- United States

- /

- Tobacco

- /

- NYSE:PM

Is Philip Morris (PM) Using Ferrari Partnership to Reframe Its Brand or Double Down on Legacy Identity?

Reviewed by Sasha Jovanovic

- Ferrari N.V. recently announced that its subsidiary Ferrari S.p.A. has renewed and strengthened its multi-year partnership with Philip Morris International, making PMI a Premium Partner of Scuderia Ferrari HP and a Series Partner of the Ferrari Challenge Trofeo Pirelli from January 1, 2026.

- This renewed, higher-profile alliance extends a relationship of more than 50 years and reinforces PMI’s association with global motorsport and luxury branding at a time when it is reaffirming its 2025 earnings guidance of reported diluted EPS of US$7.39 to US$7.49.

- We’ll now examine how becoming a Premium Partner of Scuderia Ferrari HP could influence Philip Morris International’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Philip Morris International Investment Narrative Recap

To own Philip Morris International, you need to believe its smoke free portfolio can offset the structural decline in cigarettes while regulatory and tax pressures stay manageable. The upgraded Ferrari partnership mainly improves brand visibility and does not appear to change the nearer term earnings catalyst, which is execution in IQOS and ZYN, or the key risk of tougher regulation and taxation on nicotine products.

The Ferrari renewal comes as PMI reaffirms its 2025 diluted EPS guidance of US$7.39 to US$7.49, which keeps investor focus squarely on whether smoke free growth can support that outlook. Against a backdrop of high debt, an uncovered dividend, and premium valuation multiples, this guidance confirmation is arguably more relevant for the short term narrative than the branding uplift itself.

Yet beneath this premium branding story, there is a regulatory and tax risk that investors should really be aware of...

Read the full narrative on Philip Morris International (it's free!)

Philip Morris International's narrative projects $49.4 billion revenue and $14.5 billion earnings by 2028. This requires 8.2% yearly revenue growth and about a $6.3 billion earnings increase from $8.2 billion today.

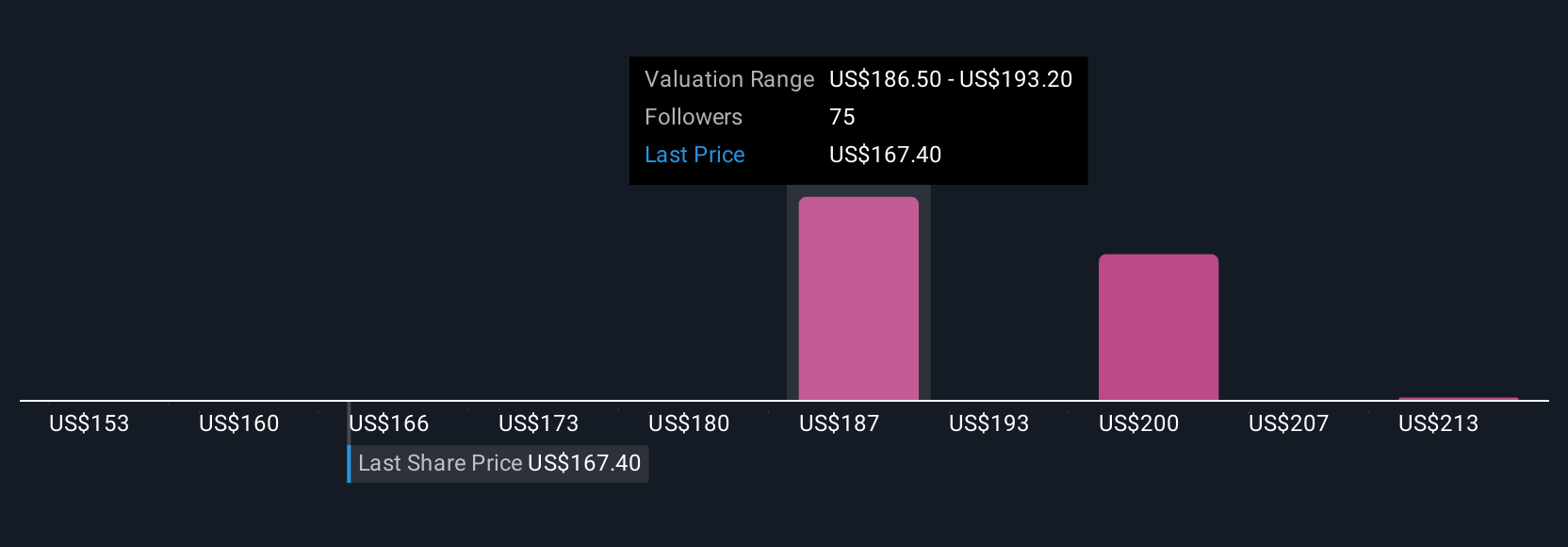

Uncover how Philip Morris International's forecasts yield a $182.94 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Compared with consensus, the most pessimistic analysts assume about US$47.1 billion in 2028 revenue and US$14.4 billion in earnings, and worry that tightening health driven regulation could blunt the benefits of deals like Ferrari, so you should recognise how widely opinions can differ and consider how this new partnership might shift those expectations over time.

Explore 11 other fair value estimates on Philip Morris International - why the stock might be worth just $153.00!

Build Your Own Philip Morris International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Philip Morris International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Philip Morris International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Philip Morris International's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PM

Good value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026