- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM) Valuation: Is There More Upside After Solid YTD Gains?

Reviewed by Simply Wall St

See our latest analysis for Philip Morris International.

Momentum in Philip Morris International's shares has tapered off slightly in recent weeks, but the stock has still posted an impressive 31% share price return year to date and a 25% total shareholder return over the past twelve months. While short-term movements have softened, the company’s strong multi-year total returns suggest ongoing confidence in its prospects and valuation.

If you're interested in broadening your search beyond tobacco giants, now’s a smart time to discover fast growing stocks with high insider ownership.

The question for investors now is whether Philip Morris International's fundamentals and recent share price gains mean the stock still has room to run, or if the market has already factored in all future growth potential.

Most Popular Narrative: 16.9% Undervalued

Philip Morris International's most popular narrative puts fair value at $190.20, a substantial premium to the last close price of $158.06, positioning the stock well below what is implied by analysts’ future expectations. This valuation sets a bullish backdrop and invites a closer look at the company's underlying growth levers.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time.

Curious how much future profit expansion and bold strategic bets on new nicotine products are baked into this number? The narrative hinges on transformative growth, ambitious margin goals, and a valuation that assumes more than just steady demand for smoke-free innovations. If you want to know which financial assumptions power this price projection and how analyst consensus builds its bullish case, you need to see the full story.

Result: Fair Value of $190.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in cigarette demand as well as regulatory or tax changes could still challenge the company's growth story and future margin expectations.

Find out about the key risks to this Philip Morris International narrative.

Another View: How Does the Market Multiple Stack Up?

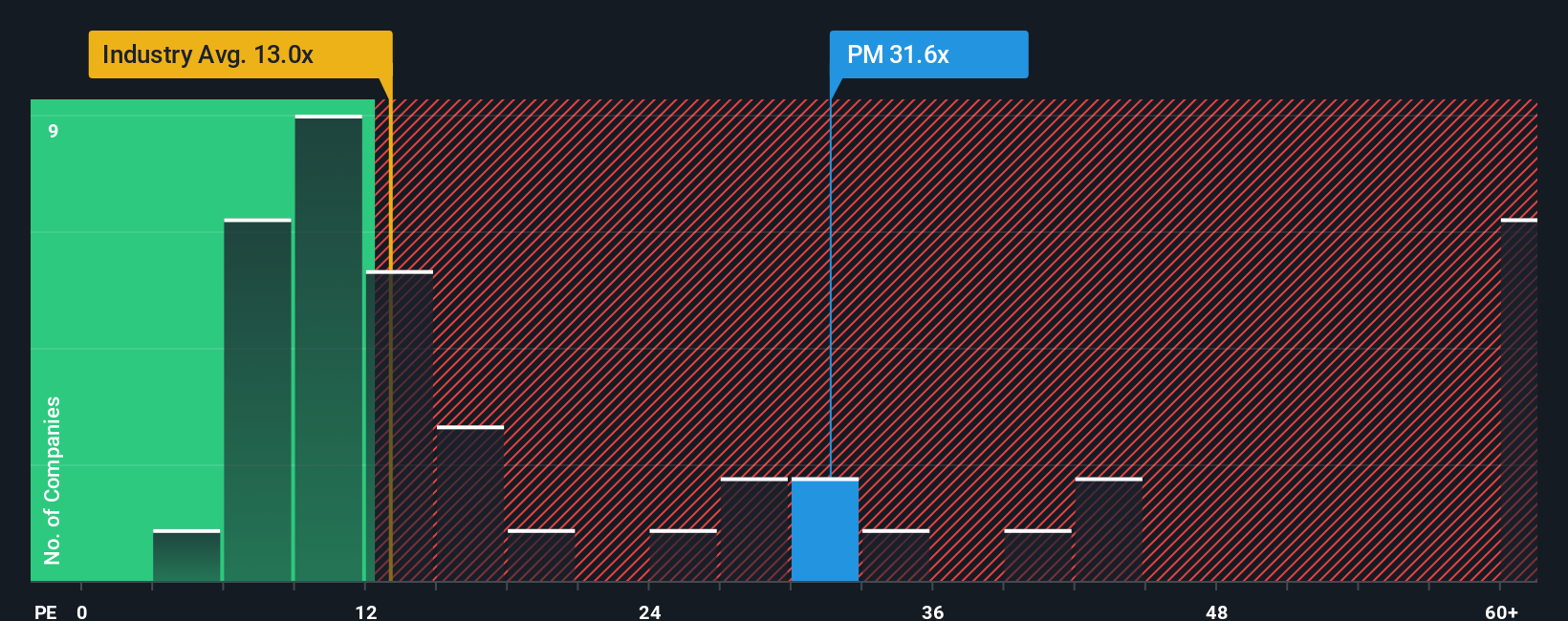

Looking from a different angle, Philip Morris International trades at a price-to-earnings ratio of 30x. This is notably higher than both its peer average of 19.3x and the broader global tobacco industry at 13.8x. However, this figure is in line with its estimated fair ratio of 30.1x. Does this premium reflect justified confidence or excessive optimism on the part of investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you see the numbers differently or want to dig deeper, it's easy to explore the data and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing is all about staying ahead of the next opportunity. These alternative stock ideas could give your portfolio an edge you don't want to miss.

- Tap into a surge of high-yield opportunities by accessing these 17 dividend stocks with yields > 3% with payouts above 3% and resilient cash flows.

- Ride the wave of digital transformation and explore potential with these 24 AI penny stocks making advancements in artificial intelligence and automation.

- Capitalize on the next fintech breakthrough by tracking these 79 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and modern finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives