- United States

- /

- Beverage

- /

- NYSE:TAP

Molson Coors Shares Rebound 3% as Growth Strategy Sparks Fresh Valuation Debate

Reviewed by Bailey Pemberton

Have you been eyeing Molson Coors Beverage and wondering if now’s the right time to buy, sell, or simply hold on? You're definitely not alone. This iconic beverage company has caught investors’ attention recently, and with good reason. Even seasoned market watchers are debating its long-term potential. The stock just closed at $46.59, and while its year-to-date return sits at -18.5%, there’s been a modest but steady recovery over the last month, with shares ticking up 3.3%. Look back a little further and you’ll notice it’s up an impressive 61.0% over the past five years, suggesting this isn’t just a story of short-term bumps.

Some of this renewed interest traces back to the company's strategic push into growth markets and product lines, like innovative non-alcoholic beverages and craft partnerships, which have received plenty of industry buzz without the stock becoming a speculative frenzy. Investors seem to be recalibrating risk, especially as broader market trends highlight the resilience of consumer staples.

But let’s get to the heart of what matters: is Molson Coors Beverage undervalued right now? According to our framework, this company scores a 5 out of 6 on key checks used to identify undervalued stocks, making it a strong contender in its sector. Next, we'll break down exactly how this score stacks up using different valuation methods. And stay tuned, because at the end I’ll share a smarter perspective for thinking about valuation that even the pros can miss.

Why Molson Coors Beverage is lagging behind its peers

Approach 1: Molson Coors Beverage Discounted Cash Flow (DCF) Analysis

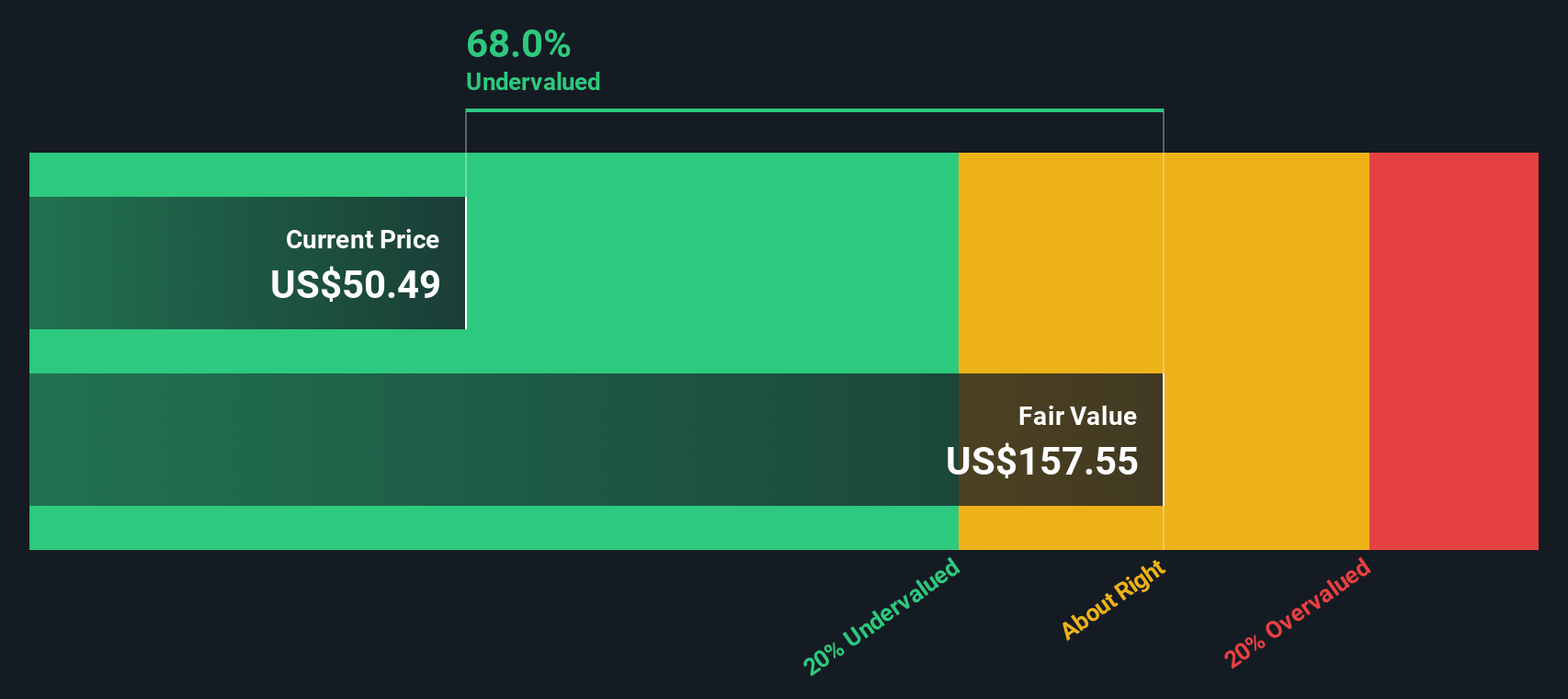

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those amounts back to today’s dollars. This approach helps investors look beyond current market swings and focus on the core value being created in the business.

For Molson Coors Beverage, the most recent reported Free Cash Flow sits at $981 million. Analyst estimates cover the next few years, and according to projections, Free Cash Flow could reach roughly $1.3 billion by 2029. Since analysts only project directly for five years, Simply Wall St extends these forecasts further by factoring in industry growth rates and company trends.

By summing up all these discounted cash flow estimates, the intrinsic value of Molson Coors Beverage is calculated at $158.06 per share. Compared to the latest share price of $46.59, this model implies the stock trades at a significant 70.5% discount to its estimated fair value. In other words, the DCF suggests shares are attractively undervalued right now, giving long-term investors a wide margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molson Coors Beverage is undervalued by 70.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

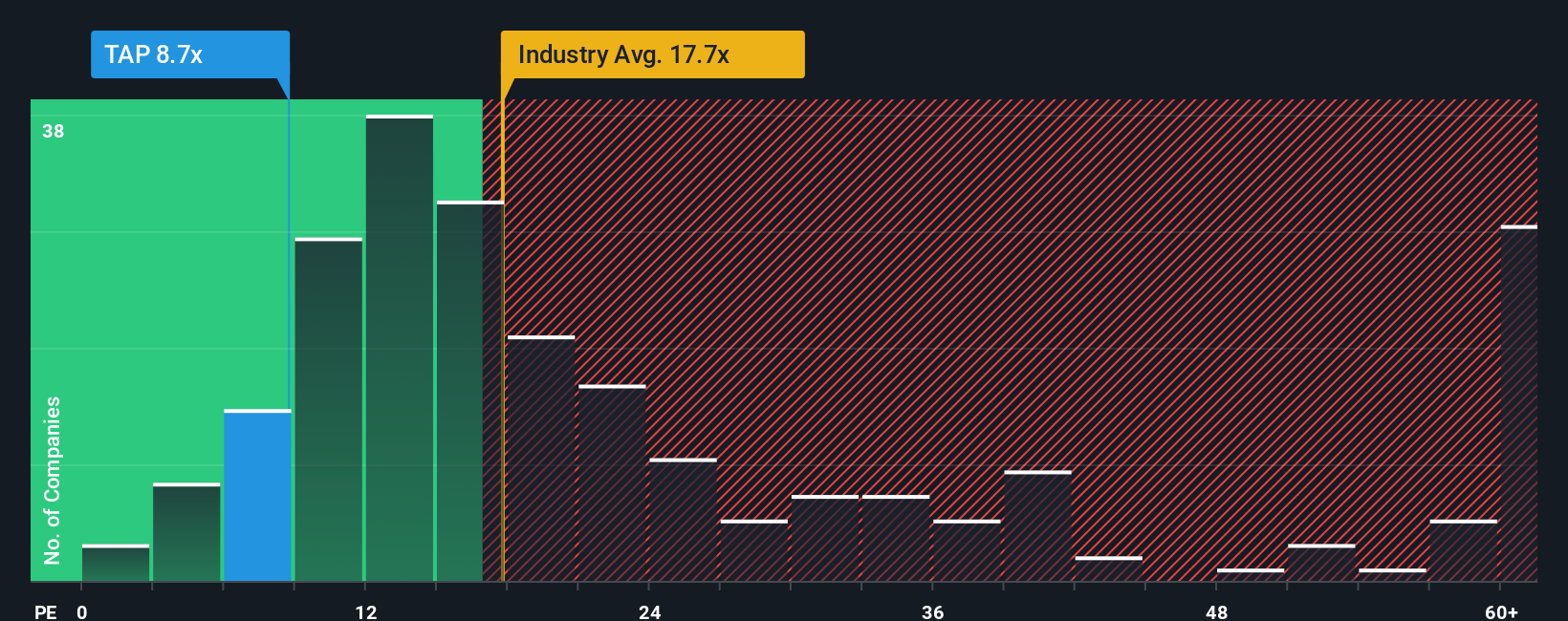

Approach 2: Molson Coors Beverage Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic valuation tool for profitable companies because it compares how much investors are willing to pay for each dollar of earnings. It is a straightforward way to gauge whether a stock seems cheap or expensive relative to its profitability, making it a good starting point for evaluating established businesses like Molson Coors Beverage.

It is important to remember, though, that growth potential and risk shape what counts as a “normal” or “fair” PE ratio. Companies expected to grow earnings faster or with more reliable profits often trade at higher multiples, while riskier or slower-growing firms see lower PE ratios.

Molson Coors Beverage currently trades at a PE ratio of 8.9x, much lower than the beverage industry average of 17.6x and its peers' average of 19.6x. This alone might make the stock seem heavily discounted, but context matters.

That is where Simply Wall St’s Fair Ratio comes in. For Molson Coors Beverage, the Fair Ratio is set at 14.6x. Unlike a plain industry or peer comparison, the Fair Ratio factors in the company’s specific growth outlook, risk profile, profit margins, market capitalization, and sector characteristics. This tailored approach helps cut through noise and gives a more accurate read on what the stock should be worth.

Comparing the current PE of 8.9x to the Fair Ratio of 14.6x, Molson Coors Beverage looks attractively undervalued by this measure, implying that the share price does not fully reflect the company’s underlying potential given its earnings power and sector.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molson Coors Beverage Narrative

Earlier, we mentioned an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about what you believe a company’s future will look like, turned into numbers: your best estimates for Molson Coors Beverage's future revenue, profit margins, and fair value. Narratives connect a company’s unique story and outlook directly to a financial forecast, helping you see not just what the numbers are today, but what they could become based on changes you think are likely (like a new product launch or shifts in market share).

On Simply Wall St’s Community page, Narratives are an easy, accessible way for investors to map out their view, compare it with others, and instantly see what price would make a buy, hold, or sell decision make sense. They update automatically as the latest earnings or industry events roll in, so your view always reflects new facts. For example, some Molson Coors Narratives reflect optimism with a fair value as high as $72.00, expecting a turnaround in beer demand, while the most cautious see fair value closer to $42.00, pricing in long-term headwinds. Narratives help you make clear, informed decisions, grounded in your own research paired with community insights.

Do you think there's more to the story for Molson Coors Beverage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAP

Molson Coors Beverage

Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives