- United States

- /

- Beverage

- /

- NYSE:SAM

Boston Beer (SAM): One-Off $35.9M Loss Clouds Yearly Margin Recovery Narrative

Reviewed by Simply Wall St

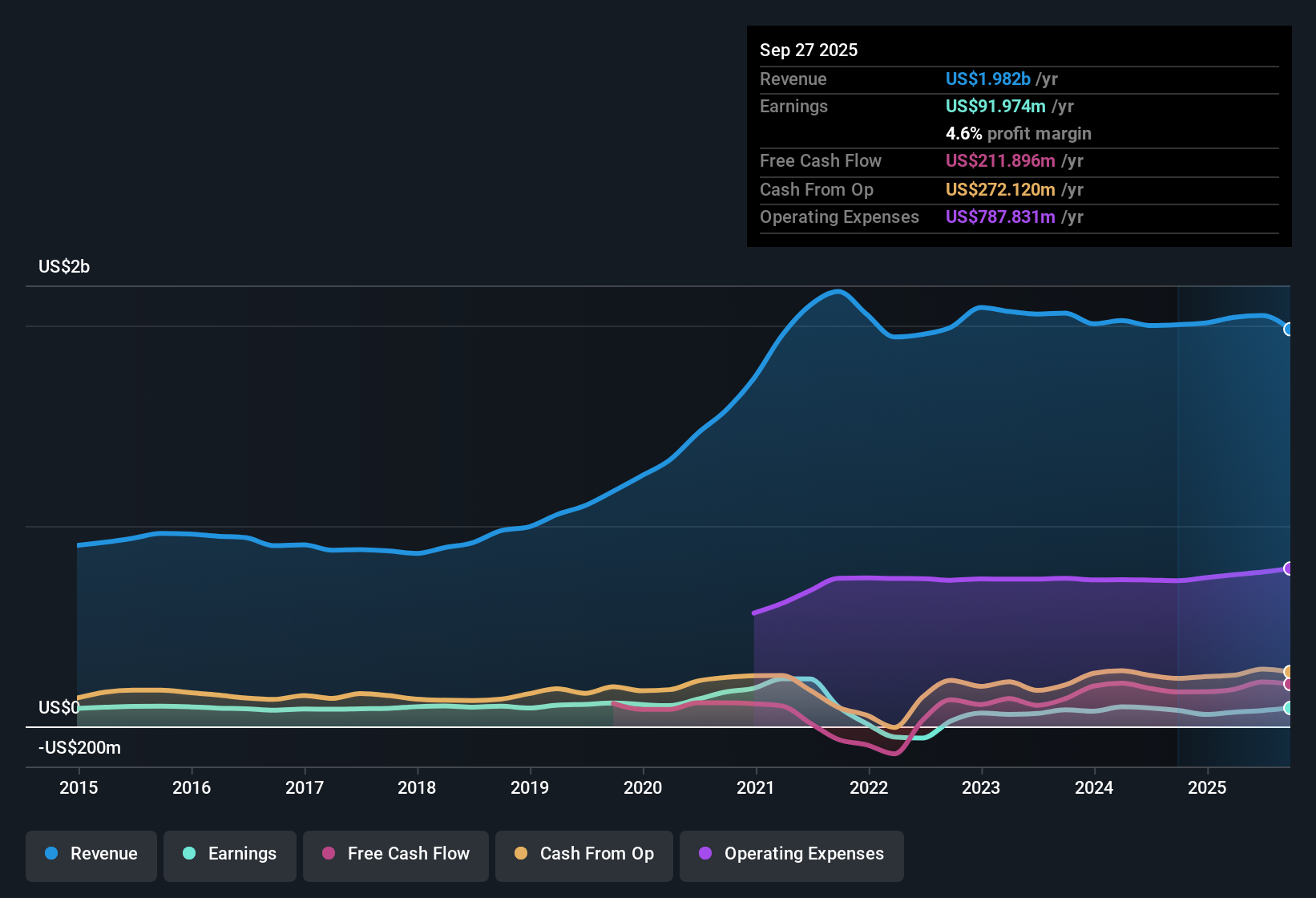

Boston Beer Company (SAM) posted earnings growth of 14.8% over the past year, marking a sharp recovery from a five-year average annual decline of 16.1%. Net profit margins improved to 4.6% from 4% last year, while earnings are forecast to rise 12.35% per year going forward. The stock trades at $231.60 per share, notably below its estimated fair value of $324.88. However, its Price-To-Earnings ratio of 26.4x remains well above industry and peer averages, reflecting a premium multiple. Investors will be weighing recent profit momentum alongside a one-off $35.9 million loss and muted 1.7% revenue growth forecasts compared to the broader US market’s 10% outlook.

See our full analysis for Boston Beer Company.Next up, we will see how these headline numbers measure up against the narratives shaping investor sentiment around Boston Beer. This will reveal which storylines are reinforced and which might be challenged.

See what the community is saying about Boston Beer Company

Margins Rebound as Productivity Pays Off

- Net profit margins improved from 4% to 4.6% year-on-year, reflecting successful cost controls and operational efficiencies not captured in previous trendlines.

- According to the analysts' consensus view, Boston Beer's structural productivity gains and premium product launches are driving gross margin uplift and earnings resilience.

- Margin expansion counters earlier periods of decline and supports the argument that investments in innovation and brewery efficiency are beginning to strengthen profitability across the business.

- Rising margins align with the consensus view that premiumization and efficiency provide Boston Beer with pricing power and a buffer against short-term volume fluctuations, making near-term profitability recovery plausible in light of category headwinds.

📈 Read the full Boston Beer Company Consensus Narrative.

One-Off $35.9 Million Loss Clouds Quality

- The latest 12-month results included a one-time $35.9 million loss, which materially affected reported net income and adds ambiguity to the quality of earnings for the year.

- Consensus narrative notes that this type of non-recurring large expense can make it challenging for investors to determine how much of the profit recovery is genuinely durable.

- While Bulls highlight short-term margin improvement, critics point out that headline profit figures are partially inflated by the exclusion of these charges, creating tension over earnings credibility.

- Persistent reliance on excluding extraordinary losses could limit further upside if such events recur or prove to be more than isolated incidents.

Valuation Premium Holds Despite Discount to Fair Value

- At $231.60 per share, Boston Beer trades significantly below its DCF fair value of $324.88. It still commands a lofty Price-To-Earnings multiple of 26.4x compared to peer (18.4x) and global beverage industry (17.5x) averages.

- According to the analysts' consensus view, investors looking at the combination of recent profit growth and a discounted price versus DCF fair value must also reckon with the fact that multiples remain elevated versus competitors.

- This valuation tension signals that, while the stock may appear attractive on some discounted cash flow metrics, the market continues to demand a premium for future earnings quality and growth potential relative to the sector.

- The relatively narrow gap (7.9%) between the current share price and analysts' price target further suggests that Boston Beer is seen as fairly valued given consensus expectations, despite headline discount to DCF-based fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Boston Beer Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your unique perspective and craft your narrative in just a few minutes by clicking here: Do it your way

A great starting point for your Boston Beer Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Although Boston Beer’s recent recovery is promising, concerns persist around the sustainability of its profit growth given the one-off loss and premium valuation.

If you want stocks with more attractive valuations and the potential for upside, check out companies trading at better prices with solid prospects using these 878 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives