- United States

- /

- Food

- /

- NYSE:THS

TreeHouse Foods (THS): Does the Current Valuation Reflect the Company’s True Growth Prospects?

Reviewed by Kshitija Bhandaru

TreeHouse Foods (THS) stock has seen moderate movement over the past week, gaining just over 3%. Investors keeping an eye on packaged foods may be curious about the company’s longer-term track record and current valuation.

See our latest analysis for TreeHouse Foods.

After a steady week, TreeHouse Foods finds itself in a broader holding pattern, with its 1-year total shareholder return down nearly 0.5%. While recent events have not sparked dramatic moves, the price suggests investors are still weighing future growth against ongoing risks, as momentum remains modest.

If you are watching for signs of stronger momentum elsewhere, it is a great time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether TreeHouse Foods is trading at an attractive discount, or if the market has already factored in its modest growth prospects. Is there a buying opportunity, or is future growth fully priced in?

Most Popular Narrative: 2.7% Undervalued

The most widely followed narrative sees fair value for TreeHouse Foods slightly above the last close price. This suggests a small margin of undervaluation that investors might be watching. The narrative is grounded in strategic shifts that could reset the company's earnings outlook.

Supply chain optimization, plant closures in underperforming businesses, and margin management initiatives are structurally lowering TreeHouse's cost base and increasing operational flexibility. These efficiency gains and disciplined capital allocation are expected to strengthen EBITDA margins and translate to higher, more predictable free cash flow over the next several years.

Curious about the financial blueprints fueling this view? The narrative’s forecasts rely on aggressive margin recovery and bold assumptions for earnings. Eager to see which future benchmarks could justify the proposed fair value? The answers might surprise you.

Result: Fair Value of $21.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume declines or intensified branded competition could easily challenge these upbeat projections and shift the outlook back to caution for TreeHouse Foods.

Find out about the key risks to this TreeHouse Foods narrative.

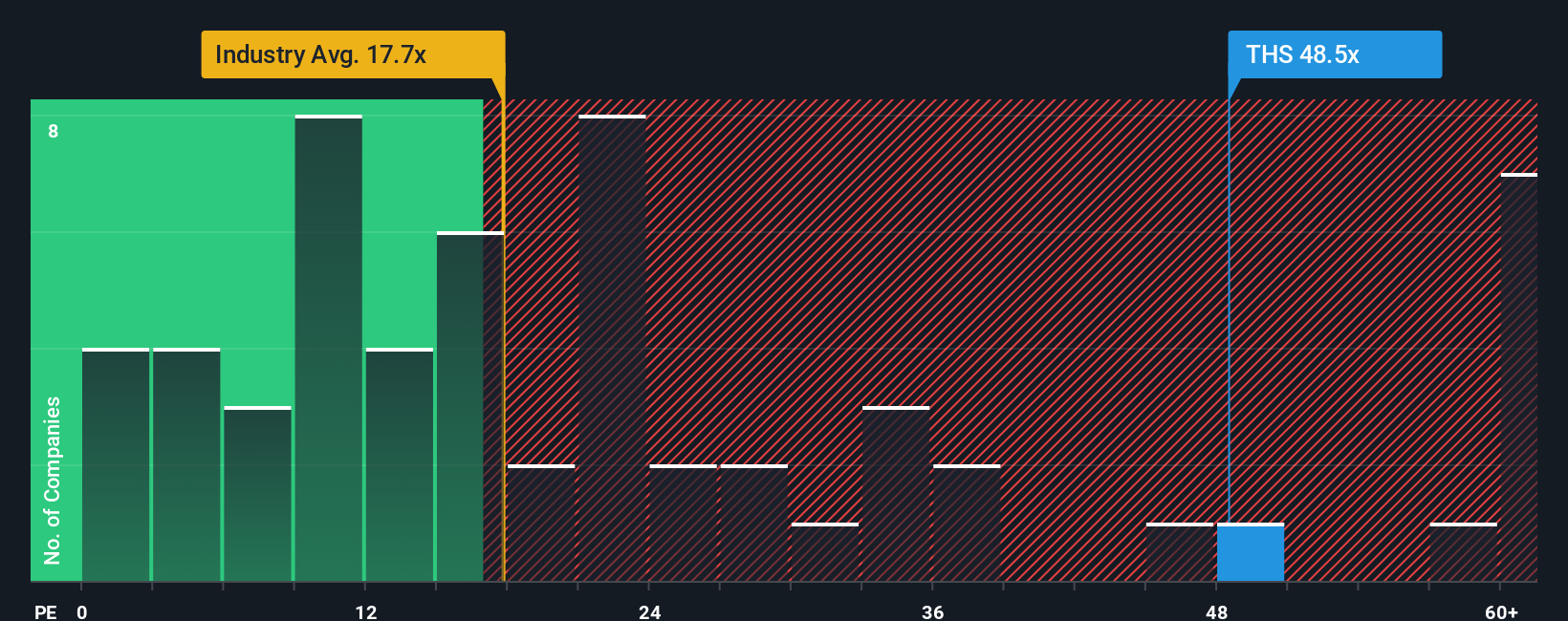

Another View: Expensive Compared to Peers

Looking at TreeHouse Foods through the lens of earnings multiples paints a much less optimistic picture. The company's price-to-earnings ratio stands at 50.8x, which is far higher than both its peer average of 18.3x and the US Food industry average of 18.1x. Even when compared to its own fair ratio of 22.9x, the current valuation suggests investors are paying a steep premium for future growth. This wide gap signals a notable valuation risk. Does the market see something others are missing, or could a correction be ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TreeHouse Foods Narrative

If you are looking for a different perspective or want to dig deeper into the numbers, you can easily craft your own narrative in just a few minutes, then Do it your way.

A great starting point for your TreeHouse Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game and grab your next opportunity with these powerful ideas you may have missed. Don’t let the right stocks slip by while you wait.

- Capitalize on future breakthroughs by targeting growth in these 23 AI penny stocks with robust potential in artificial intelligence and machine learning innovation.

- Maximize steady income streams as you review these 19 dividend stocks with yields > 3%, bringing reliable yields above 3% into your portfolio.

- Seize market mispricing and value plays by searching through these 914 undervalued stocks based on cash flows based on strong fundamentals and healthy cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TreeHouse Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THS

TreeHouse Foods

Manufactures and distributes private brands snacks and beverages in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives