- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

The Bull Case For Alignment Healthcare (ALHC) Could Change Following Bold Medicare Advantage Expansion and Intermountain Partnership

Reviewed by Sasha Jovanovic

- Alignment Healthcare recently announced an expansion of its Medicare Advantage offerings for 2026, unveiling 68 plan options across 45 counties alongside a deepened partnership with Intermountain Health.

- This move underlines the company’s ambitions for broader national reach and has sparked investor interest in anticipation of its third quarter 2025 financial results, scheduled for release on October 30, 2025.

- We'll examine how the expanded Medicare Advantage lineup and new health system collaboration may influence Alignment Healthcare's investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alignment Healthcare Investment Narrative Recap

To believe in Alignment Healthcare as a shareholder, the core thesis rests on its technology-driven care model, successful entry into more counties, and ability to convert a growing senior population into Medicare Advantage members. The recent expansion news reflects Alignment’s push for greater geographic reach, but it does not meaningfully shift the most important short-term catalyst: member growth acceleration versus escalating competition. Regulatory scrutiny and reimbursement changes remain the biggest risks that could pressure future profitability, risk factors that are largely unchanged by this announcement.

Among recent company updates, the scheduled release of Alignment’s third quarter 2025 results on October 30, paired with raised full-year revenue guidance, holds particular relevance. Investors will be focused on whether the expanded Medicare Advantage offerings and health system partnerships are translating into sustainable membership and revenue growth that aligns with management's optimistic projections.

But in contrast, investors should not overlook the potential for future Medicare Advantage reimbursement changes that could impact Alignment’s...

Read the full narrative on Alignment Healthcare (it's free!)

Alignment Healthcare's narrative projects $6.8 billion in revenue and $118.7 million in earnings by 2028. This requires 26.7% annual revenue growth and a $169.7 million increase in earnings from the current -$51.0 million.

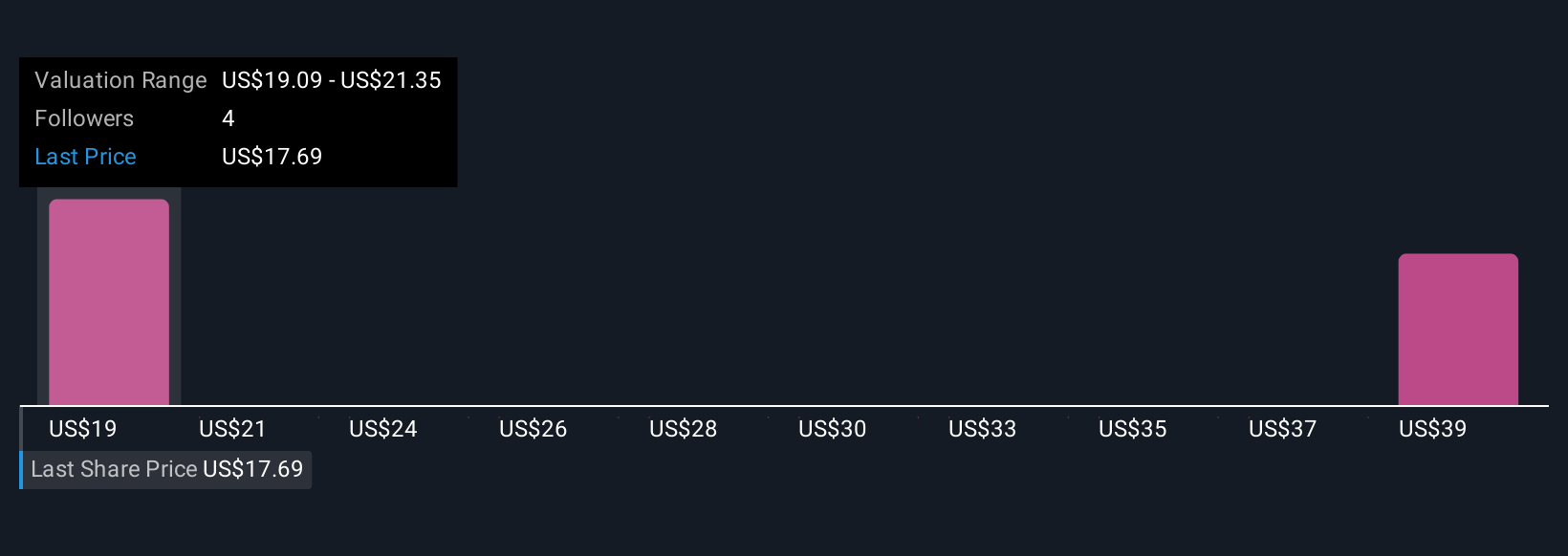

Uncover how Alignment Healthcare's forecasts yield a $19.09 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for ALHC span from US$19.09 to US$41.69, based on 2 different analyses. Keep in mind that while membership growth and provider partnerships fuel optimism, regulatory changes could alter expectations, review a range of views before making up your mind.

Explore 2 other fair value estimates on Alignment Healthcare - why the stock might be worth just $19.09!

Build Your Own Alignment Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alignment Healthcare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alignment Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alignment Healthcare's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives