- United States

- /

- Healthcare Services

- /

- NasdaqCM:ASTH

Astrana Health (ASTH): Assessing Valuation as Revenue and Earnings Growth Signal Stronger Market Position

Reviewed by Kshitija Bhandaru

Recent coverage of Astrana Health (ASTH) points to steady annual growth in both revenue and earnings per share. This suggests the company is capturing greater market share and may be benefiting from rising demand in its sector.

See our latest analysis for Astrana Health.

Astrana Health’s steady gains in annual revenue and earnings per share have not yet translated into meaningful share price momentum, with its latest close at $28.75 and total shareholder return just below flat over the past year. Despite muted short-term price action, the company’s improving fundamentals could set the stage for stronger long-term performance as confidence builds around sector growth and management execution.

Inspired by Astrana’s steady progress, you might want to see which other healthcare names are showing similar potential. See the full list for free.

With strong financial gains and a share price still trading well below analyst targets, the question for investors is whether Astrana Health’s growth has yet to be fully recognized, or if the market is already factoring in its future potential.

Most Popular Narrative: 34.5% Undervalued

With Astrana Health’s last close at $28.75 and the most popular narrative forecasting a fair value 34.5% higher, there is a substantial upside envisioned by the consensus. This valuation anchor draws from forward-looking fundamentals rather than recent market moves.

“Sustained investment and rapid integration of proprietary technology platforms and data infrastructure (including AI-driven capabilities) are enabling better cost control, real-time utilization management, and operational leverage. These factors should contribute to further EBITDA margin expansion as scale increases and as new geographies ramp.”

Want to know what bold projections put Astrana Health far ahead of its market price? Huge growth in key financial metrics forms the backbone of this high-stakes valuation. What are the analysts betting on for the future? Dive into the numbers powering this narrative’s optimistic outlook.

Result: Fair Value of $43.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing heavy reliance on government payers and challenges associated with integrating acquisitions could quickly threaten Astrana Health's profit growth and margin outlook.

Find out about the key risks to this Astrana Health narrative.

Another View: Market Multiples Tell a Different Story

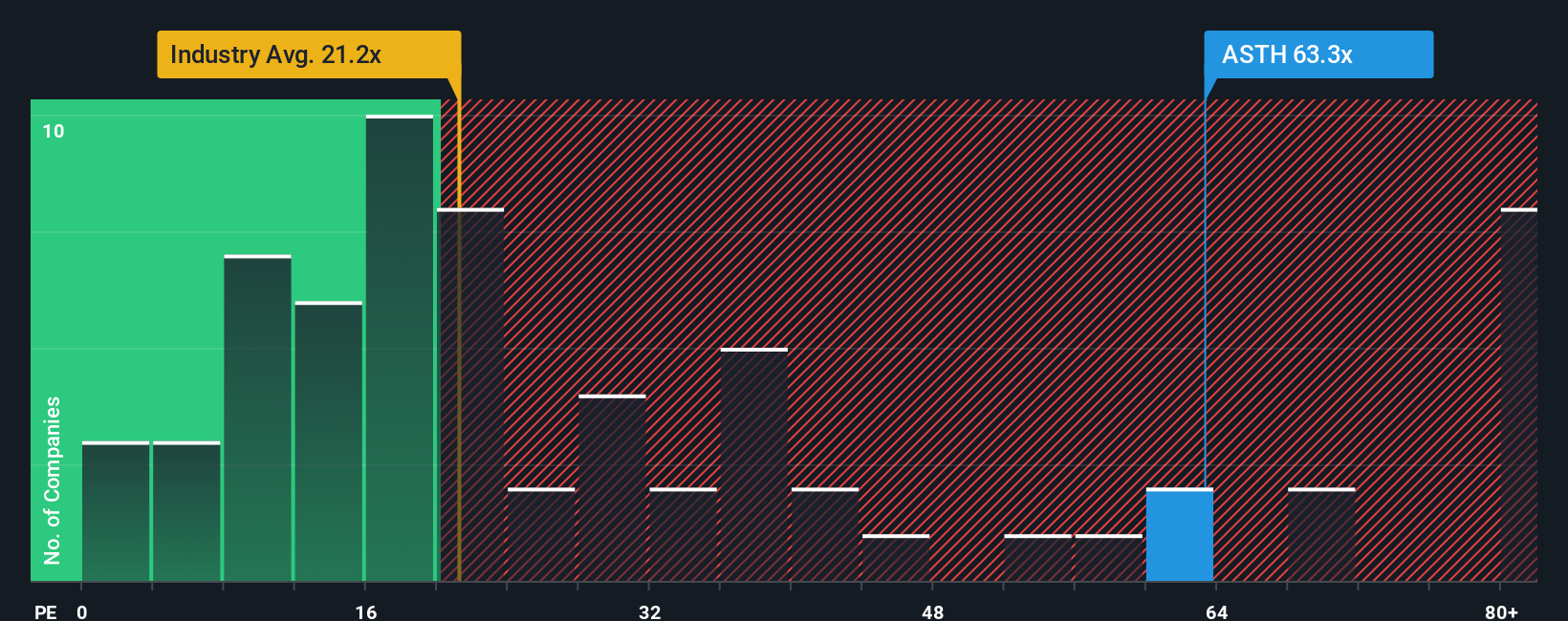

While analyst projections highlight Astrana Health as undervalued, a look at its price-to-earnings ratio suggests caution. Shares trade at 56.8 times annual earnings, much higher than the US Healthcare industry average of 21.4 and its peer average of 42.3. Even the market's fair ratio sits at 39.4. This gap points to increased valuation risk if growth slows or the story changes. So, which lens gives you the truest picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astrana Health Narrative

If you have a different take or want to dig deeper into the numbers, crafting your own perspective takes just a few minutes, so why not Do it your way?

A great starting point for your Astrana Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock smarter investment opportunities by using the Simply Wall Street Screener. Every moment you wait could mean missing a stock breakout or a powerful trend.

- Capitalize on emerging tech by checking out these 24 AI penny stocks, which are rapidly shaping tomorrow’s artificial intelligence landscape and driving new market leaders.

- Tap into strong cash flow and real asset value by reviewing these 896 undervalued stocks based on cash flows, where overlooked shares could be ready for their next big move.

- Catch the next wave of digital finance by exploring these 78 cryptocurrency and blockchain stocks, featuring companies driving innovation in blockchain and cryptocurrency markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASTH

Astrana Health

A healthcare management company, provides medical care services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives