- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

The Market Lifts AirSculpt Technologies, Inc. (NASDAQ:AIRS) Shares 26% But It Can Do More

Those holding AirSculpt Technologies, Inc. (NASDAQ:AIRS) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

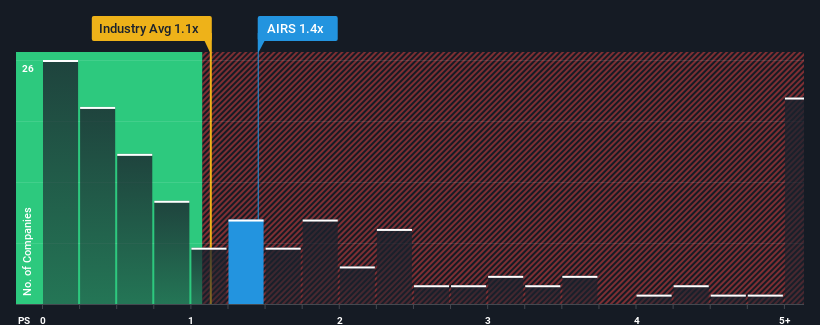

Although its price has surged higher, there still wouldn't be many who think AirSculpt Technologies' price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in the United States' Healthcare industry is similar at about 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for AirSculpt Technologies

How AirSculpt Technologies Has Been Performing

With revenue growth that's superior to most other companies of late, AirSculpt Technologies has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think AirSculpt Technologies' future stacks up against the industry? In that case, our free report is a great place to start.How Is AirSculpt Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AirSculpt Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. The latest three year period has also seen an excellent 154% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 11% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 7.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that AirSculpt Technologies' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does AirSculpt Technologies' P/S Mean For Investors?

AirSculpt Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, AirSculpt Technologies' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AirSculpt Technologies (1 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States, Canada, and the United Kingdom.

Undervalued very low.

Market Insights

Community Narratives