- United States

- /

- Food

- /

- NYSE:SJM

Evaluating Smucker's (SJM) Valuation After Bold Moves with Uncrustables, Coffee Growth, and Hostess Integration

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 6.4% Undervalued

According to the most widely cited narrative, J. M. Smucker is seen as modestly undervalued, with a consensus that the stock price does not yet reflect its future earnings and margin improvements.

"Analysts are assuming J. M. Smucker's revenue will grow by 2.6% annually over the next 3 years. Analysts assume that profit margins will increase from -16.7% today to 9.4% in 3 years time."

Looking for the full story behind this surprisingly bullish forecast? The future valuation relies on ambitious turnarounds in profits and a rating usually reserved for industry leaders. Interested in which bold analyst expectations and margin improvements drive this price target? Explore the detailed breakdown inside the narrative.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, several risks remain, including volatile coffee costs and weak organic sales growth. These factors could drive further caution among both analysts and investors.

Find out about the key risks to this J. M. Smucker narrative.Another View: Looking Through a Different Lens

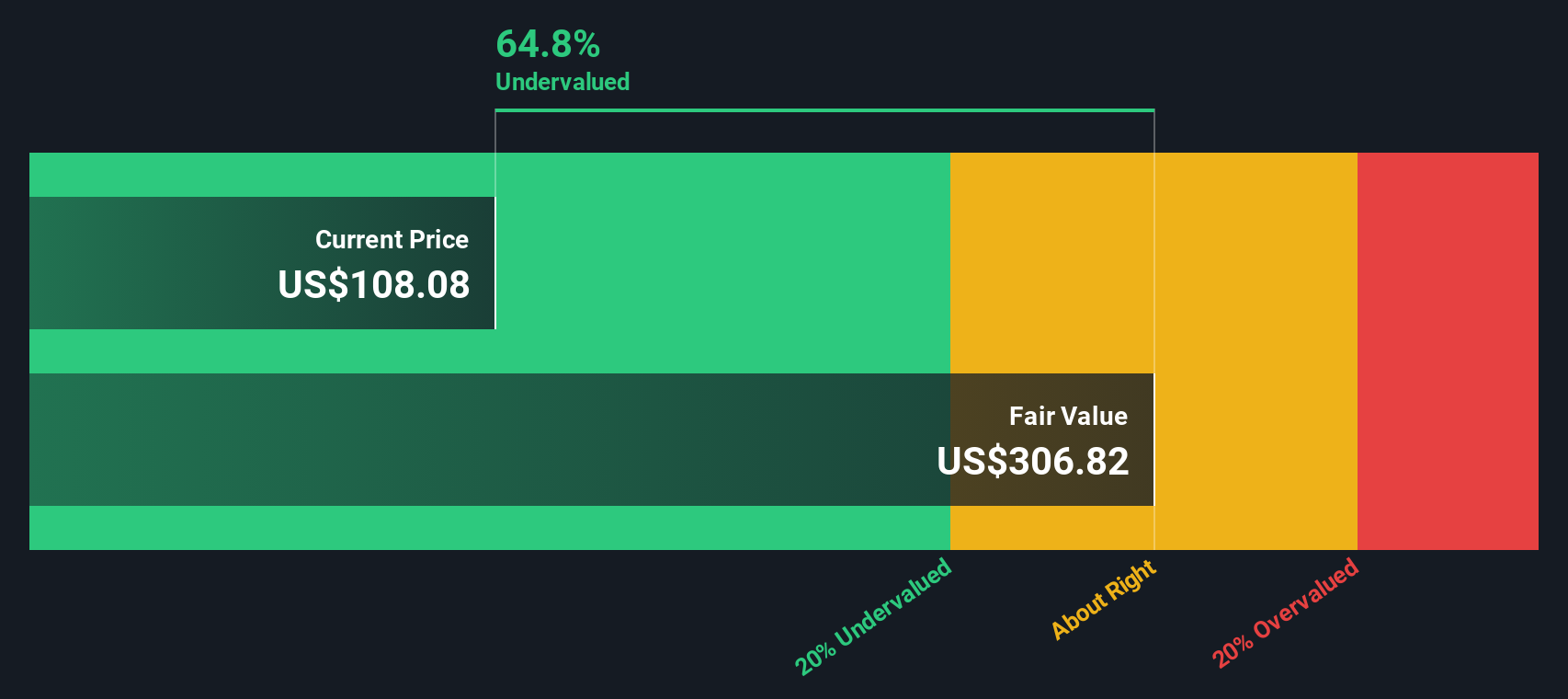

While analyst consensus sees J. M. Smucker as modestly undervalued, our SWS DCF model points to an even greater discount. This suggests the market might be overlooking something significant in the company's long-term prospects. Which picture is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding J. M. Smucker to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own J. M. Smucker Narrative

If you see a different side to the story or want to dive into the numbers yourself, creating your own take is quick and straightforward. Do it your way

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to just one opportunity. Step ahead of the crowd by exploring additional high-potential markets and sectors that could elevate your returns.

- Uncover hidden gems with strong financials by using our penny stocks with strong financials to spot small companies poised for breakout growth.

- Target impressive yields and resilient income streams through our list of dividend stocks with yields > 3%, an option well-suited for building lasting wealth in changing markets.

- Take charge of the artificial intelligence revolution by finding tomorrow's innovators with our curated picks of AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives