- United States

- /

- Tobacco

- /

- NYSE:TPB

Does FRE Watermelon's Launch Signal a Shift in Turning Point Brands' (TPB) Innovation Strategy?

Reviewed by Sasha Jovanovic

- Turning Point Brands recently launched FRE Watermelon, expanding its FRE nicotine pouch line with a range of strengths from 3mg to 15mg and targeting fruit-flavor demand in the oral nicotine segment.

- This release positions FRE as the first and only white pouch brand to offer pure watermelon flavor across a full spectrum of strengths, aiming to win over a rapidly growing but underserved market with strong appeal among female pouch users.

- We'll now explore how FRE Watermelon's differentiated strengths and flavor lineup could impact Turning Point Brands' investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Turning Point Brands Investment Narrative Recap

To see Turning Point Brands as an appealing investment, you need conviction in the long-term growth of Modern Oral nicotine pouches and the company's ability to innovate faster than competitor brands. The FRE Watermelon launch directly addresses one of today's biggest short-term catalysts, securing share in the expanding fruit-flavored pouch segment, but it doesn't reduce the key risk: potential regulatory challenges or flavor bans that could contract the market and pressure future revenue. The Stoker's Fine Cut Wintergreen packaging update was another recent product announcement, expanding traditional lines alongside Modern Oral initiatives. Both highlight TPB’s reliance on continuous product innovation as a catalyst for share gains, which amplifies the risk if external pressures, such as regulation, intensify or consumer trends shift away from flavored products. By contrast, investors should also keep a close eye on ...

Read the full narrative on Turning Point Brands (it's free!)

Turning Point Brands' outlook anticipates $745.7 million in revenue and $100.8 million in earnings by 2028. This projection is based on a 22.3% annual revenue growth rate and a $49.7 million increase in earnings from the current $51.1 million.

Uncover how Turning Point Brands' forecasts yield a $107.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

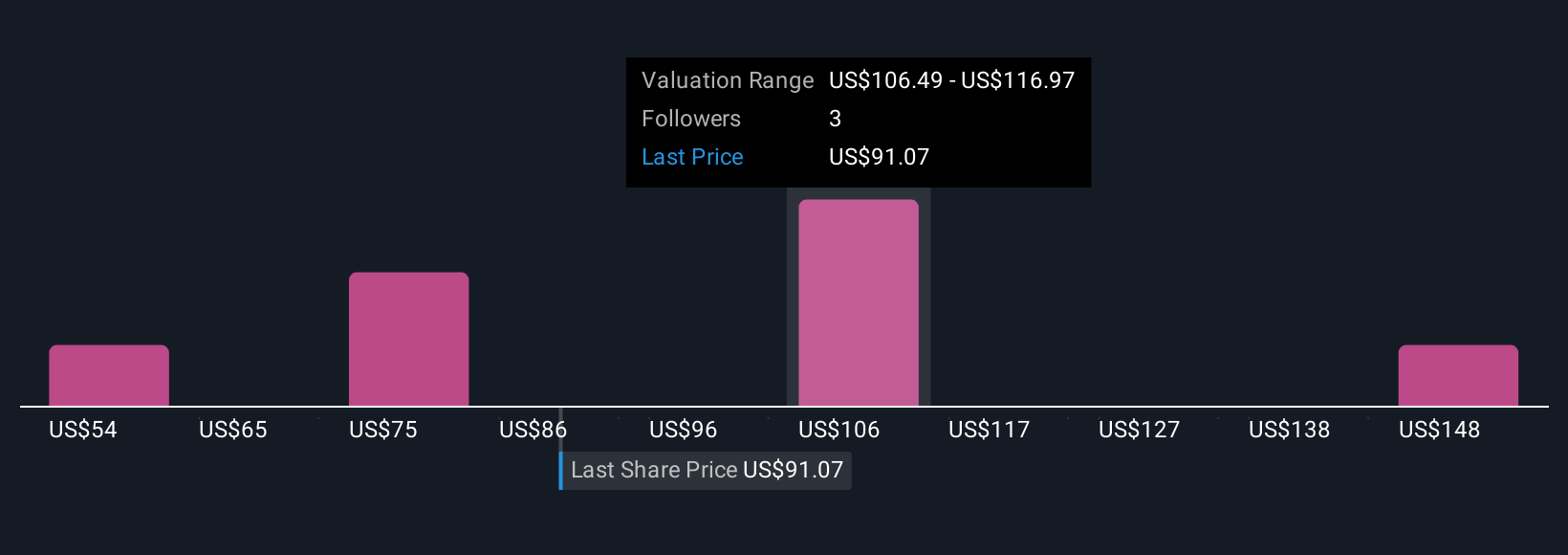

The Simply Wall St Community submitted 4 fair value estimates ranging from US$54.06 to US$158.91 per share. While opinions diverge, the dominant catalyst is robust Modern Oral segment growth, suggesting continued debate about the sustainability of recent momentum.

Explore 4 other fair value estimates on Turning Point Brands - why the stock might be worth as much as 76% more than the current price!

Build Your Own Turning Point Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Turning Point Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Turning Point Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Turning Point Brands' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Turning Point Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPB

Turning Point Brands

Manufactures, markets, and distributes branded consumer products in the United States and Canada.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives