- United States

- /

- Food

- /

- NYSE:TSN

What Tyson Foods (TSN)'s Move into Frozen Snacks Means for Shareholders

Reviewed by Sasha Jovanovic

- Hillshire Farm, a Tyson Foods brand, recently introduced its first-ever frozen snack line, launching Stuffed Croissants and Ciabatta Deli Sandwiches with several protein-rich varieties now available nationwide.

- This expansion marks Hillshire Farm's entry into the freezer aisle, highlighting Tyson Foods' efforts to meet growing consumer demand for quick, high-protein meal solutions with convenient heat-and-eat options.

- We'll explore how Hillshire Farm's entry into frozen snacks and sandwiches could influence Tyson Foods' long-term growth narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Tyson Foods Investment Narrative Recap

Tyson Foods shareholders are often focused on the company’s ability to drive sustained earnings and top-line growth despite beef supply constraints, input cost pressures, and stiff competition. Hillshire Farm’s move into frozen snacks adds to Tyson’s momentum in high-protein, value-added foods, but doesn’t materially change the short-term catalyst, which remains margin expansion from innovation and operational improvements; near-term risks from persistent beef segment challenges continue to loom large for overall earnings.

Among the recent announcements, Tyson’s September launch of Chicken Cups, another high-protein, ready-to-eat frozen product, directly complements Hillshire Farm’s frozen lineup and underscores Tyson’s shift toward convenient, protein-forward innovation aimed at improving margins. These launches support the catalyst that margin mix improvement from prepared foods could help offset pressures elsewhere in the portfolio.

Yet, against these efforts to boost profitability with innovation, there’s a counterpoint investors should not ignore: while prepared foods gain ground, the persistent negative operating income in beef remains a major headwind to...

Read the full narrative on Tyson Foods (it's free!)

Tyson Foods' narrative projects $57.7 billion revenue and $2.3 billion earnings by 2028. This requires 2.1% yearly revenue growth and a $1.5 billion earnings increase from $784.0 million.

Uncover how Tyson Foods' forecasts yield a $62.42 fair value, a 21% upside to its current price.

Exploring Other Perspectives

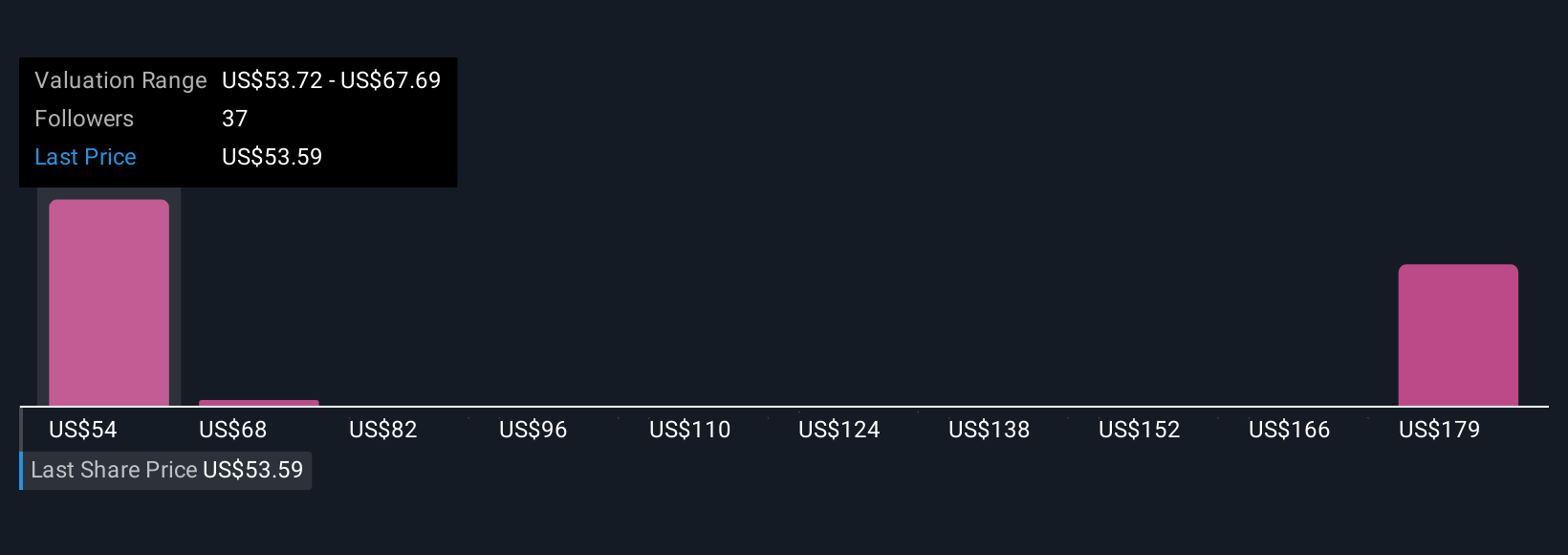

The Simply Wall St Community provided 7 fair value estimates for Tyson Foods, ranging widely from US$45 to over US$130 per share. While many see upside in Tyson’s focus on margin gains through prepared foods, the company’s ongoing beef segment losses continue to weigh on its outlook. Compare several viewpoints to see how investor confidence aligns, or doesn’t, with Tyson’s challenges and opportunities.

Explore 7 other fair value estimates on Tyson Foods - why the stock might be worth 12% less than the current price!

Build Your Own Tyson Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyson Foods research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tyson Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyson Foods' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives