from residual and phantom limb pain after amputation.

- We'll explore how the introduction of cryoXT as an innovative pain management solution could reshape AtriCure's investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AtriCure Investment Narrative Recap

To invest in AtriCure, you need confidence in the company's ability to deliver strong growth in the advanced surgical device market, led by continuous innovation and expanding adoption of new pain management technologies. The recent launch of the cryoXT device highlights AtriCure's focus on new product development as a possible short-term catalyst, but it does not materially change the most immediate risk: ongoing competitive pressures from minimally invasive catheter-based ablation technologies, which continue to threaten the core ablation franchise's revenue base in the U.S. Of recent company news, the completed enrollment in the LeAAPS clinical trial stands out for its potential long-term impact. While the cryoXT launch addresses post-amputation pain, LeAAPS could significantly broaden AtriCure's addressable market if outcomes are positive, possibly driving sustained growth and strengthening the case for ongoing innovation as a catalyst. By contrast, investors should pay close attention to evolving competitive threats in minimally invasive ablation, as...

Read the full narrative on AtriCure (it's free!)

AtriCure's narrative projects $717.8 million revenue and $13.2 million earnings by 2028. This requires 12.8% yearly revenue growth and a $49.6 million earnings increase from the current earnings of $-36.4 million.

Uncover how AtriCure's forecasts yield a $50.00 fair value, a 38% upside to its current price.

Exploring Other Perspectives

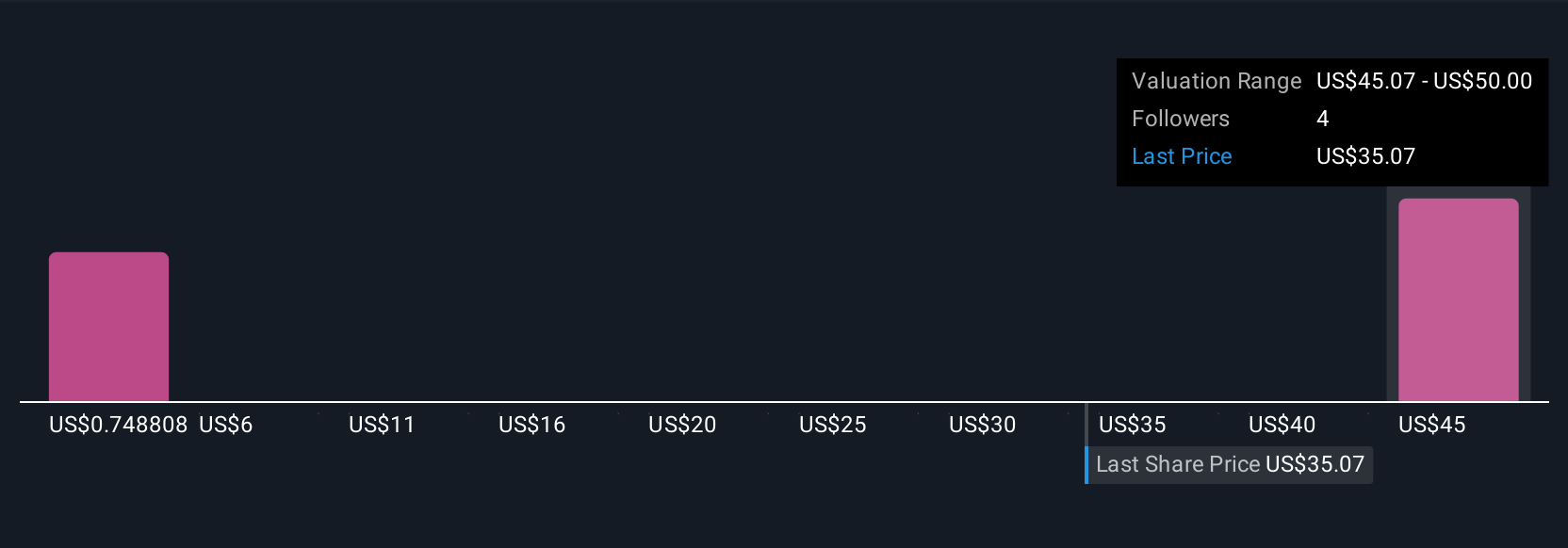

Simply Wall St Community members provided just 2 fair value estimates for AtriCure, ranging widely from US$0.75 to US$50. Analyst consensus still sees competitive risks in the key ablation segment, reminding you to weigh all sides before deciding.

Explore 2 other fair value estimates on AtriCure - why the stock might be worth less than half the current price!

Build Your Own AtriCure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AtriCure research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free AtriCure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AtriCure's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives