- United States

- /

- Beverage

- /

- NYSE:SAM

Boston Beer Company (SAM): Exploring Valuation After 12% Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Boston Beer Company.

Looking beyond the past month’s 12% drop in share price, Boston Beer’s momentum has struggled all year. The company has experienced a year-to-date share price loss of 34% and a 1-year total shareholder return of -38%. This signals that investors remain cautious, even as the company’s fundamentals show pockets of growth.

If you want to broaden your search and see what else is gaining attention, now’s the perfect moment to discover fast growing stocks with high insider ownership

With shares still trading significantly below analyst targets and recent financial gains, investors are left to wonder whether Boston Beer Company is trading at a discount or if the market has already accounted for future challenges and growth.

Most Popular Narrative: 17.2% Undervalued

Boston Beer Company’s fair value, according to the most referenced narrative, stands notably above the last close price of $198.24. This gap gives investors a reason to examine the assumptions powering the valuation shift.

Expansion into innovative, premium alcohol segments and digital marketing boosts market share, distribution, and supports resilience in revenue and earnings growth. Structural productivity gains and strong brand equity enable pricing power, margin improvement, and protection against short-term volume fluctuations.

Curious how upgraded earnings forecasts and a streamlined cost profile fuel this bullish price target? Want to see which growth levers and margin bets are behind the big gap between consensus value and today’s price? The key drivers might surprise you. Click for the full walk-through behind this narrative’s fair value call.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition in crowded beverage categories and declining alcohol consumption trends could challenge Boston Beer’s ability to deliver on optimistic earnings forecasts.

Find out about the key risks to this Boston Beer Company narrative.

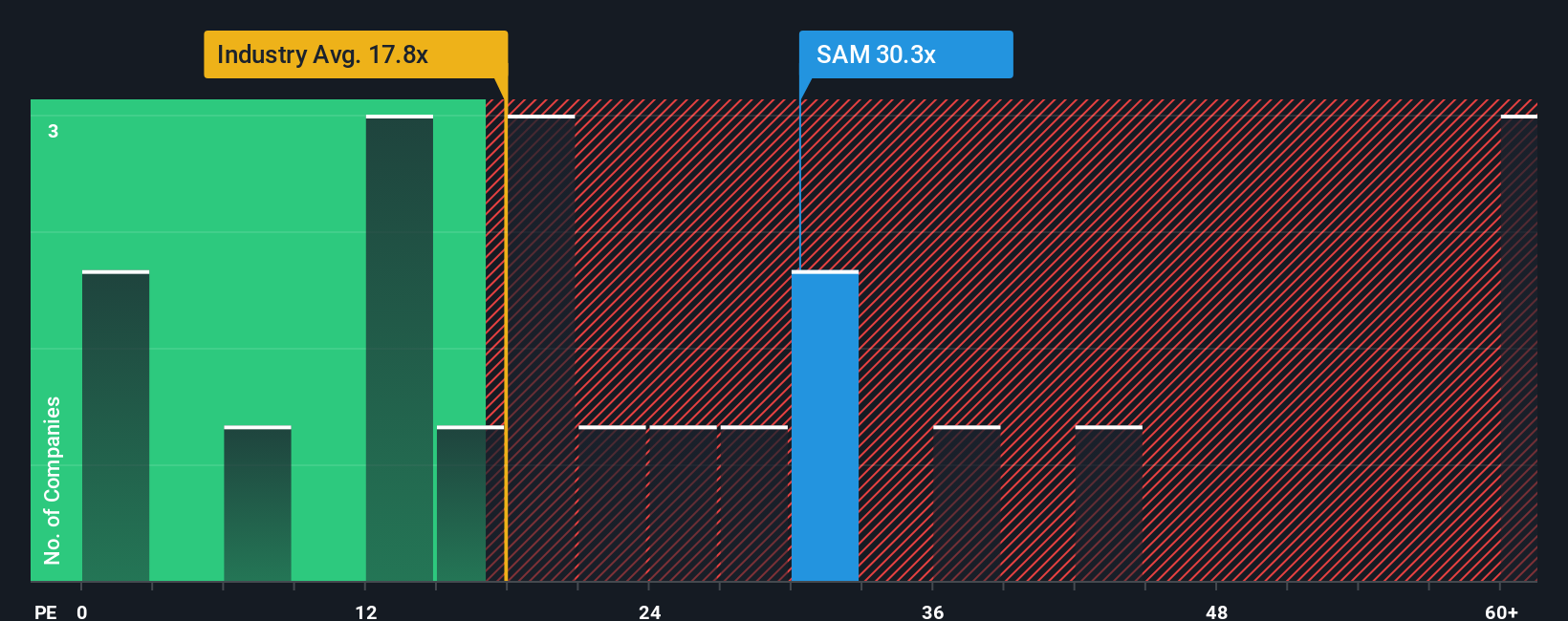

Another View: Market Multiples Tell a Cautious Story

While consensus valuations suggest Boston Beer is undervalued, a look at its price-to-earnings ratio tells a different story. Shares currently trade at 22.5 times earnings, above the global beverage industry average of 18.1 and well above the stock's fair ratio of 15.4. This premium suggests investors are paying up for future growth, which raises the stakes if the company cannot deliver.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If you prefer forming your own view or want to dig into the numbers yourself, the tools are available. Create your own perspective in just a few minutes. Do it your way

A great starting point for your Boston Beer Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single stock limit your potential. Expand your opportunities and spot winning trends before they go mainstream by checking out these exciting market arenas:

- Tap into the next wave of digital innovation with these 25 AI penny stocks, which are shaping advances in artificial intelligence for tomorrow’s economy.

- Secure reliable payouts by targeting these 16 dividend stocks with yields > 3%, which offer attractive yields above 3%.

- Position yourself for the future of technology and finance by investigating these 82 cryptocurrency and blockchain stocks, which are making headlines in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives