- United States

- /

- Beverage

- /

- NYSE:STZ

Assessing Constellation Brands After Its 40% Slide and Fresh Value Estimates

Reviewed by Bailey Pemberton

Trying to decide what to do with Constellation Brands stock? You are not alone. Even among seasoned investors, this company tends to spark debate, especially after recent price swings that have left some scratching their heads. Over the past week, Constellation Brands dipped by 5.2%, wiping out a chunk of short-term optimism. If you look at the past month, there is a glimmer of recovery with a 1.3% gain. Still, when evaluating your portfolio year-to-date, the numbers tell a more sobering story, with the stock down almost 40% from January and trading nearly 42% lower than a year ago.

What drove these dramatic moves? A mix of shifting investor sentiment and sector trends has influenced the situation. Attention has grown around beverage industry deals and changes in consumer preferences, with competitors aggressively innovating in product lines that challenge legacy brands like Constellation. Regulatory headlines and discussions about international market expansion have contributed as well. These factors combined have led investors to reevaluate the risks and opportunities, pushing the stock to levels not seen in years.

Is Constellation Brands undervalued or is the drop justified? The valuation score summarizes this question with a 3 out of 6, meaning the company appears undervalued on half the checks analysts use most. Next, we will break down what goes into that valuation score and the most common approaches investors use. Stay tuned for an even more insightful way to assess the stock's value later in the article.

Why Constellation Brands is lagging behind its peers

Approach 1: Constellation Brands Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting those amounts back to today's dollars. This approach helps investors determine what the business could be worth, based on the actual cash it is expected to generate over time.

For Constellation Brands, recent data show a current Free Cash Flow (FCF) of approximately $1.63 billion. Analysts have projected these cash flows to grow over the next five years, with estimates reaching $2.52 billion by 2030. Only the first five years are based on analysts' forecasts, and later figures are extrapolated to provide a long-term view using industry-standard assumptions.

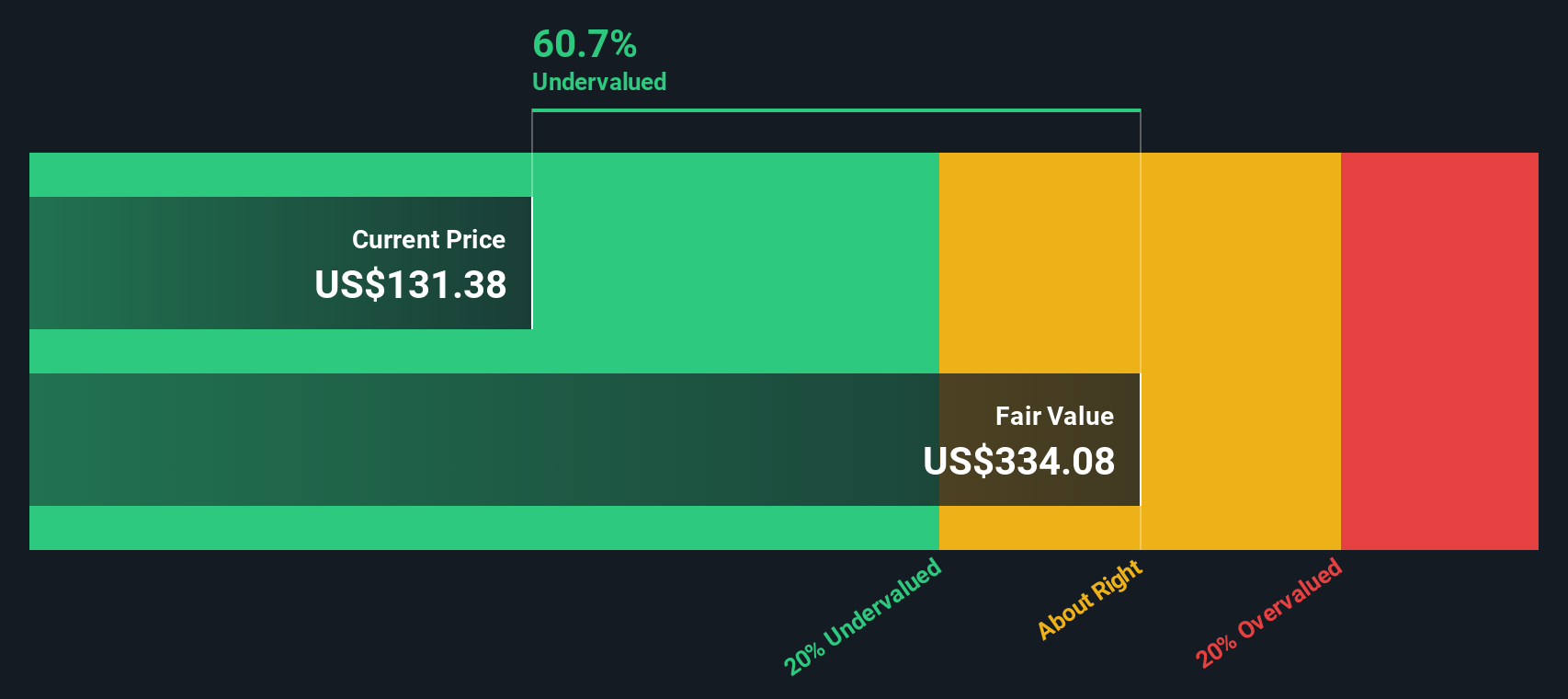

The analysis is conducted in US dollars and applies a 2 Stage Free Cash Flow to Equity method, combining short-term analyst estimates with longer-term projections. The resulting DCF valuation suggests an intrinsic value of about $334 per share, implying that Constellation Brands is trading at an approximate 59.8% discount to this fair value calculation.

This significant margin means the current share price appears well below what the company’s future cash flows are worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Brands is undervalued by 59.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

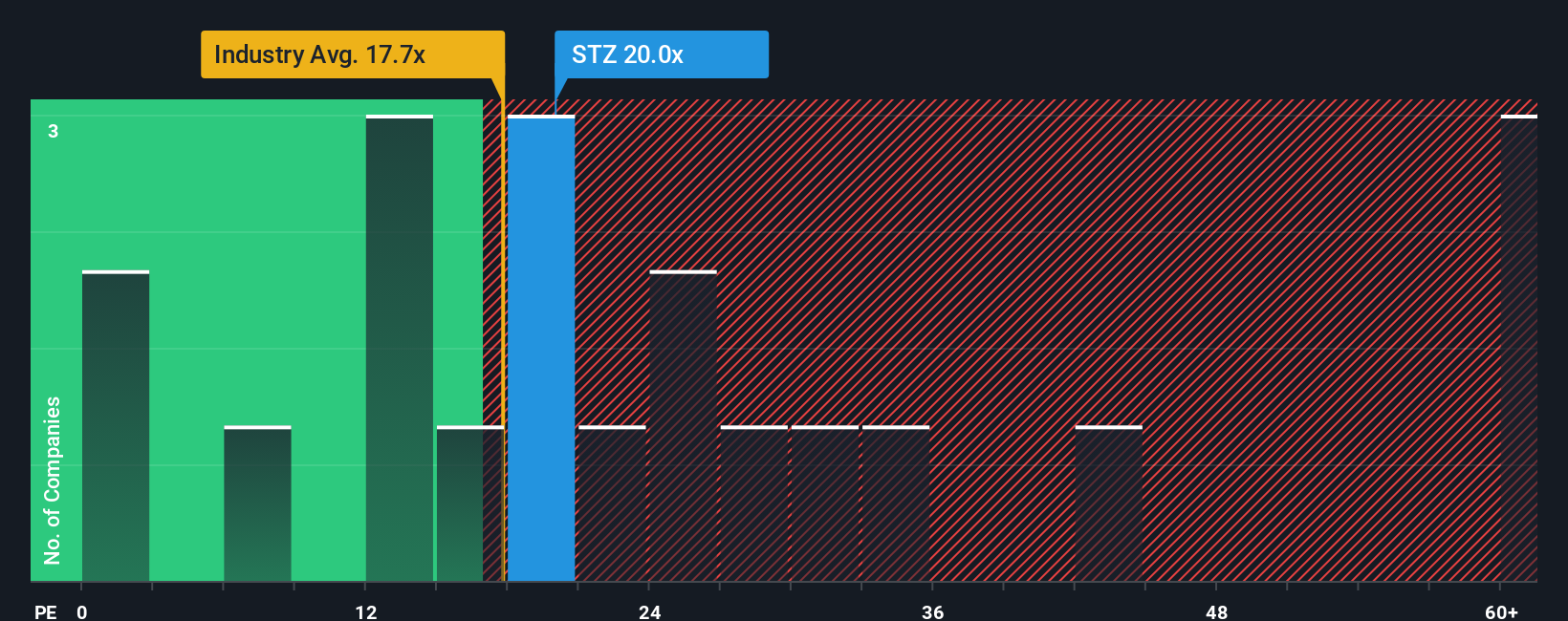

Approach 2: Constellation Brands Price vs Earnings

For profitable companies like Constellation Brands, the Price-to-Earnings (PE) ratio is a well-regarded metric. It relates the company’s stock price to its actual earnings, providing a straightforward measure of valuation grounded in real profitability. Investors often turn to the PE ratio to quickly gauge whether a stock is expensive or cheap compared to how much it earns.

Growth prospects and risk levels are key in deciding what a “normal” or “fair” PE ratio should be. High-growth businesses typically command higher PE ratios because investors are willing to pay more today for greater future earnings. Conversely, higher risk can justify a lower ratio since potential returns are less certain.

Constellation Brands is currently trading at a PE ratio of 19.2x, which is above the beverage industry average of 17.3x and slightly higher than the average for its peers at 18.5x. However, Simply Wall St's proprietary Fair Ratio for Constellation stands at 22.7x. The Fair Ratio is tailored for each company, factoring in not just growth outlook and risk, but also profit margins, market position, industry, and company size. This approach provides a more holistic and accurate benchmark than simply comparing with industry averages or peers.

Comparing Constellation’s current PE of 19.2x with its Fair Ratio of 22.7x, the stock appears to be undervalued based on this comprehensive measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Constellation Brands Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple and powerful way to connect your view of Constellation Brands' business story with future forecasts and a resulting fair value, making the numbers truly meaningful. Instead of relying solely on current financial metrics, Narratives help you articulate your perspective on the company's prospects, whether you believe in post-restructuring growth, worry about new tariffs and slow demand, or hold a more balanced outlook. On Simply Wall St's Community page, millions of investors easily create and compare Narratives. Each one lays out the story, estimates future revenue, earnings and margins, and calculates a fair value, showing if the current price offers opportunity or risk. Narratives update automatically as new news or earnings arrive, so your view always stays relevant. For example, one Narrative for Constellation Brands sees restructuring and new brewery expansion driving earnings to $2.4 billion and justifying a price target of $247.00. Another, more cautious view sees continued demand pressure, lower margins and a fair value as low as $123.00. With Narratives, you can see and challenge the reasoning behind every recommendation.

Do you think there's more to the story for Constellation Brands? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives