- United States

- /

- Tobacco

- /

- NYSE:MO

Altria Group (MO): Assessing Valuation as Earnings Hype and Analyst Upgrade Drive Renewed Investor Focus

Reviewed by Kshitija Bhandaru

Altria Group (MO) stock is catching investors’ eyes ahead of its upcoming third-quarter earnings report. The company’s steady performance, along with renewed optimism from Wall Street, has clearly set the stage for heightened market focus.

See our latest analysis for Altria Group.

Momentum around Altria Group has been building, as anticipation grows for its upcoming earnings and the recent affirmation of a “Buy” rating by a major bank has helped boost the share price in recent sessions. With a year-to-date share price return of nearly 24% and a total return of 40.7% over the past 12 months, Altria’s performance has recaptured investor attention and reinforced the longer-term growth trend anchored by solid fundamentals.

If this kind of steady performance has you looking for your next idea, make sure to check out other fast-moving opportunities through our fast growing stocks with high insider ownership.

Yet with shares hovering near recent highs and expectations running high ahead of earnings, investors are left to wonder if Altria remains undervalued, or if the market is already anticipating its next leg of growth.

Most Popular Narrative: Fairly Valued

With Altria's fair value narrative estimate of $63.83 just a shade below the last closing price of $65.05, analyst consensus points to a stock trading almost exactly where expectations converge. This creates an intriguing setup, as the market price and analyst target move in tight tandem.

Altria faces challenges in the e-vapor category due to the prevalence of illicit products, which constitute over 60% of the market. This limits their ability to generate revenue from legitimate e-vapor products, impacting future revenue growth.

Curious why analysts are willing to call this price “fair” despite turbulent trends in key segments? The fair value hinges on delicate adjustments to margins and a forward earnings multiple that could surprise even the most seasoned investors. There is tension beneath the surface, but the full growth and profit story is revealed only after a deeper look at their critical projections.

Result: Fair Value of $63.83 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong performance from traditional tobacco, along with significant growth in oral nicotine brands, could offset anticipated regulatory and economic pressures.

Find out about the key risks to this Altria Group narrative.

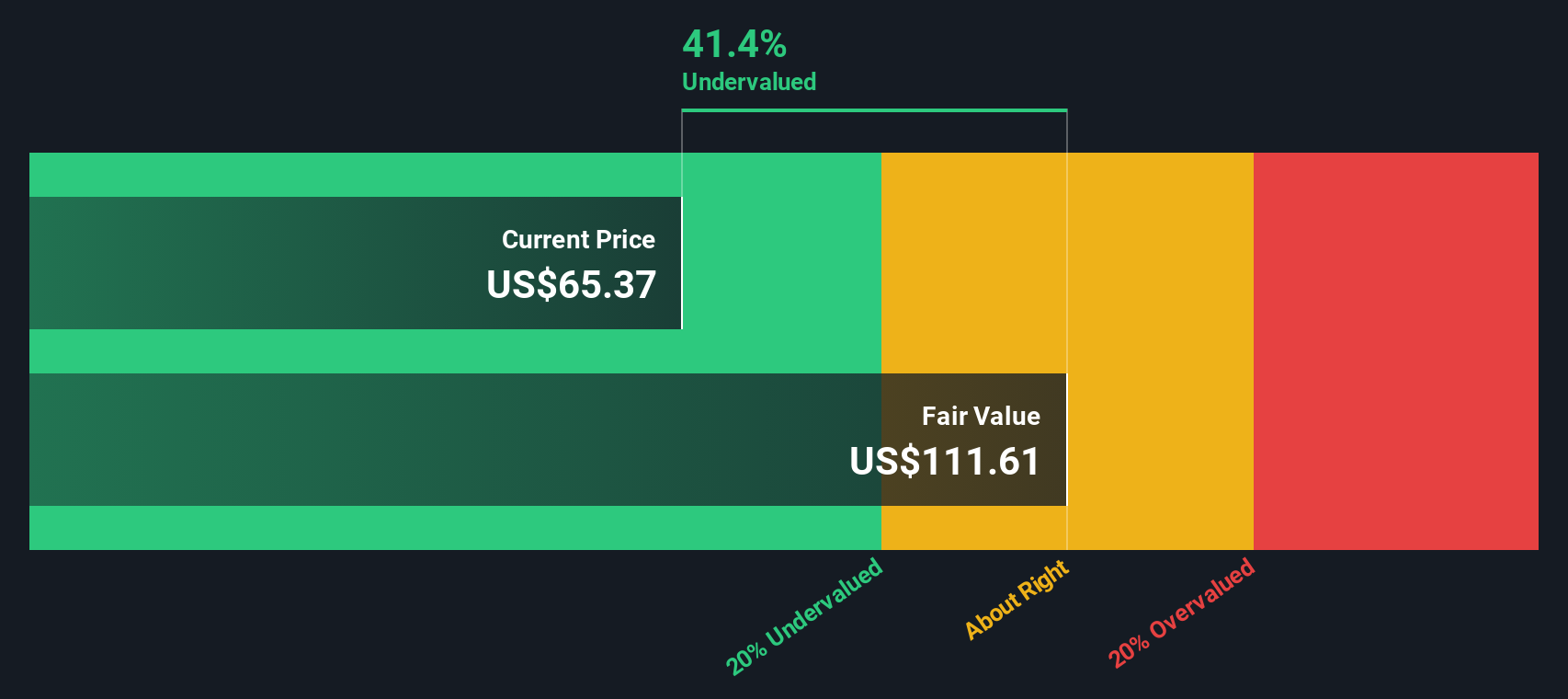

Another View: Discounted Cash Flow Signals Undervaluation

While the fair value estimate based on analyst multiples suggests Altria is priced about right, the SWS DCF model offers a different perspective. It places the fair value at $111.92, making the recent share price appear 41.9% undervalued. Does this more optimistic model reveal hidden upside, or is it too aggressive given industry headwinds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Altria Group Narrative

Prefer to weigh the numbers on your own terms? You can explore the data and build your own perspective in minutes, shaping your narrative your way. Do it your way.

A great starting point for your Altria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to find your next opportunity. Simply Wall Street’s screener tools let you pinpoint stocks with real potential that others might overlook. Don’t let an exciting pick slip through your fingers.

- Capture early growth by checking out these 3596 penny stocks with strong financials, which could turn today’s overlooked stocks into tomorrow’s standouts.

- Pounce on market inefficiencies by targeting these 877 undervalued stocks based on cash flows before the rest of Wall Street catches on.

- Tap into cutting-edge innovation as you pursue the future of finance with these 79 cryptocurrency and blockchain stocks, making waves right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MO

Altria Group

Through its subsidiaries, manufactures and sells smokeable and oral tobacco products in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives