- United States

- /

- Healthcare Services

- /

- NasdaqGS:ALHC

A Look at Alignment Healthcare's Valuation After Analyst Upgrades and Medicare Advantage Market Strength

Reviewed by Simply Wall St

Alignment Healthcare (ALHC) gained attention this week after several major financial institutions highlighted its strong performance projected for 2025, market share gains, and solid traction in the Medicare Advantage space. Upgraded outlooks sparked upbeat sentiment among investors.

See our latest analysis for Alignment Healthcare.

Momentum has clearly been building for Alignment Healthcare lately, with a surge in optimism following upbeat Q3 earnings, regulatory tailwinds, and high-profile upgrades from firms like JPMorgan and Goldman Sachs. After this string of positive catalysts, the stock boasts a year-to-date share price return of 66.3% and a 1-year total shareholder return of 52.4%. This reflects growing confidence in its growth strategy over both the short term and the long term.

If you’re wondering what other healthcare leaders could be on the move, now is the perfect time to explore the opportunities highlighted in our See the full list for free.

But after such impressive gains and bullish analyst upgrades, the big question remains: is Alignment Healthcare still undervalued at current levels, or has the recent optimism fully accounted for future growth expectations?

Most Popular Narrative: 7.9% Undervalued

Alignment Healthcare’s most widely followed valuation narrative pegs fair value at $20.88, nearly 8% above the last close of $19.22. This reinforces ongoing investor optimism. The narrative’s fair value is supported by recent projections of strong, technology-driven growth and sector tailwinds, paving the way for a closer look at the factors driving its positive outlook.

Ongoing expansion into existing counties and new states, combined with low market penetration and favorable demographic trends from a rapidly aging population, create a long-term runway for outsized membership and revenue growth as the Medicare-eligible population swells.

Think these projections are just about organic growth? There is more to consider: bold assumptions about margin expansion, aggressive earnings targets, and a future profit multiple not commonly found in healthcare. Interested in understanding what supports this ambitious price target and the risks involved? Click through and follow the narrative to explore the key financial considerations behind the fair value.

Result: Fair Value of $20.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential cuts to Medicare Advantage reimbursement rates or intensified competition could easily dampen Alignment Healthcare’s growth trajectory in the near term.

Find out about the key risks to this Alignment Healthcare narrative.

Another View: What Does the SWS DCF Model Say?

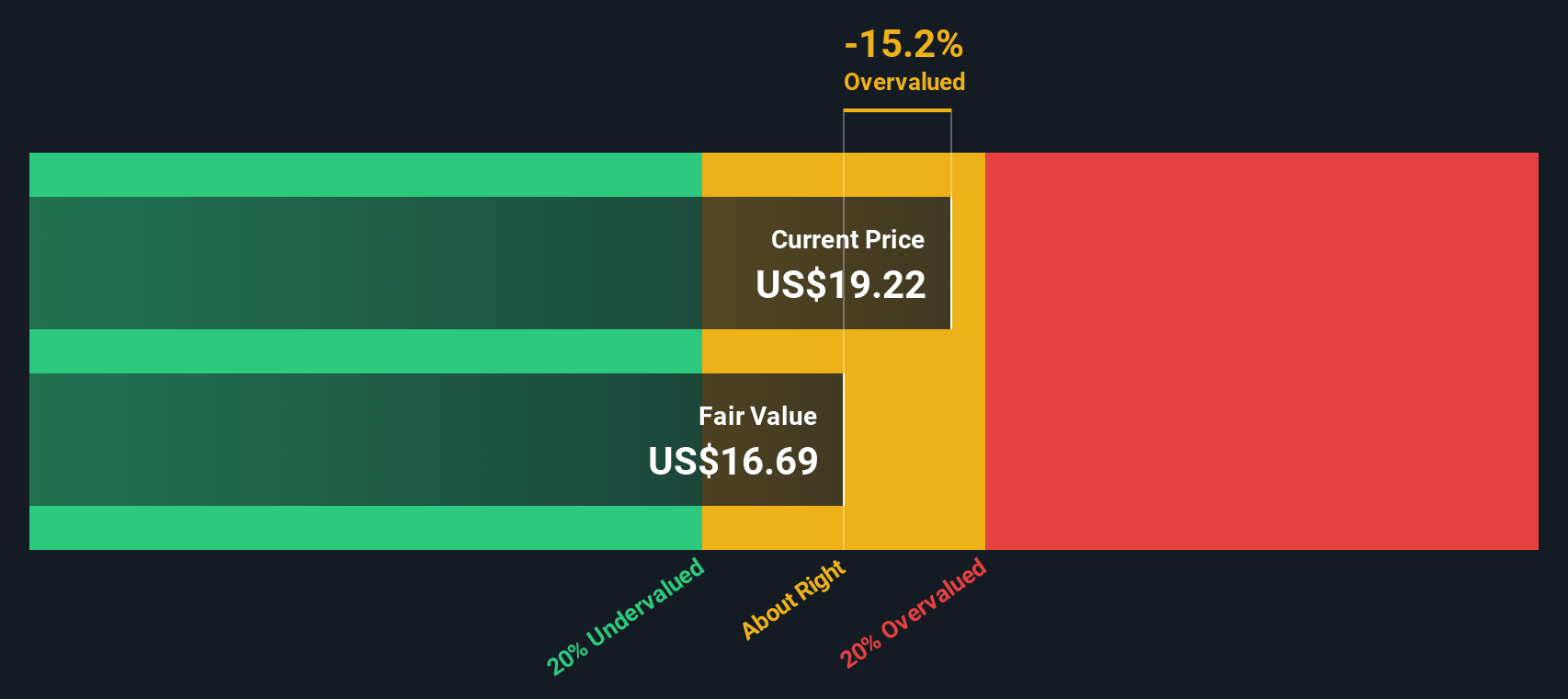

While analyst consensus points to Alignment Healthcare trading nearly 8% below fair value, our SWS DCF model offers a different perspective. According to this discounted cash flow analysis, the current share price of $19.22 stands above our intrinsic value estimate of $16.69. This suggests the stock may actually be overvalued. This contrast raises the question: which outlook will better reflect future reality as company fundamentals evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alignment Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alignment Healthcare Narrative

If you have a different perspective or want to dig deeper into the specifics, you can quickly build your own Alignment Healthcare narrative in just a few minutes. Do it your way

A great starting point for your Alignment Healthcare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Explore a variety of smart stock ideas on Simply Wall Street to enhance your investing approach and discover your next potential standout before others do.

- Catch growth early by browsing these 3578 penny stocks with strong financials offering strong financials and untapped upside potential.

- Pounce on potential with these 930 undervalued stocks based on cash flows, where hidden gems based on real cash flow metrics could be waiting just below the radar.

- Unlock yield with these 15 dividend stocks with yields > 3% and access reliable stocks boasting healthy dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALHC

Alignment Healthcare

Operates a consumer-centric healthcare platform for seniors in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.