- United States

- /

- Food

- /

- NYSE:SJM

A Look at J. M. Smucker’s Valuation Following Updated 2026 Sales Guidance and Earnings Anticipation

Reviewed by Simply Wall St

J. M. Smucker (SJM) just raised its net sales growth outlook for fiscal 2026, updating investors with revised expectations shortly before its quarterly earnings release. This timing has caught the attention of market watchers and shareholders alike.

See our latest analysis for J. M. Smucker.

Despite reaffirming its full-year sales growth guidance and drawing analyst attention ahead of earnings, J. M. Smucker’s share price has slipped lately. It ended at $101.47 with a 1-year total shareholder return of -12.07%. The combination of lowered momentum and cautious outlook suggests investors are weighing both near-term headwinds and longer-term potential.

If Smucker’s moves have you curious about what’s next, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With mixed analyst opinions and recent guidance updates, the key question now is whether J. M. Smucker’s current price undervalues its potential, or if the market already reflects the company’s future growth prospects.

Most Popular Narrative: 12.7% Undervalued

The most widely followed narrative sees J. M. Smucker’s estimated fair value at $116.19, which is meaningfully above its last close of $101.47. This disconnect has the market asking if upside potential is slipping under the radar.

Ongoing growth in e-commerce, convenience, and direct-to-customer channels, backed by a dedicated sales force, expands distribution reach and enables sharper, data-driven marketing. This provides further opportunities to capture market share and drive future sales growth.

Ever wonder which single strategic shift could redefine Smucker's next chapter? The narrative’s fair value is influenced by bold expansion moves and profits returning to growth. Find out which financial levers tip this forecast into double-digit upside.

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued cost inflation in coffee and the risk of demand shifts away from traditional brands could quickly challenge today’s fair value expectations.

Find out about the key risks to this J. M. Smucker narrative.

Another View: What About Multiples?

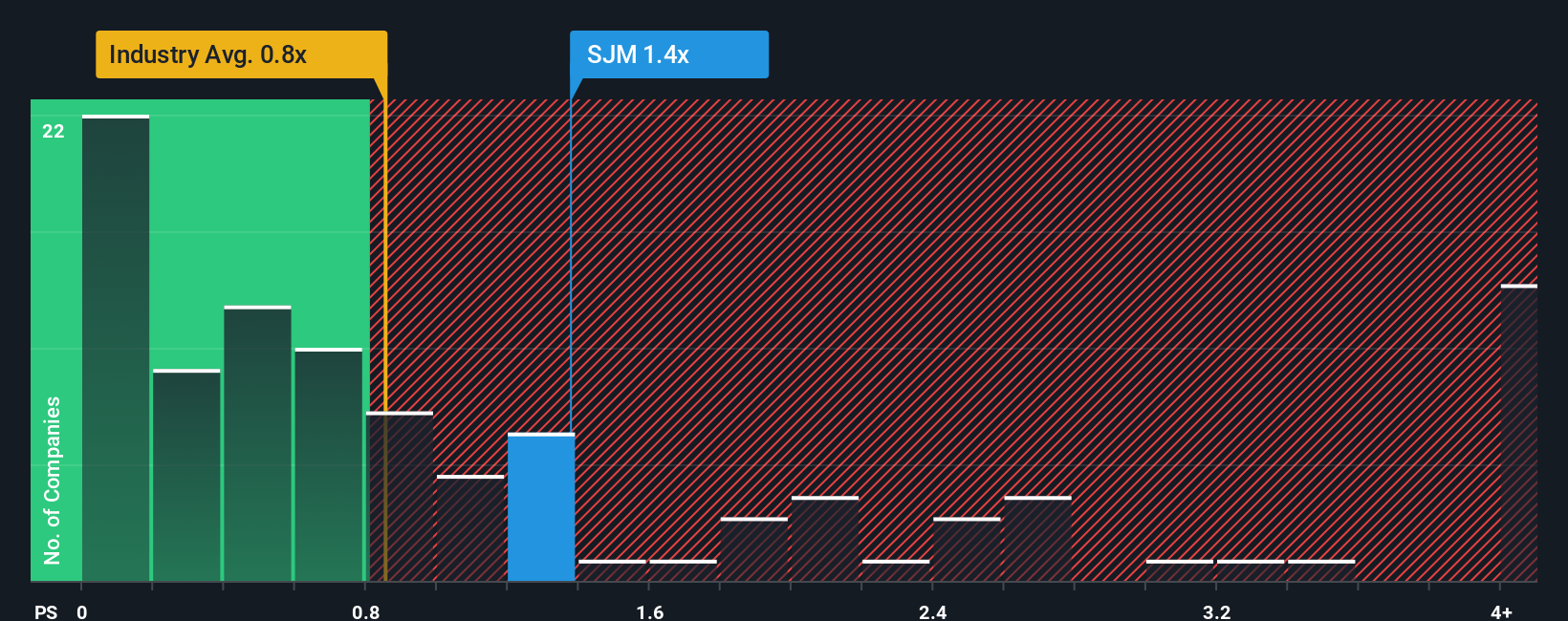

Looking through a different lens, J. M. Smucker’s price-to-sales ratio stands at 1.2x, compared to the US Food industry’s average of 0.8x and a peer average of just 0.7x. This suggests the stock is not trading at a clear discount on this basis. Could the market be pricing in extra risk, or is there opportunity if conditions shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J. M. Smucker Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes with Do it your way

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Take charge of your investments and seize unique opportunities before everyone else. The Simply Wall Street Screener makes it easy to find stocks that fit your strategy.

- Catch high yields that stand out from the crowd by checking out these 14 dividend stocks with yields > 3% with robust returns above 3%.

- Spot tomorrow’s artificial intelligence leaders as they grow. Start your research with these 26 AI penny stocks and see which companies are making headlines.

- Grab value opportunities now by using these 925 undervalued stocks based on cash flows to seek out stocks trading below their intrinsic cash flow worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SJM

J. M. Smucker

Manufactures and markets branded food and beverage products worldwide.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.