- United States

- /

- Healthcare Services

- /

- NasdaqGM:AIRS

Optimistic Investors Push AirSculpt Technologies, Inc. (NASDAQ:AIRS) Shares Up 29% But Growth Is Lacking

AirSculpt Technologies, Inc. (NASDAQ:AIRS) shareholders have had their patience rewarded with a 29% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

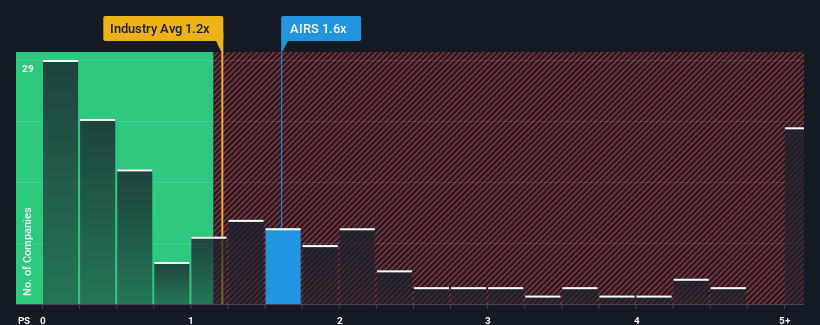

In spite of the firm bounce in price, it's still not a stretch to say that AirSculpt Technologies' price-to-sales (or "P/S") ratio of 1.6x right now seems quite "middle-of-the-road" compared to the Healthcare industry in the United States, where the median P/S ratio is around 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for AirSculpt Technologies

How Has AirSculpt Technologies Performed Recently?

AirSculpt Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AirSculpt Technologies.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, AirSculpt Technologies would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.6%. Pleasingly, revenue has also lifted 90% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 2.8% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 7.7% growth forecast for the broader industry.

In light of this, it's curious that AirSculpt Technologies' P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From AirSculpt Technologies' P/S?

Its shares have lifted substantially and now AirSculpt Technologies' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that AirSculpt Technologies' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware AirSculpt Technologies is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on AirSculpt Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AIRS

AirSculpt Technologies

Focuses on operating as a holding company for EBS Intermediate Parent LLC that provides body contouring procedure services in the United States, Canada, and the United Kingdom.

Undervalued with moderate growth potential.

Market Insights

Community Narratives