- United States

- /

- Tobacco

- /

- NYSE:PM

Philip Morris International (NYSE:PM): Evaluating Valuation as Smoke-Free Transformation Gains Traction and Dividend Rises

Reviewed by Kshitija Bhandaru

If you have found yourself reevaluating Philip Morris International (NYSE:PM) after reading recent headlines, you are not alone. In less than a month, management raised the regular quarterly dividend by 8.9% and was recognized for technology leadership, all while global survey data confirms broad support for smoke-free alternatives. These developments are more than routine news, as they hint at the company’s newfound momentum as it advances its vision beyond traditional cigarettes.

Looking at the stock’s journey, Philip Morris International has paired ambitious strategy with steady performance. Momentum has held up over the past year, with the stock climbing 40% as smoke-free products steadily contribute a larger share of revenue, now over 40%. Meanwhile, the recent dividend increase sends a strong signal that leadership is confident in the sustainability of this transformation, even as market sentiment around risk perception continues to evolve.

This brings us to the big question: after this year’s strong run, is the stock still undervalued, or has the market already priced in the company’s smoke-free future?

Most Popular Narrative: 13% Undervalued

The current most widely followed narrative views Philip Morris International as undervalued by 13% against its fair value estimate. This perspective is primarily based on prospects for robust earnings and margin expansion, supported by smoke-free products and continued global diversification.

"The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is fueling strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to capture new consumer segments, expand its addressable market, and structurally boost net revenues and operating margins over time."

This story is grabbing attention. Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Intrigued by the bold analyst assumptions that back up such a premium? The narrative lays out some surprising projections for future profitability, just waiting to be discovered.

Result: Fair Value of $190.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, currency volatility and slower growth in smoke-free products remain key risks that could quickly change the narrative for Philip Morris International.

Find out about the key risks to this Philip Morris International narrative.Another View: Testing Value Through a Different Lens

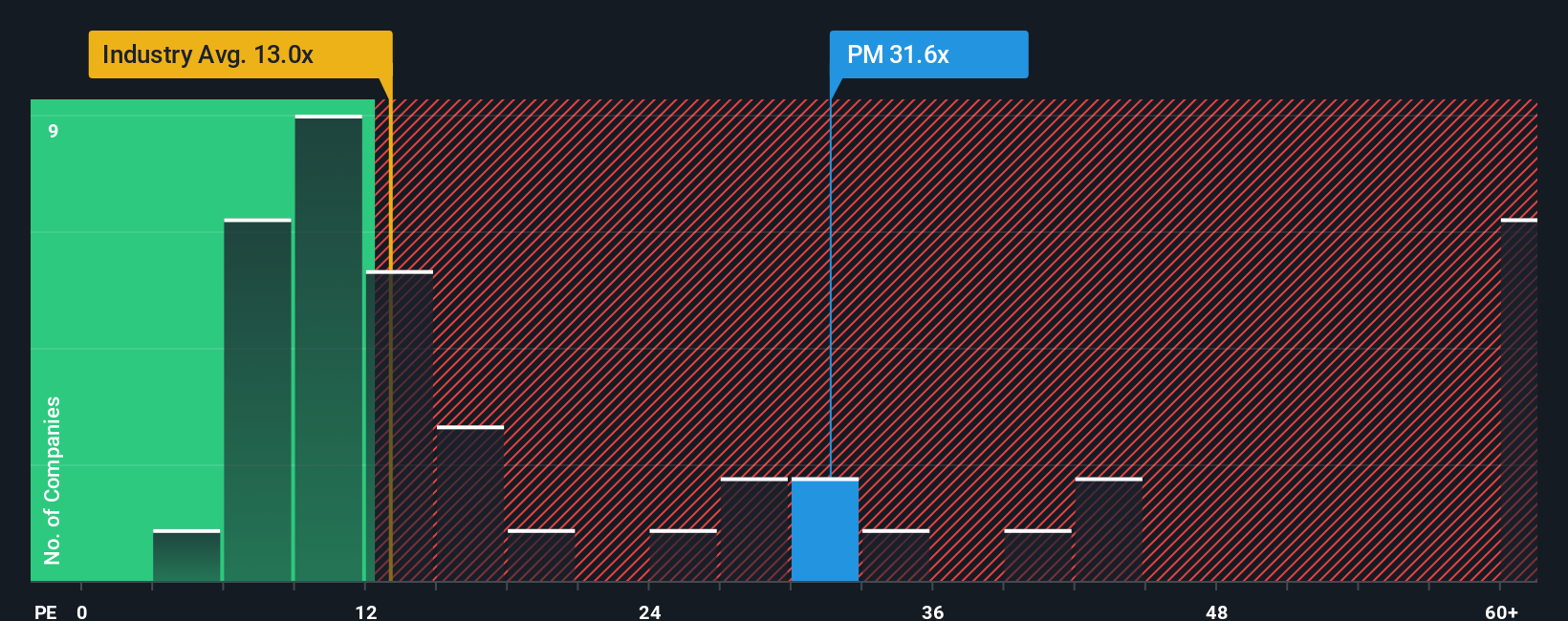

Looking at valuation through a different method, the company's current share price stands well above the industry average based on earnings multiples. This paints a less optimistic picture and raises the question of whether growth hopes are already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Philip Morris International to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Philip Morris International Narrative

If you see things differently, or want to investigate the data on your terms, you can form your own perspective in minutes. Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step confidently toward your next big opportunity by checking out other companies with real momentum. If you want to make smarter investing moves, don’t miss these handpicked stock ideas you can find using the Simply Wall Street Screener:

- Unlock high yields by scanning for shares with strong cash returns through the power of dividend stocks with yields > 3%.

- Spot fast movers in artificial intelligence and stay ahead of market trends with fresh insights from AI penny stocks.

- Target bargains that could be trading below their value by accessing unique picks within undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives