- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM) Margin Compression Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

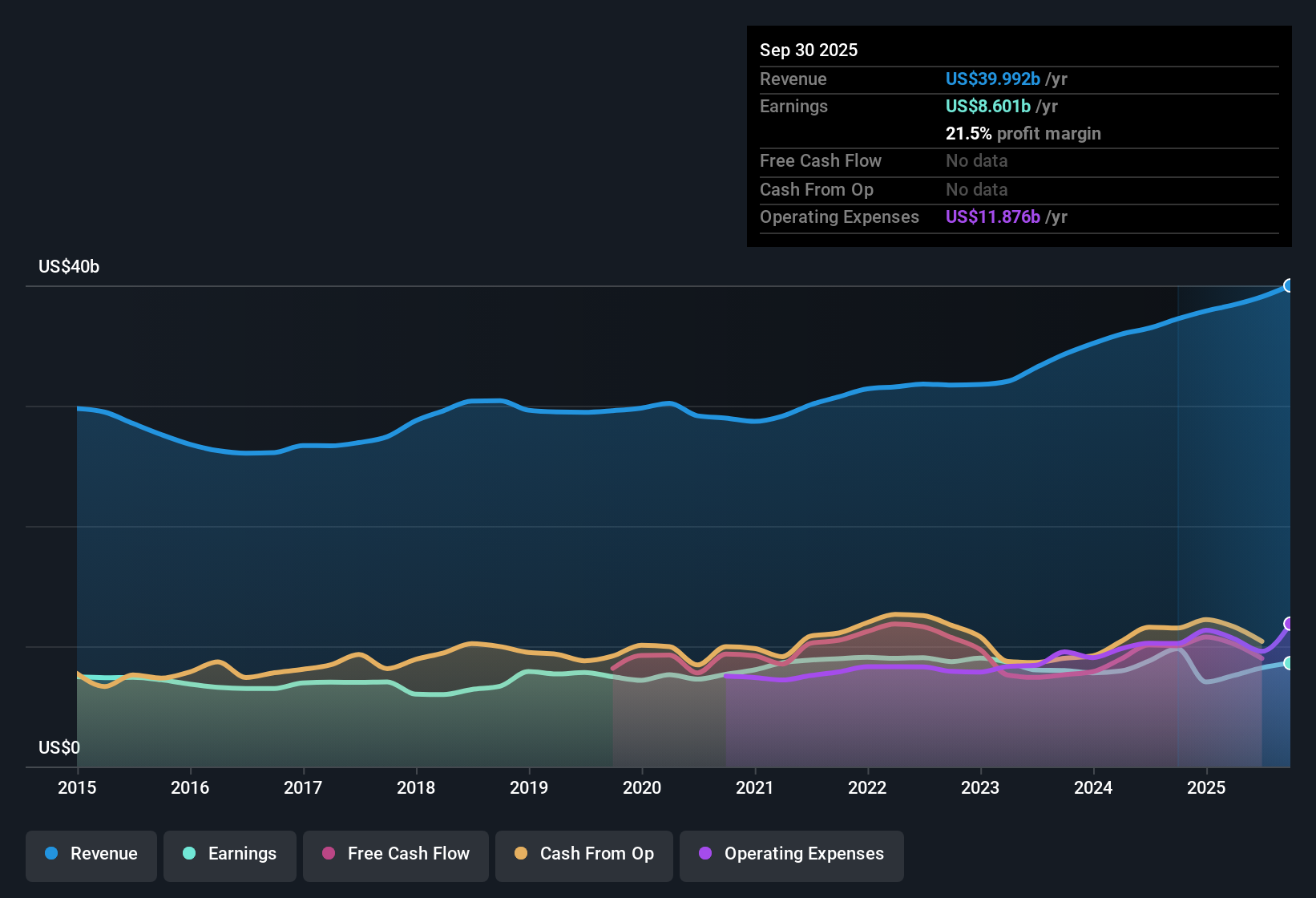

Philip Morris International (NYSE:PM) reported that earnings are forecast to grow 13% per year, with revenue expected to expand 7.6% per year. Net profit margins currently stand at 21.5%, a drop from 26.3% last year, and earnings have declined at a 1.1% annual rate over the past five years, with negative growth over the past year. Investors face a mixed picture as they weigh slowing profit trends and margin pressure against optimistic growth forecasts and valuation signals pointing to potential undervaluation.

See our full analysis for Philip Morris International.Now, we will see how these headline results compare against the prevailing narratives, and where some assumptions might need to be re-examined.

See what the community is saying about Philip Morris International

DCF Fair Value Outpaces Share Price

- Philip Morris International’s current share price of $152.00 trades at a discount to its DCF fair value of $201.77, implying a gap of about 33% that could appeal to value-focused investors.

- Bulls argue that the optimistic case for further upside is supported by analysts forecasting revenue growth of 10.9% per year for the next three years and margin expansion from 21.0% to 29.4%.

- This positive outlook relies on aggressive growth in ZYN and smoke-free products, as well as successful emerging market expansion, which could drive upward revisions to fair value and future earnings targets.

- However, to justify such valuation, bulls would need to believe earnings will climb to $15.7 billion by 2028 and that the company continues trading at a forward PE of at least 27.4x, a level that remains well above industry averages.

Bulls say the premium could be warranted if PMI’s shift to smoke-free products unlocks a new era of growth and margin gains. 🐂 Philip Morris International Bull Case

Peer Premium Adds Pressure

- Philip Morris's price-to-earnings ratio sits at 27.5x, notably higher than both the peer group average of 19.4x and the global tobacco industry average of 13.9x, indicating the market currently assigns a sizable premium despite recent margin compression.

- Bears argue this high valuation leaves little margin for error, especially given rising regulatory and ESG risks.

- Persistent regulatory hurdles and expected low-single-digit declines in cigarette volumes create headwinds for the company’s core business, raising concerns that the premium is unjustified without stronger offsetting growth from new categories.

- Additional margin pressure could arise if PMI’s transition to smoke-free products fails to fully compensate for declines in traditional tobacco or if costs escalate, reflecting bear concerns that today’s multiple is difficult to defend in a rapidly evolving industry landscape.

Bears warn that lofty multiples could unravel quickly if regulatory challenges or competition stall new growth engines. 🐻 Philip Morris International Bear Case

Margins Contract Amid Strategic Shift

- Net profit margins have narrowed to 21.5% from 26.3% last year, reflecting both operational pressures and the significant investment behind expanding PMI's reduced-risk product portfolio.

- Analysts’ consensus view sees this margin squeeze as a transition phase, with long-term expansion possible if new smoke-free offerings scale profitably.

- Consensus indicates that accelerating global adoption of reduced-risk products is already translating to higher segment margins, outpacing combustibles by over 4.5 percentage points and establishing a potential path for future company-wide improvement.

- However, the shift requires near-term tolerance for volatility as ongoing investments, regulatory adaptation, and geographic expansion affect current margin stability, aligning with the consensus narrative’s balanced perspective on opportunity and risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Philip Morris International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Share your take and craft a custom narrative in just a few minutes: Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite an optimistic outlook for new products, Philip Morris International faces narrowing profit margins, expensive valuations, and ongoing uncertainty regarding its ability to deliver steady earnings growth.

If you want more predictable gains and less volatility, turn to stable growth stocks screener (2085 results) to find companies that consistently expand both revenue and profit year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives