- United States

- /

- Healthcare Services

- /

- NasdaqGS:ADUS

Is Addus HomeCare's (ADUS) Leadership Transition a Turning Point for Operational and Financial Strategy?

Reviewed by Simply Wall St

- Addus HomeCare Corporation recently reported second quarter earnings with net income rising to US$22.05 million from US$18.08 million a year earlier, and announced the appointment of Heather Dixon, a former CFO of Acadia Healthcare and board member of Addus, as President and Chief Operating Officer, effective mid-September.

- This leadership transition brings extensive healthcare and financial expertise to the executive team at a time when the company is already showing improved profitability.

- We'll consider how appointing a new President and COO with deep financial leadership experience could influence Addus HomeCare's future outlook.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Addus HomeCare Investment Narrative Recap

To be a shareholder of Addus HomeCare, you need to believe in the company’s ability to drive profitable growth through state reimbursement tailwinds, expansion in personal care, and ongoing acquisitions, while managing the risks of Medicare and Medicaid funding changes, margin pressure, and workforce shortages. The appointment of Heather Dixon as President and COO brings financial and operational expertise to the helm, but this executive change does not materially shift the most important near-term catalyst, state-level reimbursement rate increases, or the most significant risk of reimbursement cuts and regulatory headwinds. Recent Q2 earnings saw net income rise to US$22.05 million (up from US$18.08 million a year earlier), reflecting incremental progress in profitability and margin expansion. The ongoing attraction of favorable reimbursement rates in core markets remains the most relevant catalyst, supporting continued earnings growth and positioning the company to respond to regulatory shifts or challenges. However, investors should keep in mind that, despite leadership upgrades, pressure from proposed Medicare payment reductions in 2026 remains the kind of risk that...

Read the full narrative on Addus HomeCare (it's free!)

Addus HomeCare is projected to reach $1.7 billion in revenue and $136.5 million in earnings by 2028. This outlook assumes a 10.1% annual revenue growth and reflects a $53.5 million increase in earnings from the current $83.0 million.

Uncover how Addus HomeCare's forecasts yield a $138.18 fair value, a 22% upside to its current price.

Exploring Other Perspectives

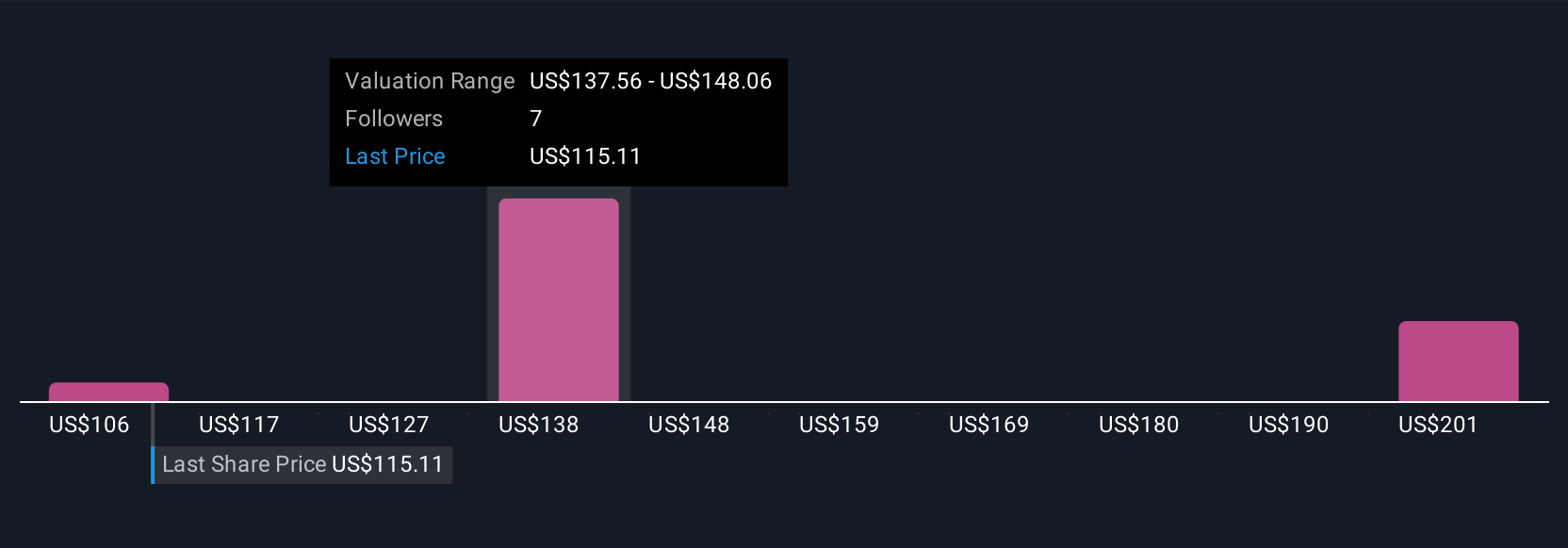

Four fair value estimates from the Simply Wall St Community range from US$106.06 to US$211.05. While state-level reimbursement rate increases are seen as a key catalyst for earnings growth, you may want to compare how community sentiment aligns with your own expectations for Addus’s future performance.

Explore 4 other fair value estimates on Addus HomeCare - why the stock might be worth 6% less than the current price!

Build Your Own Addus HomeCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Addus HomeCare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Addus HomeCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Addus HomeCare's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADUS

Addus HomeCare

Provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives