- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

The Market Lifts Alignment Healthcare, Inc. (NASDAQ:ALHC) Shares 37% But It Can Do More

Alignment Healthcare, Inc. (NASDAQ:ALHC) shares have had a really impressive month, gaining 37% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

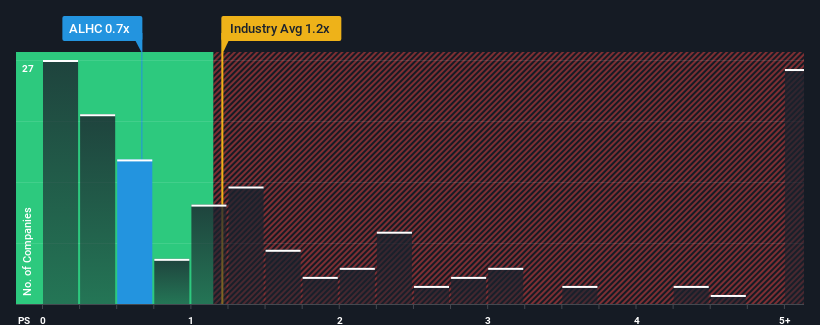

Even after such a large jump in price, it would still be understandable if you think Alignment Healthcare is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.7x, considering almost half the companies in the United States' Healthcare industry have P/S ratios above 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Alignment Healthcare

How Has Alignment Healthcare Performed Recently?

With revenue growth that's superior to most other companies of late, Alignment Healthcare has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alignment Healthcare.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Alignment Healthcare would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. The strong recent performance means it was also able to grow revenue by 101% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 25% per annum during the coming three years according to the ten analysts following the company. That's shaping up to be materially higher than the 7.0% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Alignment Healthcare's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Alignment Healthcare's P/S Mean For Investors?

Despite Alignment Healthcare's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Alignment Healthcare's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Alignment Healthcare you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives