- United States

- /

- Tobacco

- /

- NYSE:UVV

Investors Aren't Entirely Convinced By Universal Corporation's (NYSE:UVV) Earnings

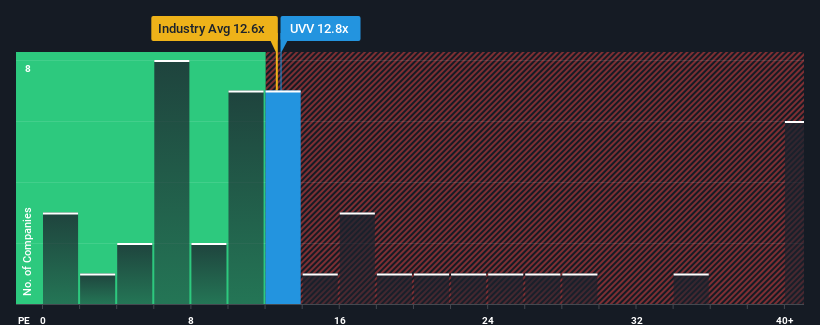

With a price-to-earnings (or "P/E") ratio of 12.8x Universal Corporation (NYSE:UVV) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Universal certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Universal

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Universal's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 36% last year. The strong recent performance means it was also able to grow EPS by 117% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Universal's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Universal revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Universal that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UVV

Universal

A business-to-business agriproducts company, provides leaf tobacco and plant-based ingredients to food and beverage end markets worldwide.

6 star dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives