- United States

- /

- Tobacco

- /

- NYSE:TPB

Reassessing Turning Point Brands (TPB) Valuation After a Strong Multi‑Year Share Price Rally

Reviewed by Simply Wall St

Setting the stage

Turning Point Brands (TPB) has quietly become a strong performer, with shares up around 74% year to date and roughly 83% over the past year, far outpacing many consumer staples peers.

See our latest analysis for Turning Point Brands.

That surge has come with a few bumps, including a recent pullback in the share price to about $105.76 after a hot run. However, the 1 month share price return of roughly 8.5 percent and exceptionally strong multi year total shareholder returns suggest momentum is still broadly intact as investors reassess both growth prospects and perceived risks.

If TPB’s rally has you rethinking your watchlist, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the share price hovering just below analyst targets after a powerful multi year run, investors now face a tougher question: is Turning Point Brands still trading below its true potential, or is future growth already priced in?

Most Popular Narrative Narrative: 10.9% Undervalued

Compared with the most followed fair value estimate of $118.75, Turning Point Brands last closed at $105.76, setting up a valuation gap driven by ambitious growth assumptions.

The expanding route-to-market strategy, including a major increase in sales force headcount and the rollout of leading DTC brands like ALP into brick-and-mortar retail, leverages shifts in consumer purchasing to alternative channels, supporting broader distribution, incremental revenue, and improved operational efficiency.

Want to see what kind of growth runway justifies that higher value, and how margins and future earnings power are being projected to get there? The answers sit inside the narrative assumptions about rapid top line expansion, rising profitability, and a future earnings multiple more often associated with faster moving categories.

Result: Fair Value of $118.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in scaling Modern Oral or tighter nicotine regulations could quickly undermine the upbeat growth narrative that currently supports TPB’s valuation.

Find out about the key risks to this Turning Point Brands narrative.

Another Angle on Valuation

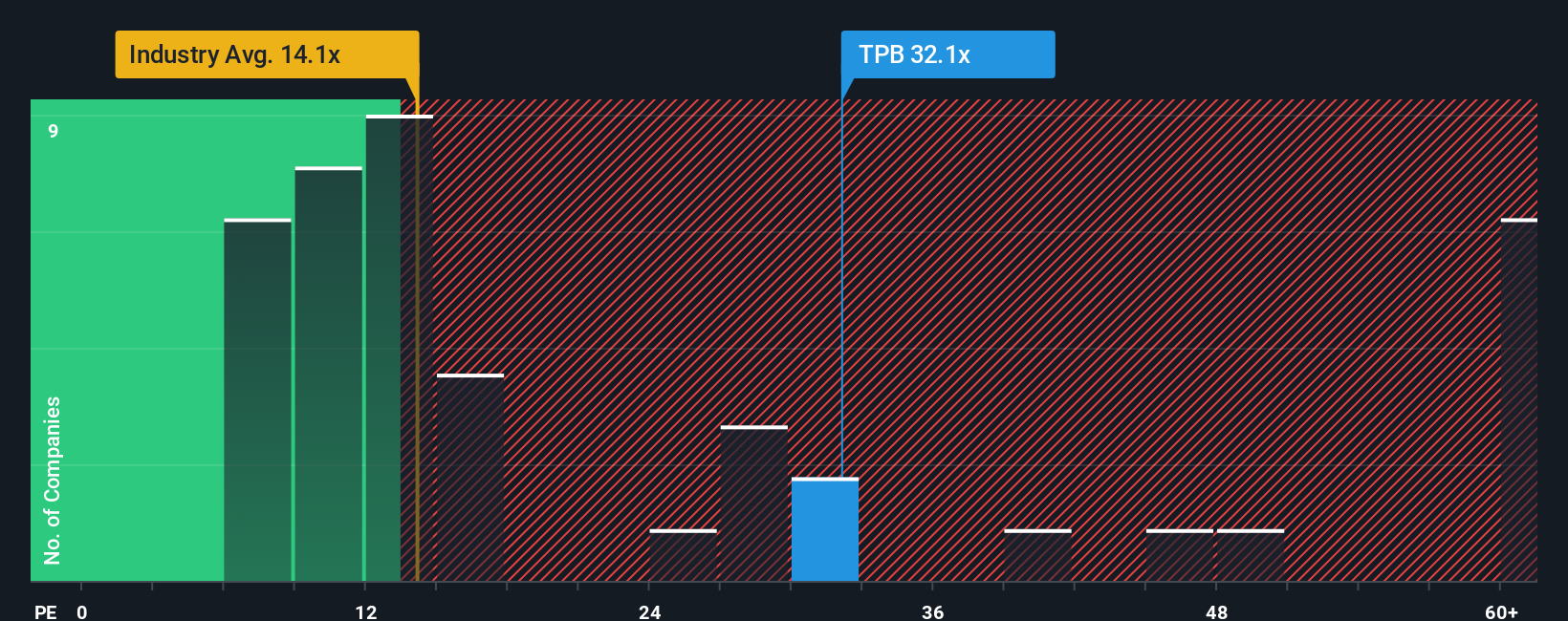

While the narrative framework suggests Turning Point Brands is about 10.9 percent undervalued, our earnings ratio work paints a hotter picture. The current price to earnings ratio sits near 33.8 times, versus a 25.5 times fair ratio and 28 times for peers, and just 13.3 times for the wider tobacco group. That premium signals execution must stay nearly flawless, or today’s optimism could unwind quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Turning Point Brands Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Turning Point Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with Turning Point Brands, you could miss standout opportunities, so put the Simply Wall St Screener to work and let fresh ideas come to you.

- Capture the next wave of high potential growth by targeting these 24 AI penny stocks accelerating breakthroughs across automation, data analytics, and intelligent software.

- Lock in potential income and resilience by focusing on these 10 dividend stocks with yields > 3% that can support returns even when markets turn volatile.

- Position yourself ahead of the crowd by uncovering these 79 cryptocurrency and blockchain stocks reshaping payments, digital assets, and blockchain infrastructure worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion