- United States

- /

- Medical Equipment

- /

- NasdaqGM:ATRC

AtriCure (NASDAQ:ATRC) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies AtriCure, Inc. (NASDAQ:ATRC) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for AtriCure

What Is AtriCure's Net Debt?

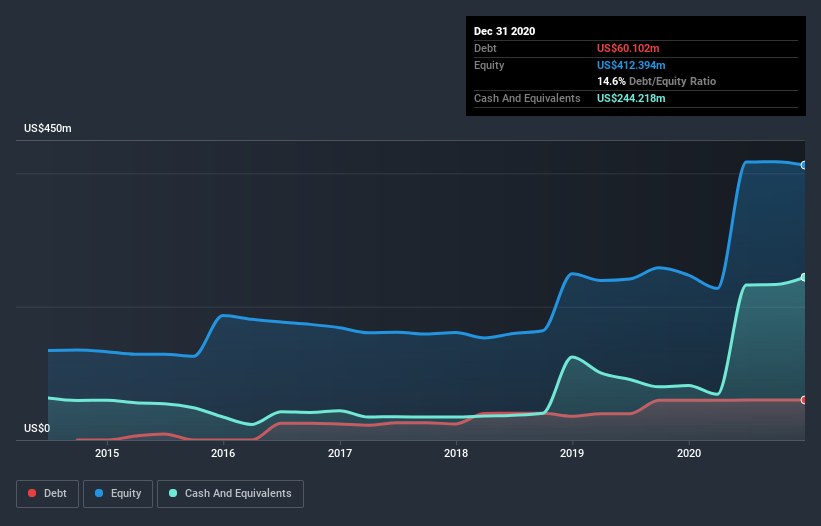

As you can see below, AtriCure had US$60.1m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has US$244.2m in cash, leading to a US$184.1m net cash position.

A Look At AtriCure's Liabilities

Zooming in on the latest balance sheet data, we can see that AtriCure had liabilities of US$49.1m due within 12 months and liabilities of US$253.0m due beyond that. On the other hand, it had cash of US$244.2m and US$23.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$34.8m.

This state of affairs indicates that AtriCure's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$2.86b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, AtriCure boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine AtriCure's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year AtriCure had a loss before interest and tax, and actually shrunk its revenue by 11%, to US$207m. That's not what we would hope to see.

So How Risky Is AtriCure?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year AtriCure had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$25m and booked a US$48m accounting loss. But at least it has US$184.1m on the balance sheet to spend on growth, near-term. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for AtriCure you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade AtriCure, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:ATRC

AtriCure

Develops, manufactures, and sells devices for surgical ablation of cardiac tissue, exclusion of the left atrial appendage, and temporarily blocking pain by ablating peripheral nerves to medical centers in the United States, the Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives