- United States

- /

- Food

- /

- NYSE:SJM

Is Smucker (SJM) Undervalued? Exploring the Latest Valuation Perspectives

Reviewed by Kshitija Bhandaru

J. M. Smucker (SJM) is drawing some attention lately as investors look for value in companies with steady consumer demand and reliable brands. The stock’s recent price movement may offer perspective on current sentiment.

See our latest analysis for J. M. Smucker.

J. M. Smucker’s latest share price movements have been muted, with the stock recently closing at $107.8. While the 5-year total shareholder return is a modest 8.3%, the one-year figure is negative. This suggests that sentiment has yet to shift decisively, and momentum remains subdued despite the company’s steady fundamentals.

If you’re watching the food industry but looking for new opportunities, now’s a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

The question for investors now is whether J. M. Smucker shares are undervalued given recent declines, or if the market is already factoring in any potential rebound in growth and profit margins.

Most Popular Narrative: 7% Undervalued

With J. M. Smucker trading at $107.80 and the most widely followed narrative setting fair value at $116.19, the narrative suggests a meaningful gap between current price and analysts’ aggregate forecast. The spread sets up a debate regarding the company’s path to profitability and competitive positioning in the years ahead.

“Focus on pricing strategies, SKU rationalization, and brand investments aims to drive profitability, expand margins, and strengthen competitive positioning. Enhanced e-commerce, direct-to-customer channels, and strong cash flow enable reinvestment, marketing innovation, and increased financial flexibility for future growth.”

Want to uncover why analysts believe Smucker’s brand moves will translate to margin expansion? The narrative relies on bold expectations for margin turnaround, strategic pricing, and improved earnings. Curious which assumptions might prove controversial? Intrigued by revenue and profit math that support the target? Dive deeper for the numbers and logic that drive this call.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing volatility in coffee input costs and evolving consumer preferences for healthier foods could quickly test the bullish outlook currently reflected in forecasts.

Find out about the key risks to this J. M. Smucker narrative.

Another View: Multiples Send a Different Signal

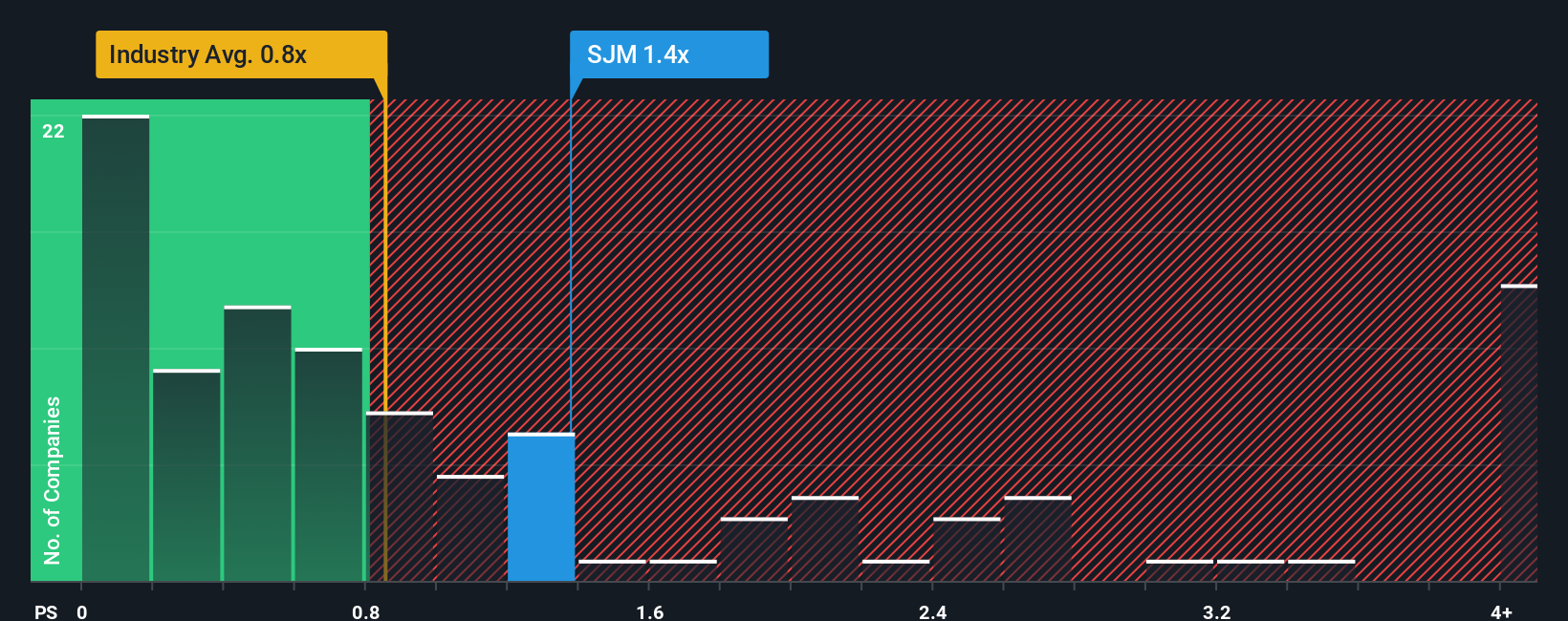

While the consensus narrative points to upside, market-based ratios tell a more cautious story. J. M. Smucker’s price-to-sales ratio stands at 1.3x, making it expensive compared with both US Food industry peers at 0.9x and the average peer at 0.7x. If share prices were to align with these comps, there could be less room for upside than the optimistic forecasts imply. Does this raise the risk of disappointment for value-focused investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

Feel free to dig into the numbers and trends for yourself. If you want your own take or to challenge these views, you can quickly shape your own narrative in just a few minutes with Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by finding opportunities others miss. Don’t stay on the sidelines while great stocks are making their move. Get ahead with fresh ideas just a click away.

- Unleash your portfolio’s potential by joining these 909 undervalued stocks based on cash flows and find companies trading below their intrinsic worth for confident value investing.

- Catch the wave of booming trends and supercharge growth with these 24 AI penny stocks, where innovation meets real-world impact in artificial intelligence.

- Secure reliable income streams by tapping into these 19 dividend stocks with yields > 3%, connecting you to strong yield opportunities for lasting financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives