- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (STZ): Exploring Valuation After Recent Share Price Declines

Reviewed by Simply Wall St

Constellation Brands (STZ) has caught the eye of investors after months of share price pressure. The stock has dropped 8% over the past month and 22% in the past 3 months. Many are starting to question what is driving this trend and whether the current level presents an opportunity.

See our latest analysis for Constellation Brands.

Looking at the bigger picture, Constellation Brands has seen momentum fade this year, with a 1-year total shareholder return of -44% and shares recently closing at $129.16. The weak long-term total return suggests investors are rethinking growth versus risk, especially after the company’s notable losses in recent months.

If you’re keeping an eye out for fresh opportunities beyond beverages, consider broadening your search and discover fast growing stocks with high insider ownership

With Constellation Brands now trading well below analyst targets, investors are left to wonder: is the recent slide a chance to buy at a deep discount, or are markets simply baking in weaker future growth?

Most Popular Narrative: 24.9% Undervalued

According to the most popular narrative, Constellation Brands’ calculated fair value sits well above its recent closing price. The wide gap signals a potential mispricing that could attract both bargain hunters and growth-focused investors.

“The company plans to generate approximately $9 billion in operating cash flow and $6 billion in free cash flow from fiscal '26 to fiscal '28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.”

Want to know what’s really driving that bold valuation? One daring set of future growth and profit forecasts forms the backbone of this narrative. Curious which numbers are behind the optimism? The details might surprise you. Explore the projections that shaped this fair value.

Result: Fair Value of $172.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff pressures and slower beer segment growth could quickly undermine the optimistic fair value narrative if consumer demand does not rebound.

Find out about the key risks to this Constellation Brands narrative.

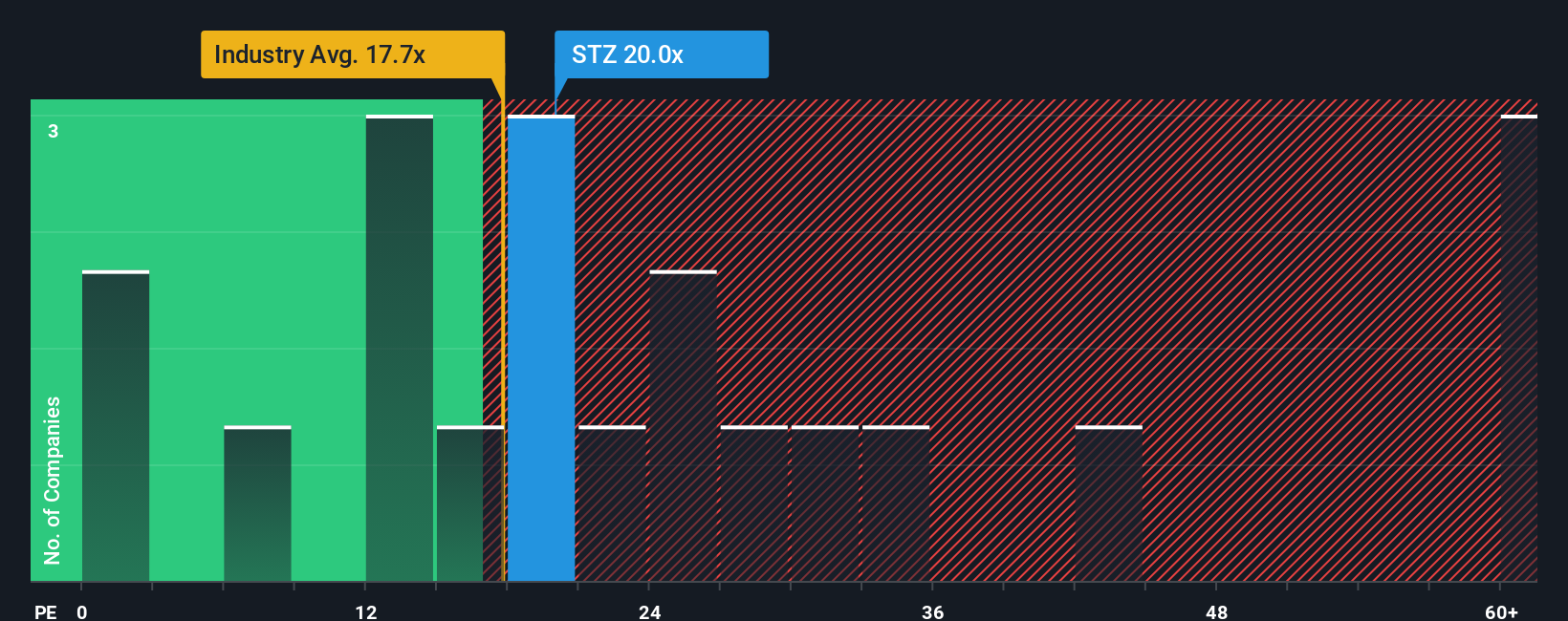

Another View: Market Ratios Raise Some Questions

Looking at the company’s price-to-earnings ratio of 18.4x, it stands higher than the beverage industry’s 18.1x average but lower than the peer average of 18.9x. Interestingly, it is also below the fair ratio of 20.7x, hinting at a possible valuation buffer. Could the market be missing something, or is risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

If you want to challenge the current storyline or dig deeper into the numbers, building your own perspective takes just a few minutes. Do it your way

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Let’s make sure you’re not missing out on smarter growth opportunities. Use the Simply Wall Street Screener and sharpen your edge with new possibilities right now.

- Capitalize on tomorrow’s innovations by checking out these 25 AI penny stocks making waves with breakthrough AI technology and disruptive business models.

- Strengthen your passive income strategy by scanning these 16 dividend stocks with yields > 3% that offer reliable yields and stand out for stable, long-term performance.

- Ride the digital transformation by investing in these 82 cryptocurrency and blockchain stocks powering new frontiers in payments, tokenization, and blockchain security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives