- United States

- /

- Beverage

- /

- NYSE:STZ

A Fresh Look at Constellation Brands (STZ) Valuation After Recent Rebound and Ongoing Industry Headwinds

Reviewed by Simply Wall St

Constellation Brands (STZ) has been in focus lately as investors weigh its recent share price moves over the past month. The stock’s 5% rally has sparked some discussion about the company’s valuation and longer-term prospects.

See our latest analysis for Constellation Brands.

After a steady climb in the past month, Constellation Brands’ momentum has cooled amid broader sector uncertainty, but its longer-term results underline challenges. Its one-year total shareholder return is down nearly 40%, with five-year returns still negative. The recent rebound could signal shifting investor sentiment, especially as the stock navigates ongoing industry headwinds and recalibrates following a steep year-to-date share price decline.

If you’re tracking market movers beyond beverage stocks, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares still trading well below their analyst price targets and fundamentals showing some positive signals, the pressing question for investors is whether there is genuine value left to unlock or if the market has already taken any potential turnaround into account.

Most Popular Narrative: 19% Undervalued

Constellation Brands is trading well below what the most followed narrative considers its fair value, signaling that the stock might be offering investors a rare opportunity versus its previous close.

Constellation Brands anticipates significant improvements in its Wine & Spirits business post-2025 following the divestiture of mainstream wine brands and related restructuring actions. These actions are expected to yield over $200 million in net annualized cost savings across the enterprise by fiscal '28, which will positively impact operating margins and earnings.

Curious what drives such a bullish outlook on Constellation’s future? Discover which fundamental shifts and bold operational bets are fueling this surprisingly optimistic valuation call. One headline move stands out as the linchpin for this turnaround story, but the full scope might change how you see the stock. Dive in and get the details that Wall Street’s watching.

Result: Fair Value of $172.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand softness or new tariffs on production inputs could undermine the bullish scenario and trigger further downward revisions to Constellation Brands' outlook.

Find out about the key risks to this Constellation Brands narrative.

Another View: How Do Multiples Stack Up?

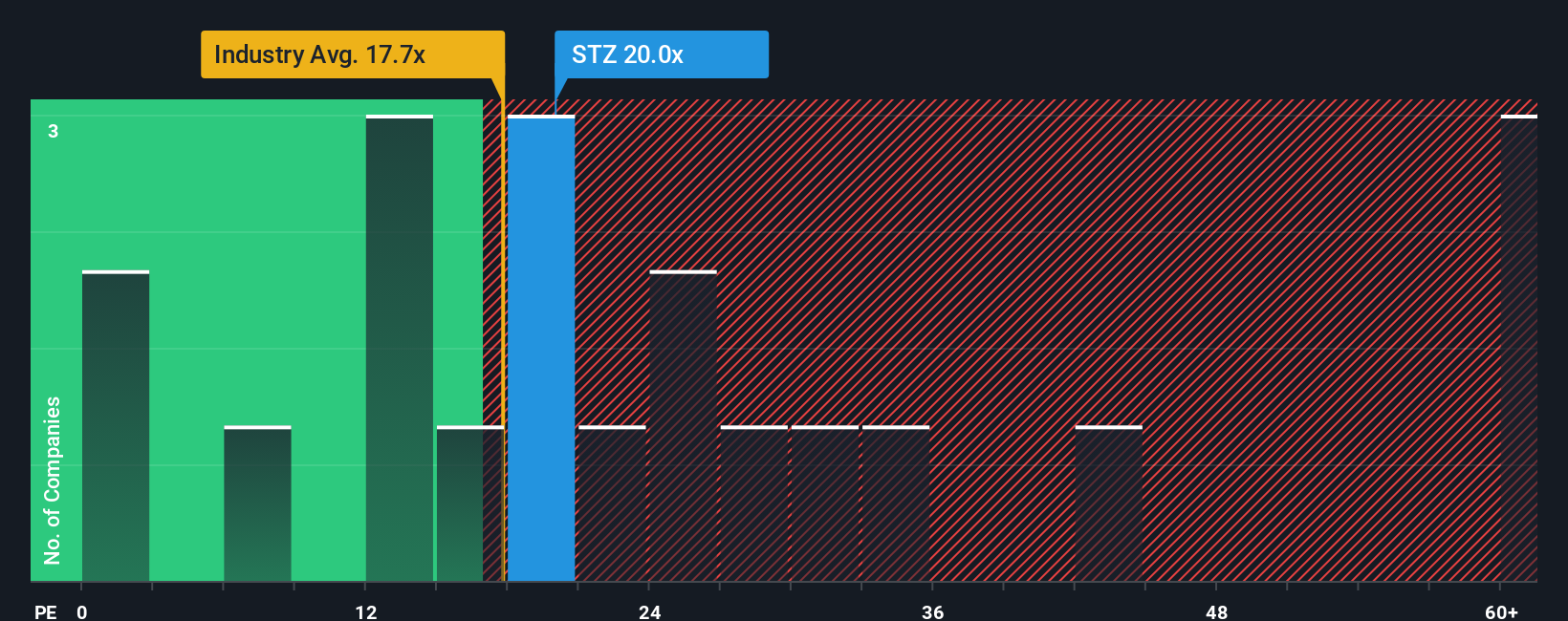

Looking at Constellation Brands’ valuation through the lens of its price-to-earnings ratio, some cracks emerge. The company is trading at 20 times earnings, significantly higher than both the global beverage industry average of 17.7 and the peer average of 18.2. However, compared to its fair ratio of 22.7, the stock still offers some value, even if it looks pricey against immediate competitors. Does this premium signal justified optimism, or is it an extra risk investors should factor in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

If our perspective doesn't fit your view, or you prefer charting your own course, you can analyze the data and piece together a narrative yourself in just a few minutes, so Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait for headlines to show you what’s next. Discover high-potential stocks yourself right now using the powerful Simply Wall Street Screener. Your next big winner could be just a click away.

- Capture steady income streams and boost your portfolio’s yield with these 17 dividend stocks with yields > 3% paying out more than 3% annually.

- Ride the momentum in artificial intelligence by targeting growth-focused innovators among these 27 AI penny stocks transforming industries today.

- Spot undervalued treasures with these 872 undervalued stocks based on cash flows, and seize compelling opportunities other investors might be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STZ

Constellation Brands

Produces, imports, markets, and sells beer, wine, and spirits in the United States, Canada, Mexico, New Zealand, and Italy.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives