- United States

- /

- Tobacco

- /

- NYSE:TPB

Turning Point Brands (TPB): Evaluating Valuation After Explosive 651% Nicotine Pouch Revenue Growth and Upgraded Outlook

Reviewed by Simply Wall St

Turning Point Brands (TPB) just stunned the market with its nicotine pouch business, posting more than 651% year over year revenue growth and lifting its full year growth and profit outlook on the back of that momentum.

See our latest analysis for Turning Point Brands.

The market has been steadily repricing that growth story, with the share price now at $98.68 after a strong year to date share price return of 62.7 percent and an eye catching three year total shareholder return of 379.66 percent that signals sustained momentum behind the story.

If TPB’s surge has you thinking about where growth driven stories emerge next, it could be a smart moment to explore fast growing stocks with high insider ownership.

With the shares up sharply but still trading around a 20 percent discount to analyst targets, the key question now is whether Turning Point Brands remains undervalued or if the market is already pricing in years of nicotine pouch growth.

Most Popular Narrative: 16.9% Undervalued

Turning Point Brands last closed at $98.68, while the most widely followed narrative sees fair value materially higher. This implies potential headroom if execution stays on track.

The analysts have a consensus price target of $107.75 for Turning Point Brands based on their expectations of its future earnings growth, profit margins and other risk factors.

Curious how strong double digit growth, rising margins and a richer earnings multiple all fit together? Want to see the projections that make that target tick?

Result: Fair Value of $118.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained outperformance is not guaranteed. Execution missteps or tougher nicotine pouch regulation are both capable of quickly undermining today’s upbeat growth narrative.

Find out about the key risks to this Turning Point Brands narrative.

Another Angle on Valuation

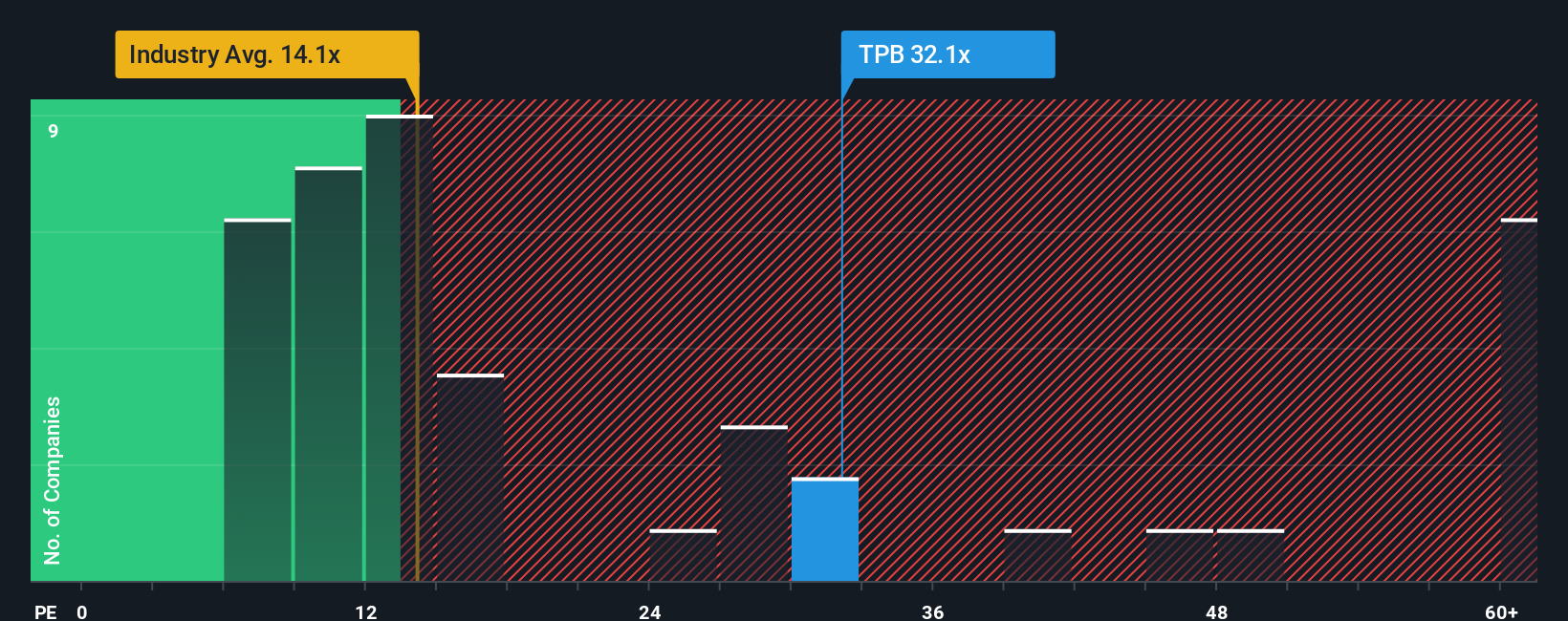

Analysts see fair value at $118.75, but on earnings TPB already looks stretched. The stock trades on a 31.5x PE versus a fair ratio of 25.2x, the peer average of 28.3x and a global Tobacco average of 13.4x. This comparison tilts the risk reward toward downside if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Turning Point Brands Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Turning Point Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the edge by scanning fresh opportunities on Simply Wall Street’s Screener, where high potential stories are waiting to be found.

- Secure potential stability and income by reviewing these 15 dividend stocks with yields > 3% that can help underpin your portfolio with reliable cash returns.

- Tap into structural growth trends by targeting these 30 healthcare AI stocks that are reshaping how medicine, diagnostics and patient care are delivered.

- Position yourself early in digital finance by assessing these 81 cryptocurrency and blockchain stocks that are building the infrastructure behind the next wave of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026