- United States

- /

- Healthcare Services

- /

- NasdaqGS:ADUS

Is Addus HomeCare a Hidden Opportunity After Recent Contract Wins and Acquisition Expansion?

Reviewed by Bailey Pemberton

- If you have been wondering whether Addus HomeCare at around $115 a share is a quiet bargain or a value trap, you are not alone. This stock often flies under the radar despite operating in a steadily growing home health market.

- The share price has inched up about 2.6% over the last week and 5.6% over the past month, but is still down 7.3% year to date and 11.9% over the last year, a mix that hints at recovering sentiment after a softer stretch.

- Recent headlines have focused on Addus expanding its footprint through selective acquisitions and winning new state level contracts in personal care and home health, supporting a longer term growth story. At the same time, ongoing discussions about Medicaid reimbursement rates and regulatory oversight have kept some investors cautious, helping to explain the uneven share price performance.

- On our valuation checks, Addus scores a 4 out of 6, suggesting pockets of undervaluation that standard multiples do not fully capture. Next, we will unpack what different valuation methods say about the stock and finish by looking at an even richer way to think about its long term value.

Find out why Addus HomeCare's -11.9% return over the last year is lagging behind its peers.

Approach 1: Addus HomeCare Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows, then discounts them back to today’s dollars to estimate what the business is worth right now. For Addus HomeCare, the latest twelve month Free Cash Flow is about $93.2 million, with analysts and model estimates pointing to steady growth over the coming decade.

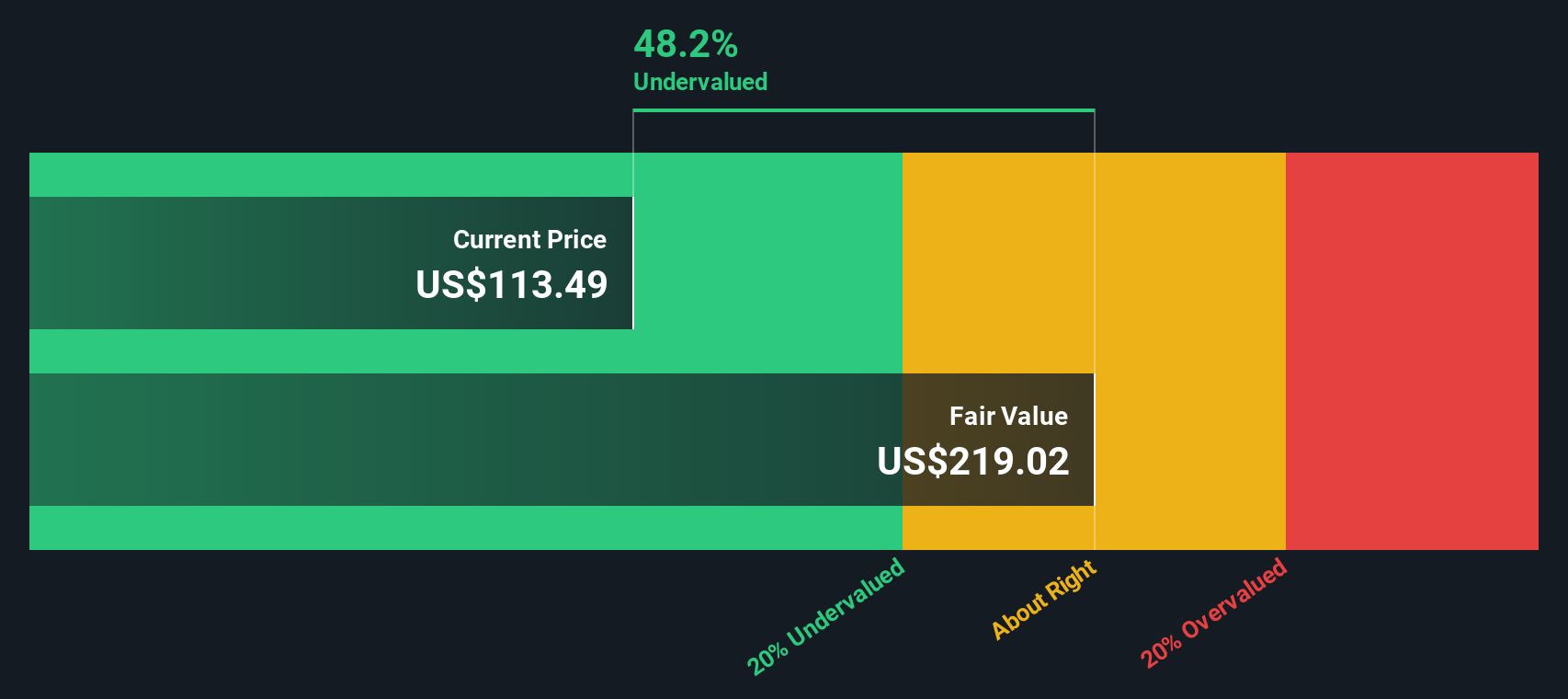

On Simply Wall St’s 2 Stage Free Cash Flow to Equity model, Addus’s free cash flow is expected to rise to roughly $199 million by 2035, with near term analyst estimates through 2027 and further years extrapolated from those trends. All figures are in $, and although the model factors in risk by discounting each future cash flow, the sum of those discounted amounts still points to a materially higher value than today’s price.

That DCF exercise yields an estimated intrinsic value of about $219.02 per share, implying the stock is trading at roughly a 47.4% discount to its calculated fair value. In other words, the current share price embeds a lot of caution relative to the cash flows Addus is expected to generate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Addus HomeCare is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Addus HomeCare Price vs Earnings

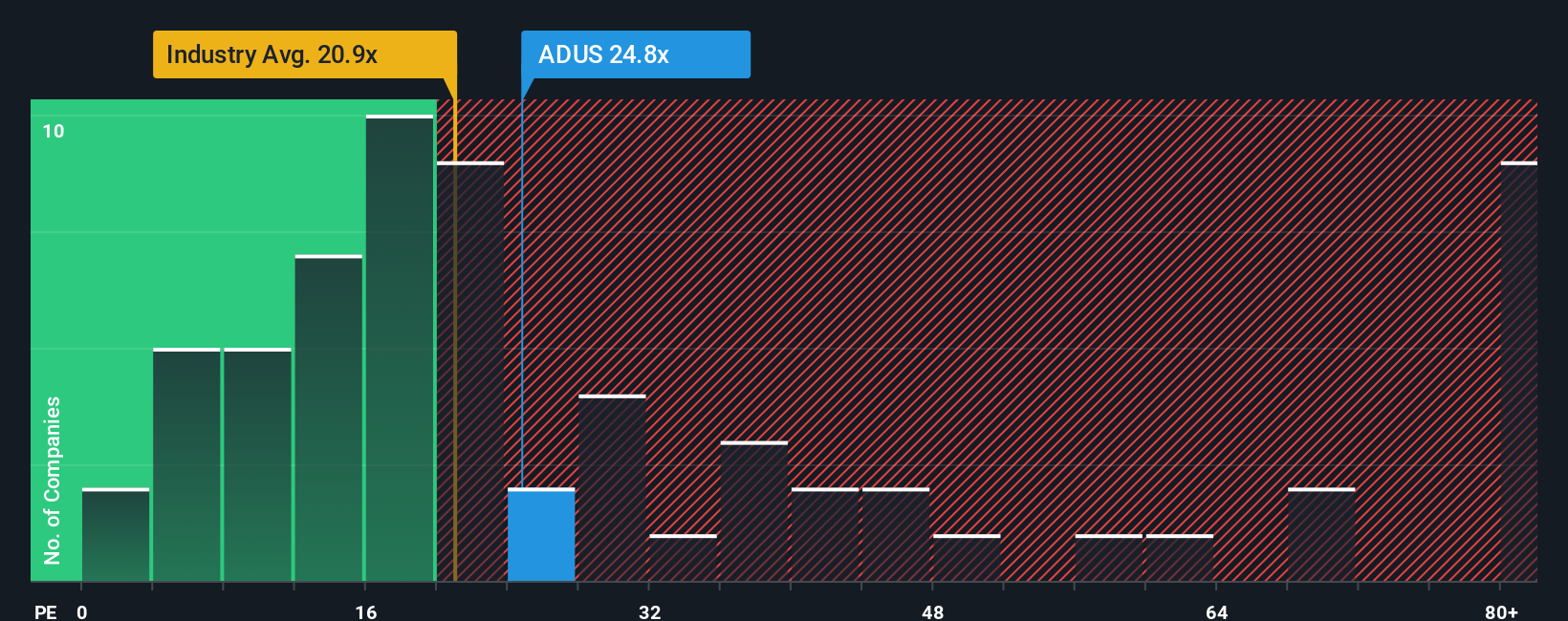

For profitable companies like Addus, the price to earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profits. What counts as a normal PE depends on how quickly earnings are expected to grow and how risky those earnings are, with faster growth and lower risk usually justifying a higher multiple.

Addus currently trades on a PE of about 24.5x, which is broadly in line with the wider Healthcare industry average of around 23.9x but sits well below a peer group average near 77.9x, where a few richly valued names can skew the picture. To add more nuance, Simply Wall St’s proprietary Fair Ratio for Addus comes in at roughly 22.1x, an estimate of the PE investors might expect given its specific mix of earnings growth, margins, risk profile, industry, and market cap.

Because the Fair Ratio bakes in these company specific characteristics, it is generally more reliable than blunt comparisons with peers or the sector as a whole. With the current PE only modestly above the Fair Ratio, the stock appears slightly expensive on earnings, but not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Addus HomeCare Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers, link that story to a financial forecast and fair value, and then compare that Fair Value to today’s Price to inform a potential choice to buy, hold, or sell. The Narrative automatically updates as new news or earnings arrive. For example, one Addus HomeCare investor might build a cautiously optimistic Narrative that sees fair value in the $147 to $162 range, while another, more conservative investor leans closer to the low analyst target near $111. Both of those perspectives can coexist and evolve in real time as assumptions about revenue growth, margins, risks, and required returns change.

Do you think there's more to the story for Addus HomeCare? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADUS

Addus HomeCare

Provides personal care services to elderly, chronically ill, disabled persons, and individuals who are at risk of hospitalization or institutionalization in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)