- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM): Examining Valuation Following $37 Million Expansion into Smoke-Free Products in North Carolina

Reviewed by Kshitija Bhandaru

Philip Morris International (PM) has committed $37 million to grow its Wilson, North Carolina facility. The investment will allow for new production that supports PMI’s push into smoke-free alternatives, specifically the forthcoming IQOS ILUMA system.

See our latest analysis for Philip Morris International.

PM shares have moved sideways for much of the year, with a recent dip reflecting investor caution around ongoing regulatory risks and demand shifts in the tobacco industry. Still, the latest $37 million U.S. investment highlights a commitment to growth, and the stock's total shareholder return remains modestly positive both in the short and long run.

If this bold move into smoke-free alternatives has you watching industry shifts, it might be time to broaden your outlook and discover fast growing stocks with high insider ownership

With these developments and a stock trading well below analysts’ average price target, investors are left wondering: Is Philip Morris International undervalued at current levels, or has the market already priced in its future growth story?

Most Popular Narrative: 19% Undervalued

Philip Morris International's widely followed narrative points to a fair value of $190.20, which is significantly above its last close of $153.27. This valuation sets up a compelling debate over the scale and sustainability of the company's anticipated transformation and growth prospects.

Growth in disposable incomes and urbanization in emerging markets is supporting robust demand expansion, particularly for PMI's smoke-free offerings, as evidenced by strong volume growth in regions such as Indonesia, Egypt, and the Middle East. Continued geographic diversification and deep market penetration are likely to provide sustained top-line growth and earnings stability.

What is fueling the optimism behind this price target? The future valuation depends on market-shifting expansion, bold profit forecasts, and one especially ambitious revenue assumption. Click through to discover what is driving these numbers.

Result: Fair Value of $190.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster decline in cigarette volumes or regulatory changes in key markets could pose challenges to Philip Morris International's growth story in the coming years.

Find out about the key risks to this Philip Morris International narrative.

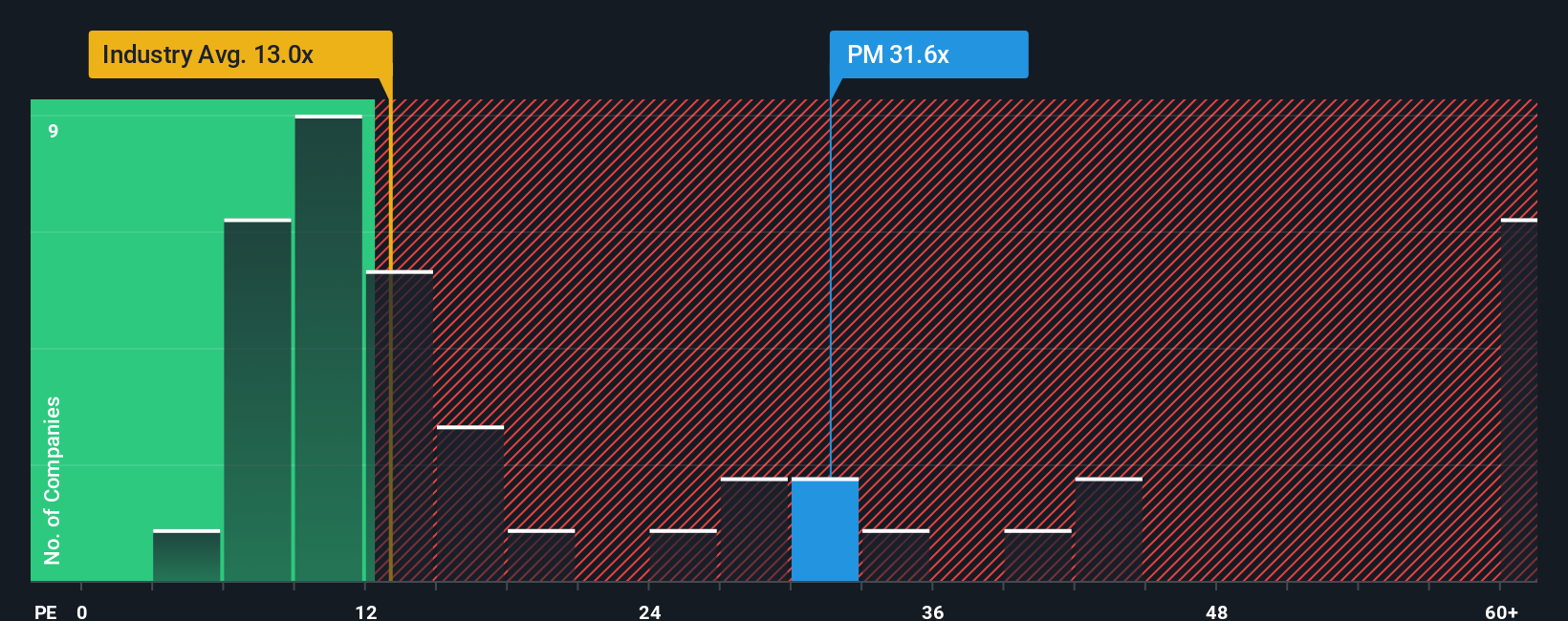

Another View: Earnings Ratio Paints a Different Picture

While many see Philip Morris International as undervalued, its current earnings ratio is 29.1x, which is significantly higher than the global tobacco industry average of 14.6x and also above its peer average of 18.8x. Even compared to its fair ratio of 30.4x, there is little margin for error. Could these premium multiples signal future upside, or do they highlight valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you see things differently or want to dig deeper, you can easily build your own perspective using our data and insights in just a few minutes. Do it your way

A great starting point for your Philip Morris International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investing Ideas?

Smart investors never settle for just one opportunity. Expand your horizons now, or risk missing out on the next sector poised for big moves.

- Discover compelling income potential and steady returns by checking out these 19 dividend stocks with yields > 3%, which consistently deliver yields above 3%.

- Explore cutting-edge tech prospects by evaluating these 24 AI penny stocks, filled with companies shaping the next wave of artificial intelligence growth.

- Maximize your buying power and gain an edge with these 896 undervalued stocks based on cash flows, currently priced below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives