- United States

- /

- Tobacco

- /

- NYSE:VGR

Three Days Left To Buy Vector Group Ltd. (NYSE:VGR) Before The Ex-Dividend Date

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Vector Group Ltd. (NYSE:VGR) is about to go ex-dividend in just 3 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. In other words, investors can purchase Vector Group's shares before the 14th of September in order to be eligible for the dividend, which will be paid on the 29th of September.

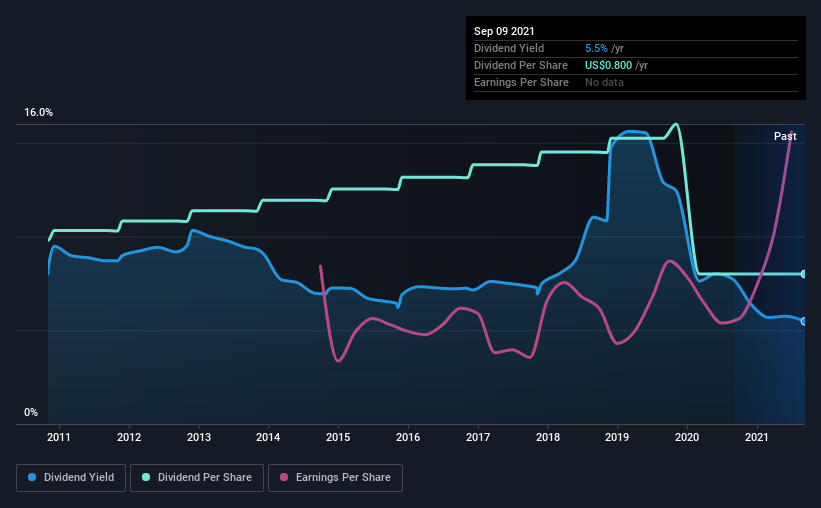

The company's next dividend payment will be US$0.20 per share. Last year, in total, the company distributed US$0.80 to shareholders. Based on the last year's worth of payments, Vector Group has a trailing yield of 5.5% on the current stock price of $14.61. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Vector Group

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Vector Group paid out 63% of its earnings to investors last year, a normal payout level for most businesses. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The company paid out 98% of its free cash flow over the last year, which we think is outside the ideal range for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want look more closely here.

Vector Group paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Vector Group to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see how much of its profit Vector Group paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see Vector Group's earnings have been skyrocketing, up 26% per annum for the past five years. Earnings have been growing quickly, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Vector Group has seen its dividend decline 2.0% per annum on average over the past 10 years, which is not great to see. It's unusual to see earnings per share increasing at the same time as dividends per share have been in decline. We'd hope it's because the company is reinvesting heavily in its business, but it could also suggest business is lumpy.

The Bottom Line

Is Vector Group worth buying for its dividend? Earnings per share growth is a positive, and the company's payout ratio looks normal. However, we note Vector Group paid out a much higher percentage of its free cash flow, which makes us uncomfortable. In summary, while it has some positive characteristics, we're not inclined to race out and buy Vector Group today.

If you want to look further into Vector Group, it's worth knowing the risks this business faces. For example, Vector Group has 4 warning signs (and 3 which are potentially serious) we think you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Vector Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:VGR

Vector Group

Through its subsidiaries, engages in the manufacture and sale of cigarettes in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026