Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Vector Group Ltd. (NYSE:VGR) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Vector Group

How Much Debt Does Vector Group Carry?

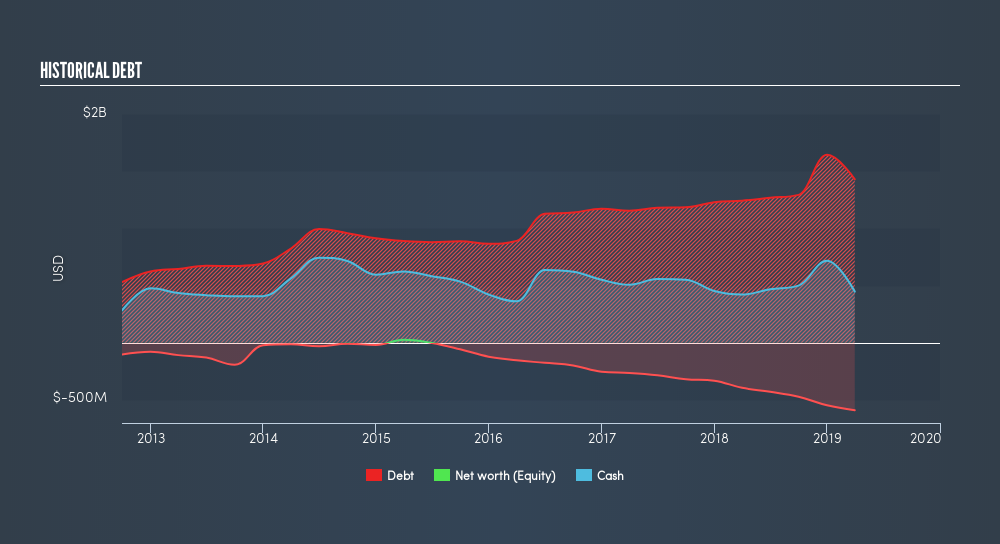

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Vector Group had US$1.43b of debt, an increase on US$1.24b, over one year. However, because it has a cash reserve of US$447.3m, its net debt is less, at about US$981.7m.

A Look At Vector Group's Liabilities

We can see from the most recent balance sheet that Vector Group had liabilities of US$302.6m falling due within a year, and liabilities of US$1.72b due beyond that. Offsetting this, it had US$447.3m in cash and US$45.8m in receivables that were due within 12 months. So it has liabilities totalling US$1.53b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's US$1.35b market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Since Vector Group does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't blink an eye at Vector Group's net debt to EBITDA ratio of 4.07, we think its super-low interest cover of 1.22 times is a bad sign. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even more troubling is the fact that Vector Group actually let its EBIT decrease by 9.5% over the last year. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Vector Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Vector Group recorded free cash flow worth 50% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

We'd go so far as to say Vector Group's interest cover was disappointing. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. Overall, it seems to us that Vector Group's debt load is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on the balance sheet . In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VGR

Vector Group

Through its subsidiaries, engages in the manufacture and sale of cigarettes in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives