- United States

- /

- Tobacco

- /

- NYSE:TPB

Shareholders Will Probably Hold Off On Increasing Turning Point Brands, Inc.'s (NYSE:TPB) CEO Compensation For The Time Being

Key Insights

- Turning Point Brands' Annual General Meeting to take place on 8th of May

- Salary of US$772.5k is part of CEO Graham Purdy's total remuneration

- Total compensation is 141% above industry average

- Turning Point Brands' EPS declined by 1.1% over the past three years while total shareholder return over the past three years was 103%

Turning Point Brands, Inc. (NYSE:TPB) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. The upcoming AGM on 8th of May may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Turning Point Brands

Comparing Turning Point Brands, Inc.'s CEO Compensation With The Industry

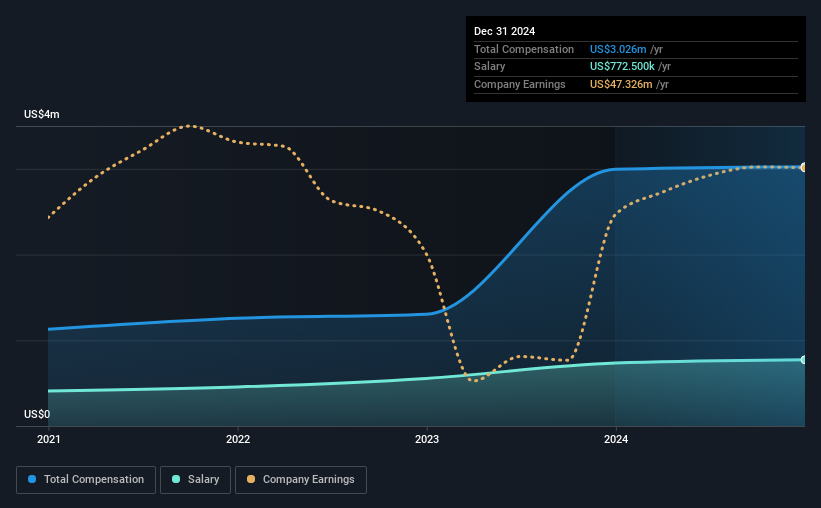

According to our data, Turning Point Brands, Inc. has a market capitalization of US$1.1b, and paid its CEO total annual compensation worth US$3.0m over the year to December 2024. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$773k.

On examining similar-sized companies in the the US Tobacco industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$1.3m. This suggests that Graham Purdy is paid more than the median for the industry. Furthermore, Graham Purdy directly owns US$10m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$773k | US$736k | 26% |

| Other | US$2.3m | US$2.3m | 74% |

| Total Compensation | US$3.0m | US$3.0m | 100% |

On an industry level, roughly 32% of total compensation represents salary and 68% is other remuneration. Turning Point Brands sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Turning Point Brands, Inc.'s Growth

Over the last three years, Turning Point Brands, Inc. has shrunk its earnings per share by 1.1% per year. Its revenue is up 11% over the last year.

The lack of EPS growth is certainly uninspiring. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Turning Point Brands, Inc. Been A Good Investment?

Boasting a total shareholder return of 103% over three years, Turning Point Brands, Inc. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Turning Point Brands that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026