- United States

- /

- Food

- /

- NYSE:TSN

Tyson Foods (TSN): Is the Current Valuation Overlooked After Recent Share Price Rebound?

Reviewed by Simply Wall St

Tyson Foods (TSN) has caught investor attention recently as its stock performance adjusts to ongoing industry pressures and shifting consumer trends. A closer look at the numbers shows how the company is navigating a changing food landscape.

See our latest analysis for Tyson Foods.

Tyson Foods has seen its share price rebound lately, jumping over 11% in the past month. However, its year-to-date move is still slightly negative and its one-year total shareholder return stands at -7.3%. This recent momentum suggests that investors may be rethinking the company’s outlook as industry sentiment shifts.

Curious what else is capturing investor attention right now? It could be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst targets and a notable recovery in recent weeks, the question now is whether Tyson Foods is undervalued, or if the market has already factored in its prospects for future growth.

Most Popular Narrative: 8.8% Undervalued

With Tyson Foods trading at $57.17 compared to the narrative’s fair value of about $62.67, there is a notable gap that is capturing investor focus. This difference puts the spotlight on the detailed projections behind the valuation, and why the consensus outlook sees more upside ahead.

Continuous operational efficiencies, supply chain optimization, and manufacturing improvements, are delivering tangible cost savings, higher fill rates, and reduced waste, which should support net margin expansion and greater earnings stability. As protein demand grows in emerging international markets and the company continues to expand its operational discipline overseas, there is further potential for stable international earnings contribution and top-line growth.

Want to know why analysts think Tyson’s value could break away from its current price? There is a surprising growth play embedded in this narrative, with a fresh profit outlook and a reimagined earnings multiple reshaping what future returns might look like. The numbers behind this scenario could flip market expectations. Dive deeper to reveal what is really driving this valuation.

Result: Fair Value of $62.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cattle supply constraints and ongoing input cost inflation remain real risks that could challenge Tyson Foods’ path to durable earnings growth.

Find out about the key risks to this Tyson Foods narrative.

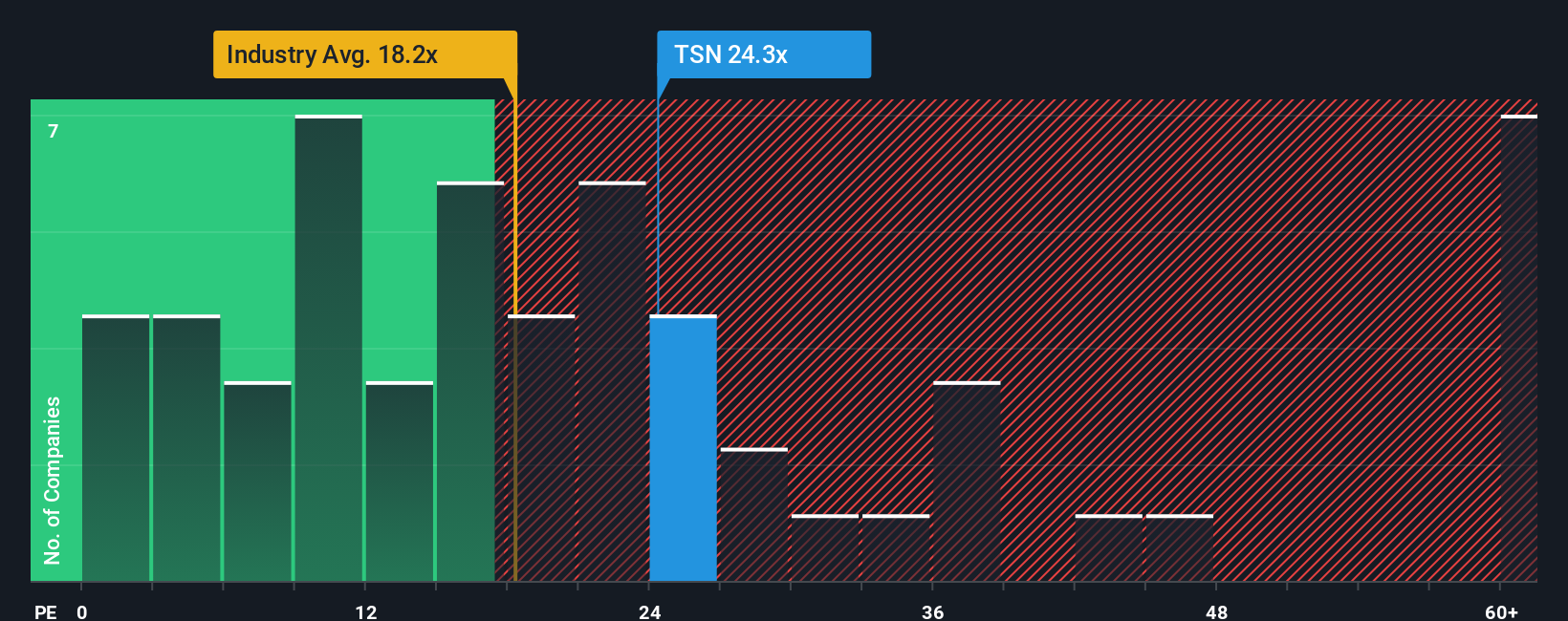

Another View: Multiples Paint a Pricier Picture

While some valuation models suggest Tyson Foods is undervalued, looking at its current price-to-earnings ratio tells a different story. At 42.6x, Tyson trades well above the US Food industry average of 19x, its peer average of 14x, and even its fair ratio of 28.5x. This signals the market is pricing in a lot of optimism, perhaps too much, raising questions about risk if expectations are not met. Will this premium be justified as earnings normalize, or is there room for a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tyson Foods Narrative

If you want to see the story differently or build your own research-backed view, you can shape your narrative in just minutes. Do it your way

A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your portfolio stand out by targeting tomorrow’s opportunities. Uncover completely new angles and outperform the crowd by checking out these handpicked stock ideas you should not ignore.

- Boost your income stream and secure higher yields by tapping into these 14 dividend stocks with yields > 3% offering over 3% returns.

- Catch the momentum of rapid innovation by jumping on these 26 AI penny stocks as they transform industries with artificial intelligence breakthroughs.

- Strengthen your strategy with value picks and spot hidden potential through these 920 undervalued stocks based on cash flows using powerful cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tyson Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSN

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026