- United States

- /

- Tobacco

- /

- NYSE:MO

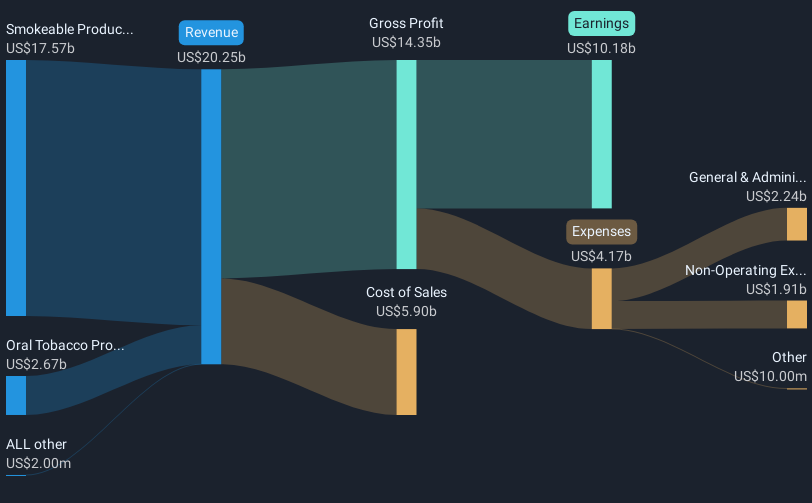

Altria Group (NYSE:MO) Reports Decline in Q1 Earnings With Net Income at US$1 Billion

Reviewed by Simply Wall St

Altria Group (NYSE:MO) reported a challenging first quarter for 2025, with declines in sales, net income, and diluted earnings per share compared to the previous year. Despite these results, the company's stock experienced a positive price move of 11% over the last quarter. This movement aligns with broader market trends, as the Dow Jones and S&P 500 extended their winning streaks. Factors such as Altria's dividend declaration and share repurchase program announcement likely supported this upward trend, contributing to the overall investor confidence amidst a general market upswing during the period.

The recent developments at Altria Group suggest mixed implications for the company. Despite a challenging first quarter in 2025 with drops in sales and earnings, its stock still rose by 11% in the last quarter, buoyed by dividend declarations and a share repurchase program. This optimistic market reaction needs to be juxtaposed against Altria’s longer-term performance, where total shareholder returns, including dividends, have surged 128.39% over the past five years. Such a robust longer-term return provides a reassuring backdrop for investors, even as they weigh the current revenue decline of 0.3% annually anticipated by analysts.

Compared to the previous year, where the company outperformed both the US Market and the Tobacco industry, the forecasted earnings reductions and the expected decline in profit margins remain a concern. Nonetheless, Altria's strong tobacco brands and effective cash flow management indicate that its future revenue and earnings may still offer growth opportunities amidst these challenges. The forecasted earnings are set to fall to US$8.9 billion by 2028, a contrast to the present US$11.24 billion, which analysts expect will align with a price target of US$57.14. With the current share price slightly above this target, at US$58.82, it signals that analysts see Altria close to its fair market value. Investors may need to consider whether ongoing regulatory challenges and the shifting landscape in smoke-free products will substantiate or unsettle these forecasts.

Review our growth performance report to gain insights into Altria Group's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives