- United States

- /

- Food

- /

- NYSE:POST

Does Shrinking Unit Sales and Rising Capital Needs Alter the Bull Case for Post Holdings (POST)?

Reviewed by Sasha Jovanovic

- Recently, reports indicated that Post Holdings has been contending with shrinking unit sales and increased capital consumption, signaling continued operational challenges.

- This reduction in competitiveness highlights an urgent need for Post Holdings to address the underlying trends driving shifts in consumer preferences and cost pressures.

- We'll now examine how concerns around shrinking unit sales and rising capital needs could reshape Post Holdings' investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Post Holdings Investment Narrative Recap

To be a shareholder in Post Holdings right now, you need to believe the company can stabilize unit sales and adapt effectively to shifting consumer preferences despite the immediate operational headwinds. The recent news around shrinking unit volumes and rising capital use may raise concern, but does not present a material change to the primary short-term catalyst, which remains the successful execution of portfolio innovation and cost optimization. The biggest risk is persistent erosion of core product demand, which could pressure both near-term results and long-term growth potential.

One recent announcement of particular relevance is the company’s decision to close cereal manufacturing facilities in Cobourg, Ontario and Sparks, Nevada by the end of 2025. This move aligns with ongoing efforts to optimize operations and cut costs in response to volume pressures, and serves as a tangible example of the cost-saving initiatives viewed as key to protecting profitability in the near term.

Yet, in contrast to these cost actions, investors should be aware that sustained volume declines in core categories may signal...

Read the full narrative on Post Holdings (it's free!)

Post Holdings' outlook anticipates $9.2 billion in revenue and $537.3 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.2% and a $171 million increase in earnings from the current $366.3 million.

Uncover how Post Holdings' forecasts yield a $127.44 fair value, a 20% upside to its current price.

Exploring Other Perspectives

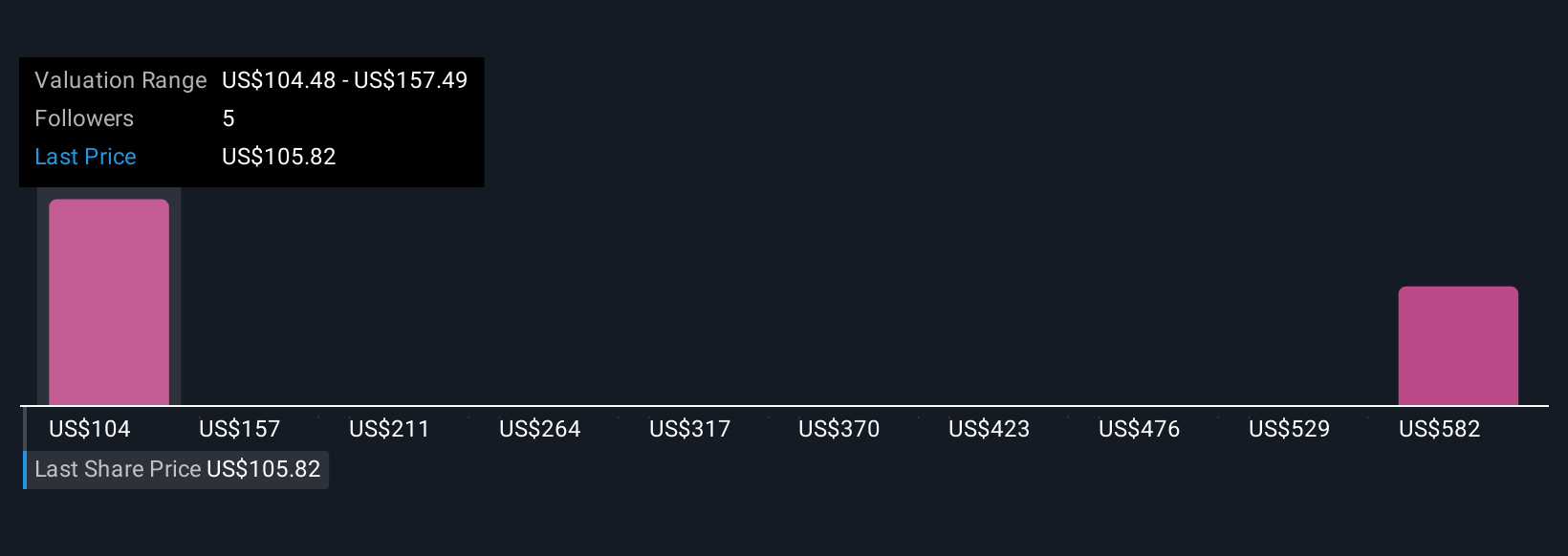

Four Simply Wall St Community fair value estimates for Post Holdings range from US$104.48 to US$634.58 per share, reflecting sharply different outlooks. Strong competition and changing consumer preferences could drive continued debate over how the company delivers future earnings and growth, explore how other investors approach this.

Explore 4 other fair value estimates on Post Holdings - why the stock might be worth just $104.48!

Build Your Own Post Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Post Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Post Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Post Holdings' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:POST

Post Holdings

Operates as a consumer packaged goods holding company in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives