- United States

- /

- Medical Equipment

- /

- NasdaqGS:ANGO

We Think AngioDynamics (NASDAQ:ANGO) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether AngioDynamics (NASDAQ:ANGO) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

When Might AngioDynamics Run Out Of Money?

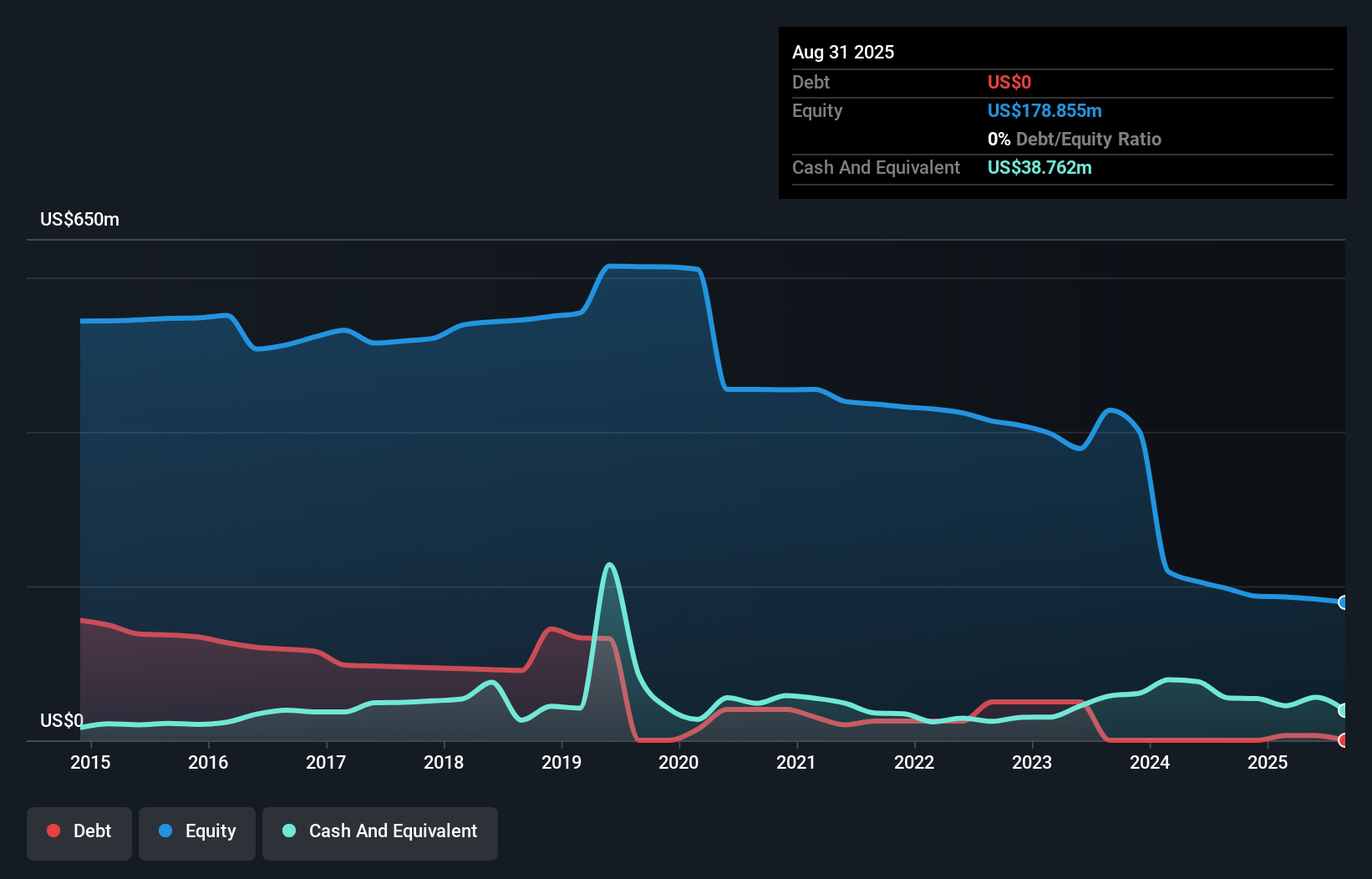

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When AngioDynamics last reported its August 2025 balance sheet in October 2025, it had zero debt and cash worth US$39m. In the last year, its cash burn was US$18m. That means it had a cash runway of about 2.2 years as of August 2025. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

View our latest analysis for AngioDynamics

How Well Is AngioDynamics Growing?

It was fairly positive to see that AngioDynamics reduced its cash burn by 44% during the last year. Revenue also improved during the period, increasing by 2.7%. On balance, we'd say the company is improving over time. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For AngioDynamics To Raise More Cash For Growth?

Even though it seems like AngioDynamics is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of US$455m, AngioDynamics' US$18m in cash burn equates to about 3.9% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

How Risky Is AngioDynamics' Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way AngioDynamics is burning through its cash. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Notably, our data indicates that AngioDynamics insiders have been trading the shares. You can discover if they are buyers or sellers by clicking on this link.

Of course AngioDynamics may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ANGO

AngioDynamics

A medical technology company, designs, manufactures, and sells medical, surgical, and diagnostic devices for the use in treating peripheral vascular disease, and oncology and surgical settings in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives