- United States

- /

- Medical Equipment

- /

- NasdaqGS:ALGN

Assessing Align Technology (ALGN) Valuation After New Invisalign Mandibular Advancement Launch in Asia-Pacific

Reviewed by Simply Wall St

Align Technology (ALGN) just rolled out its Invisalign System with mandibular advancement and occlusal blocks across Thailand and key Asia Pacific markets, a focused bet on treating common Class II malocclusions in growing patients.

See our latest analysis for Align Technology.

The launch builds on Align’s steady pipeline of innovations, yet the stock tells a mixed story. It has a strong 1 month share price return of 21.39%, but a 1 year total shareholder return of minus 24.82%, suggesting improving momentum from a still bruised base.

If this kind of innovation has your attention, it might be worth scanning healthcare stocks to spot other healthcare names that are quietly reshaping their niches.

Yet despite years of share price drawdowns, Align still trades at only a modest discount to Wall Street targets and a hefty intrinsic discount. This raises the key question: is this a genuine entry point, or is future growth already fully priced in?

Most Popular Narrative Narrative: 12.8% Undervalued

With the most followed narrative putting fair value well above Align Technology’s last close of $160.58, the story hinges on a carefully mapped earnings ramp.

The continued expansion of clinical indications for Invisalign (such as Invisalign First for teens/kids and palate expanders) and the increasing adoption by general practitioner dentists are broadening Align's addressable market, positioning the company for higher long term revenues and double digit earnings growth as these new segments mature.

Curious how steady revenue growth, rising margins and a richer earnings base combine into that upside case? The playbook is more ambitious than it looks.

Result: Fair Value of $184.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro headwinds and a multiyear shift back toward traditional braces could still derail the hoped-for Invisalign volume and margin recovery.

Find out about the key risks to this Align Technology narrative.

Another View: Price Tag Looks Full

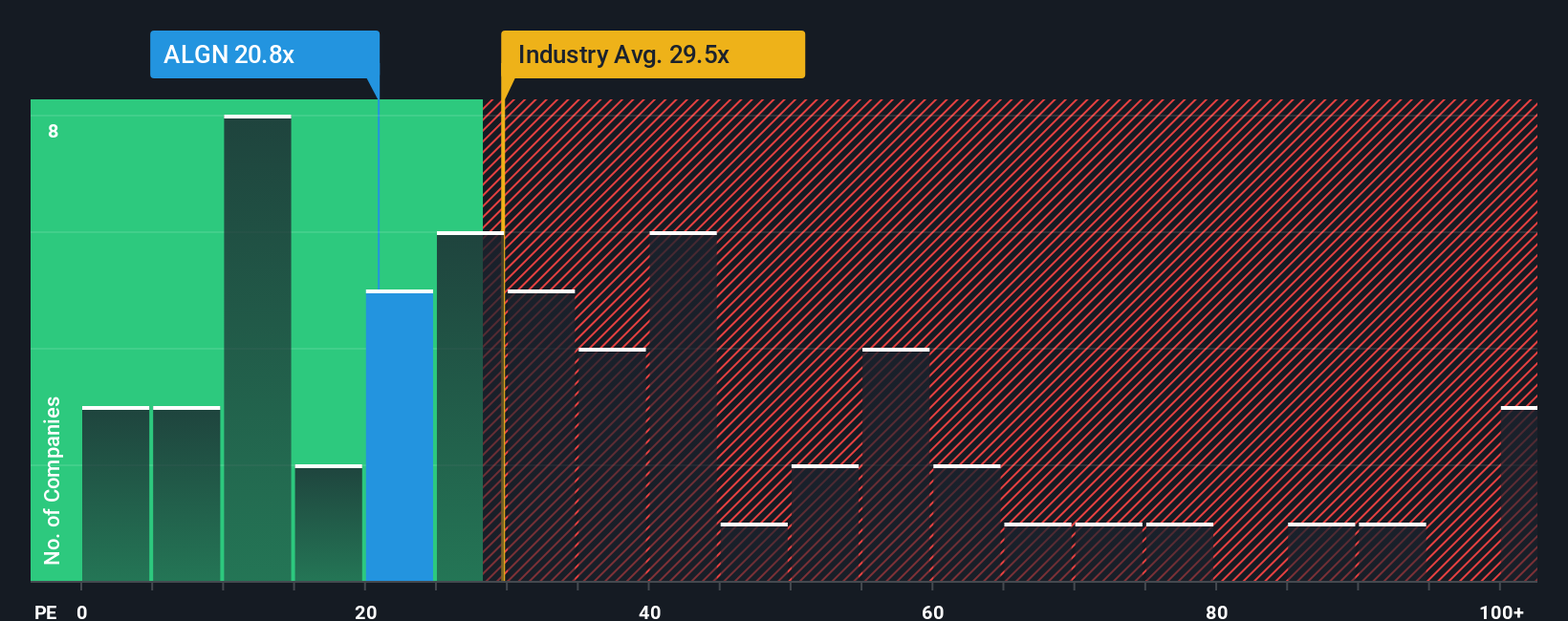

On a simple earnings lens, Align trades at about 30.4 times earnings, slightly richer than both the US medical equipment sector at 30 times and close peers at 29.5 times, and only in line with our fair ratio of 30.7 times. That leaves little obvious multiple based upside, so is the market already paying up for the recovery story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Align Technology Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Align Technology.

Looking for more investment ideas?

Put your research momentum to work by scanning fresh opportunities on Simply Wall Street’s Screener, so you do not miss the next move that fits your strategy.

- Capture potential mispricings by targeting companies trading below their cash flow value through these 908 undervalued stocks based on cash flows, and position yourself early in quality names the market has overlooked.

- Explore companies in the AI space by focusing on innovators involved in data and automation trends with these 26 AI penny stocks.

- Seek dependable income by focusing on regular payouts from these 13 dividend stocks with yields > 3%, helping you build a portfolio designed to provide returns even when markets are flat.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGN

Align Technology

Provides Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion