- United States

- /

- Beverage

- /

- NYSE:STZ

Constellation Brands (NYSE:STZ) Removed From Russell Top 200 Indices

Reviewed by Simply Wall St

Constellation Brands (NYSE:STZ) experienced notable index reclassifications last week, including its removal from the Russell Top 200 and addition to the Russell Midcap Index. Although the company saw a flat price movement, these index changes might have added some weight to the broader market dynamics. While major indices like the S&P 500 and Nasdaq Composite achieved new highs amid a positive market sentiment driven by optimistic trade talks and economic outlooks, Constellation Brands' price changes were relatively muted. The company's recent index movements were unlikely to divert significantly from the broader market's upbeat trajectory.

Constellation Brands has 2 possible red flags we think you should know about.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

The recent index reclassifications for Constellation Brands, transitioning from the Russell Top 200 to the Russell Midcap Index, may influence investor perceptions and trading volumes, subtly affecting the company's overall market dynamics. Despite a muted price response initially, shifts in index participation can impact stock liquidity and investor interest, potentially altering long-term investment trends. Over the past five years, the company's total shareholder return, including dividends, experienced a 6.22% decline. This timeframe indicates challenges in creating consistent shareholder value, particularly as broader markets have shown varying performances.

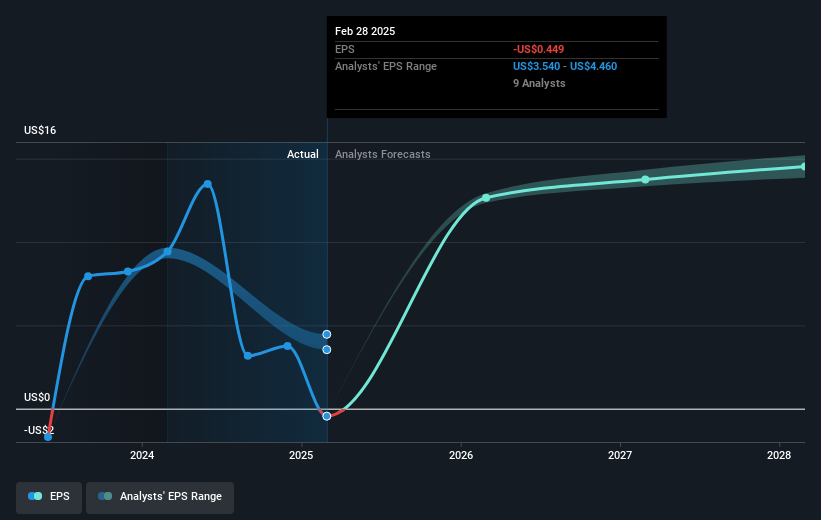

Over the last year, Constellation Brands underperformed the US Market, which posted a 13.7% return, highlighting the company's relative struggles within its industry context. Such performance disparities may heighten scrutiny on Constellation's upcoming business strategies, especially given the mixed economic environment. The company's initiatives focusing on restructuring and expansion are pivotal; however, these index changes might exert additional pressure on revenue and earnings forecasts. Understanding these dynamics will be crucial, as earnings are forecasted to improve significantly over the next few years, with an anticipated shift from a loss of US$81.4 million to earnings of US$2.4 billion by 2028.

Regarding share prices, the current level of US$187.07 remains a 13.4% discount from the analysts' consensus price target of US$216.09. This suggests that while the market remains cautious, there's potential for appreciation should Constellation Brands successfully execute its growth plans. However, any adverse impacts from the index reclassification could influence investor sentiment, affecting the company's ability to reach or exceed its forecasted benchmarks. As the situation evolves, continued monitoring and adjustment to these moving parts will be essential for both investors and management.

Review our growth performance report to gain insights into Constellation Brands' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives