- United States

- /

- Beverage

- /

- NYSE:SAM

A Fresh Look at Boston Beer Co (SAM) Valuation After Citigroup Downgrade Over Sales and Cost Pressures

Reviewed by Kshitija Bhandaru

Citigroup has revised its stance on Boston Beer Company (NYSE:SAM), moving from a Buy to a Neutral rating. This adjustment follows a summer marked by ongoing sales softness and expectations for continued headwinds into late 2025.

See our latest analysis for Boston Beer Company.

Boston Beer's shares briefly rallied this summer on better-than-expected profits but have since come under pressure, sliding 2.3% after the recent rating downgrade. While the 90-day share price return is a healthy 14.2%, the total shareholder return over the past year remains down 18.5%, and the longer-term picture reveals more significant declines. Momentum has faded, reflecting investor concern over ongoing sales challenges and a tougher industry backdrop despite earlier signs of operational improvement.

If Boston Beer's recent volatility has you curious about what's outperforming elsewhere, now's a good moment to broaden your search and discover fast growing stocks with high insider ownership

Given these shifting dynamics and Citi’s more cautious stance, the pressing question is whether Boston Beer’s recent declines and low valuation signal a rare bargain, or if the market has already priced in ongoing industry headwinds and future growth challenges?

Most Popular Narrative: 8.6% Undervalued

Based on the most widely followed narrative, Boston Beer Company’s fair value is set at $242.22, which is a modest 8.6% above the last close of $221.45. The current price leaves a slight gap for upside, but reaching that target would require the business to clear some important hurdles. This sets the stage for a pivotal discussion on what is driving analyst expectations.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins. This should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Want to know what’s behind these margin bets and growth ambitions? The fair value here hinges on some bold improvements in earnings, margins and scale not seen for years. Curious which assumptions make the valuation tick? The full narrative breaks down the numbers and timelines that could make or break this outlook.

Result: Fair Value of $242.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, industry-wide declines and the intense competition in premium beverages could threaten Boston Beer's innovation-led growth and margin recovery story.

Find out about the key risks to this Boston Beer Company narrative.

Another View: DCF Model Paints a Different Picture

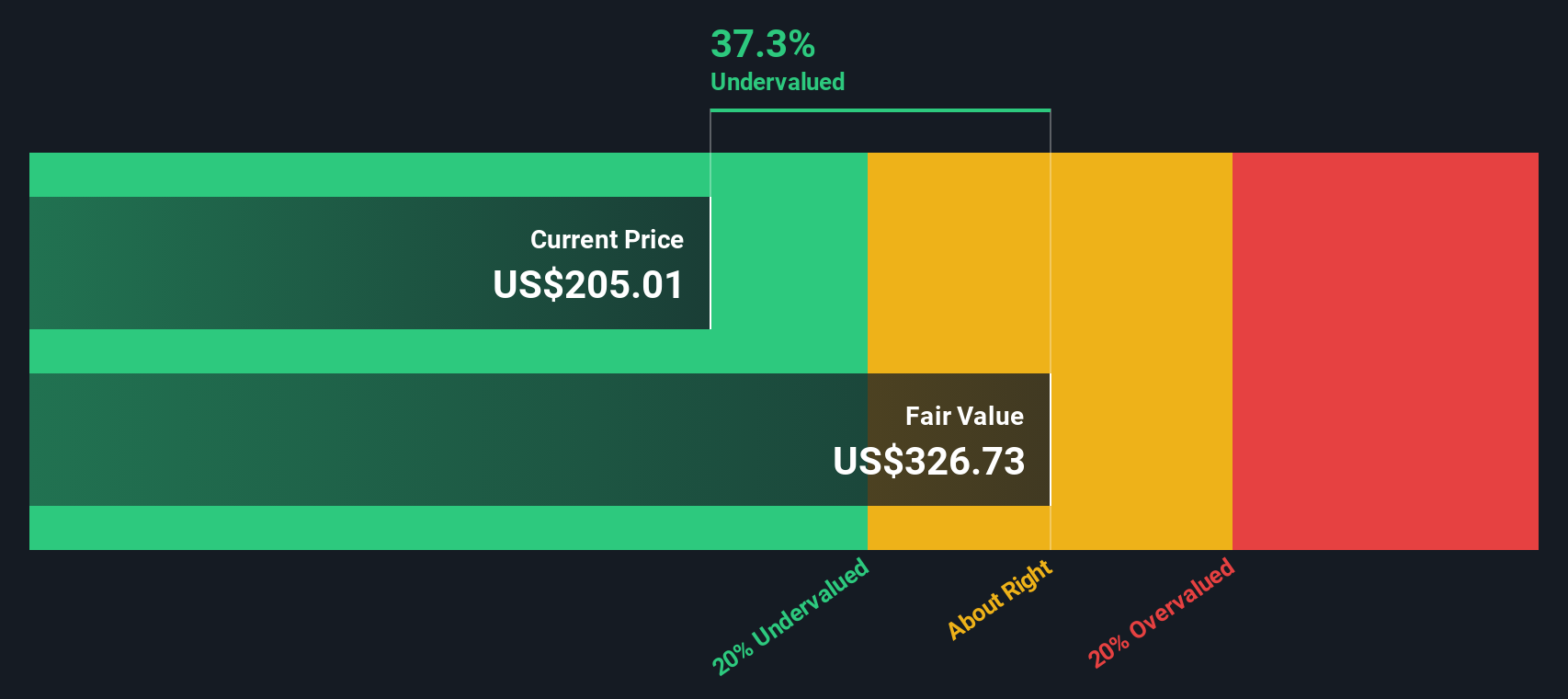

While analyst targets suggest Boston Beer is close to fair value, our SWS DCF model points to a very different story. According to this method, the company’s shares are trading 40% below their estimated fair value. This implies a much deeper undervaluation than what typical multiples or consensus forecasts show. Could the current market pessimism be overstated? Alternatively, does the DCF miss risks that multiples capture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boston Beer Company Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own perspective on Boston Beer Company in just a few minutes. Do it your way

A great starting point for your Boston Beer Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the smartest opportunities emerging right now. Use these advanced screens to power your portfolio with companies most investors are overlooking or undervaluing:

- Tap into under-the-radar potential with these 3579 penny stocks with strong financials that show robust financials and the agility to capture tomorrow’s big trends before the crowd catches on.

- Target steady income and stability by selecting from these 19 dividend stocks with yields > 3% which consistently deliver yields above 3% for portfolios seeking reliable returns.

- Get ahead on groundbreaking innovation by following these 25 AI penny stocks driving growth in artificial intelligence, automation, and the technologies powering the next wave of disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Beer Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SAM

Boston Beer Company

Produces and sells alcohol beverages primarily in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives