- United States

- /

- Beverage

- /

- NYSE:TAP

Does Molson Coors Offer Value After Canada Boycott and Record US Drinking Lows in 2025?

Reviewed by Bailey Pemberton

Thinking about Molson Coors Beverage these days? You are not alone. The stock has given investors plenty to talk about, with a recent 4.0% bounce last week that stands out after a rough few months. If you have been watching the headlines, you know that setbacks like a Canadian boycott of U.S. alcohol and record-low drinking rates among Americans have created a wave of caution, and that has impacted Molson Coors, pushing the stock down by 8.1% over the past month and 19.3% so far this year. Even with all that, the five-year return sits at 42.7%, hinting at the company’s ability to weather challenging industry shifts.

A lot is happening beneath the surface, and that is where valuation becomes crucial. Molson Coors has a valuation score of 5 out of 6, meaning it appears undervalued across nearly every major metric we check. That is not easy to find in today’s market, and it is why this stock is worth a closer look. In the next section, we will dig into those valuation methods, but stick around, because understanding true value means going even a step further than the usual numbers.

Why Molson Coors Beverage is lagging behind its peers

Approach 1: Molson Coors Beverage Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach is used to determine what Molson Coors Beverage is fundamentally worth, based on its ability to generate cash in the years ahead.

Currently, Molson Coors reports annual Free Cash Flow (FCF) of $981 million. Analyst estimates cover the next five years, expecting cash flow to grow steadily each year. By 2029, projections show annual FCF increasing to $1.27 billion, with further long-term growth forecasted by Simply Wall St beyond that period. These future cash flows are brought back to a present value using a discount rate that accounts for risk and time.

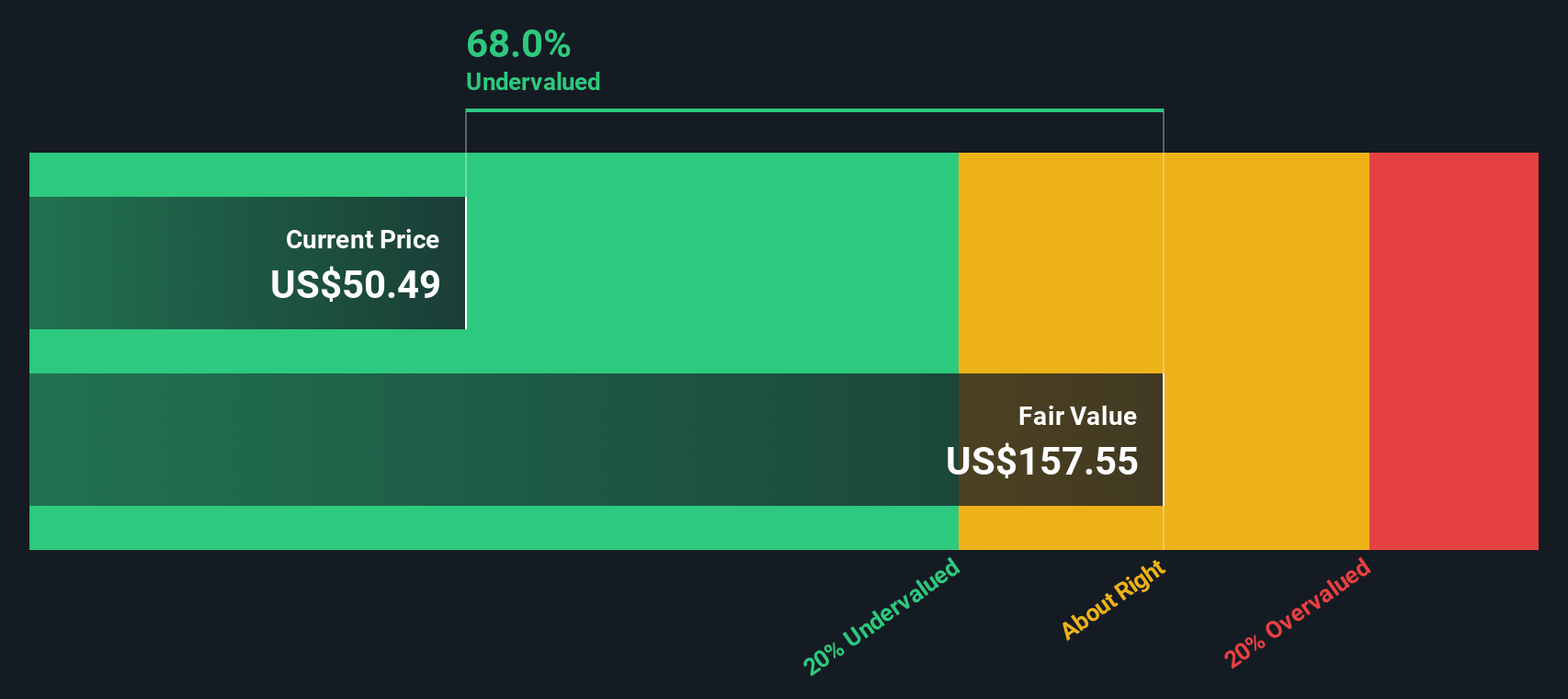

Based on this DCF analysis, the estimated fair value for Molson Coors is $151.36 per share. Compared to its current trading price, the DCF suggests the stock is trading at a 69.5% discount to its intrinsic value. This indicates significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Molson Coors Beverage is undervalued by 69.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Molson Coors Beverage Price vs Earnings (PE)

The price-to-earnings (PE) ratio is one of the most widely used methods to value profitable companies like Molson Coors Beverage. It shows how much investors are willing to pay today for a dollar of earnings, making it particularly insightful for established businesses with steady profits.

Understanding what a “normal” PE ratio should look like depends on growth expectations and the perceived risk of the business. Companies with higher expected earnings growth and lower risk typically trade at higher PE ratios, while slower-growing or riskier businesses command lower multiples.

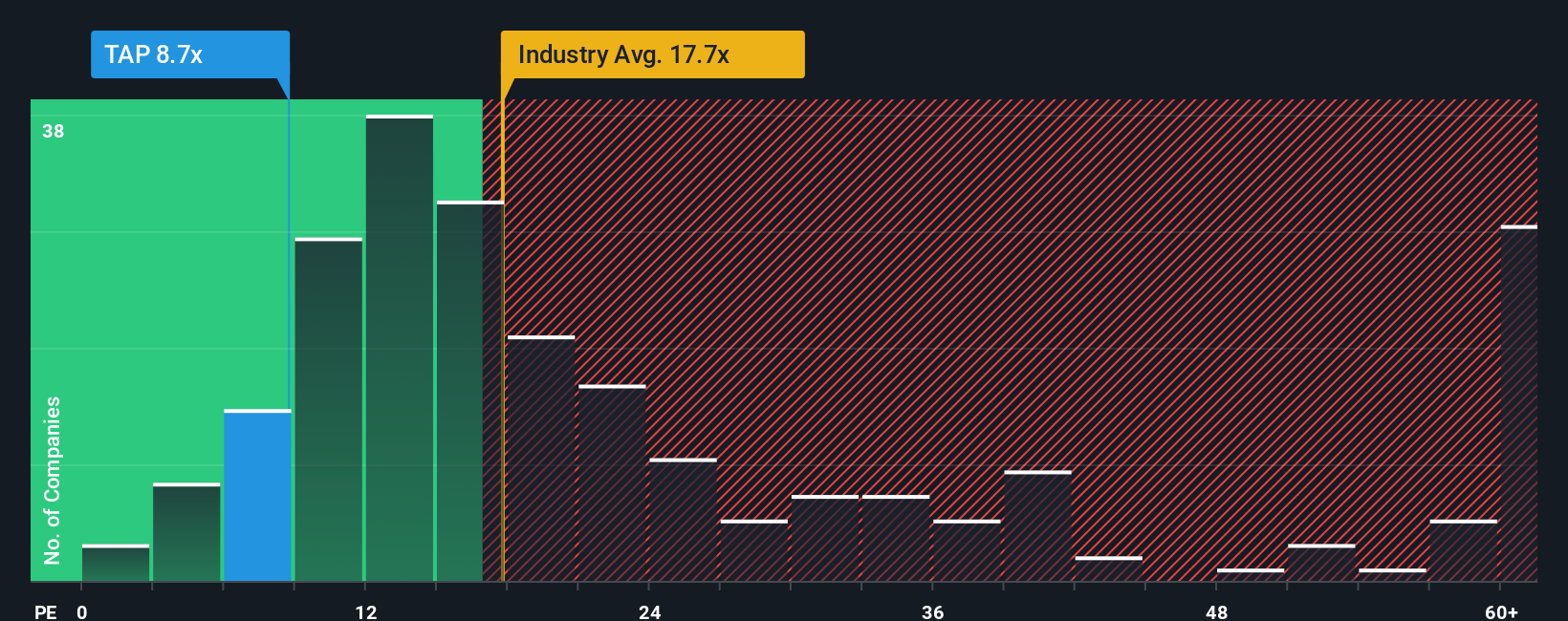

Currently, Molson Coors is trading at a PE ratio of 8.80x. For context, the average PE ratio for beverage industry peers is 19.17x, while the broader industry average sits at 17.70x. These benchmarks suggest Molson Coors is trading at a steep discount to both its competitors and the industry as a whole.

Simply Wall St’s proprietary “Fair Ratio” for Molson Coors is 14.45x. This Fair Ratio goes beyond simple peer or industry comparisons by factoring in key elements such as company-specific earnings growth, market risks, profit margins, and market capitalization. This provides a more tailored view of what would be a reasonable valuation for Molson Coors in today’s market.

Comparing the Fair Ratio of 14.45x to the current PE of 8.80x shows that the stock remains significantly undervalued, even after accounting for its unique risks and growth prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Molson Coors Beverage Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story you build around a company—your perspective on where it is heading, what will drive its future, and what that means for its underlying numbers, such as fair value, projected revenue, earnings, and profit margins.

By creating a Narrative, you link the company’s story directly to a financial forecast, giving context to your estimates and turning them into actionable insights. Narratives help make it easier to decide when to buy or sell by comparing your Fair Value estimate to the actual market Price, and they update dynamically as new news, data, or earnings come in, so you are never working from outdated information.

On Simply Wall St’s Community page, Narratives are an accessible and intuitive tool used by millions of investors to share, compare, and refine their investment perspectives. For example, when it comes to Molson Coors Beverage, one investor might believe "Above-premium beverage diversification will unlock future value," estimating a fair value as high as $72 per share, while another may see ongoing risks and set a more cautious fair value of $42, demonstrating that Narratives capture the full range of views behind each forecast and valuation.

Do you think there's more to the story for Molson Coors Beverage? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAP

Molson Coors Beverage

Manufactures, markets, and sells beer and other malt beverage products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives