- United States

- /

- Food

- /

- NYSE:LW

Lamb Weston (LW): Exploring Valuation After a Recent Period of Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Lamb Weston Holdings.

While Lamb Weston’s 1-day and 7-day share price returns show a bit of positive momentum, the bigger picture is more muted, with a 1-year total shareholder return of -20.3%. After a challenging stretch, sentiment suggests investors are still weighing recent risks against the company’s underlying growth drivers.

If you’re curious about other opportunities with potential beyond the food sector, now is a great moment to branch out and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and recent performance lagging, investors face an important question. Is Lamb Weston now trading at a discount that opens the door to gains, or does the current price reflect all expected growth?

Most Popular Narrative: 9.7% Undervalued

Compared to the last close at $59.61, the most popular narrative sets Lamb Weston's fair value at $66. This suggests the stock trades at a notable discount, inviting close attention to the story driving that valuation.

Lamb Weston's $250 million cost savings program, which includes operational streamlining, zero-based budgeting, and supply chain efficiency, aims to lower the cost base significantly by fiscal 2028. This could directly enhance net margins and overall profitability. Industry rationalization, as shown by the postponement or cancellation of competing international capacity projects, is likely to foster a more favorable supply-demand balance. This could restore more constructive pricing and improve gross profit and EBITDA margins after current pressures subside.

Want the inside story on the numbers behind this narrative's fair value? The key is major operational initiatives and future profit multiples shaped by significant assumptions. Discover which specific trends and forecasts are informing analyst confidence. Only in the full narrative.

Result: Fair Value of $66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price and mix headwinds, as well as slow recovery in both volume and margins, could create further challenges to the current valuation outlook.

Find out about the key risks to this Lamb Weston Holdings narrative.

Another View: Looking at Price Ratios

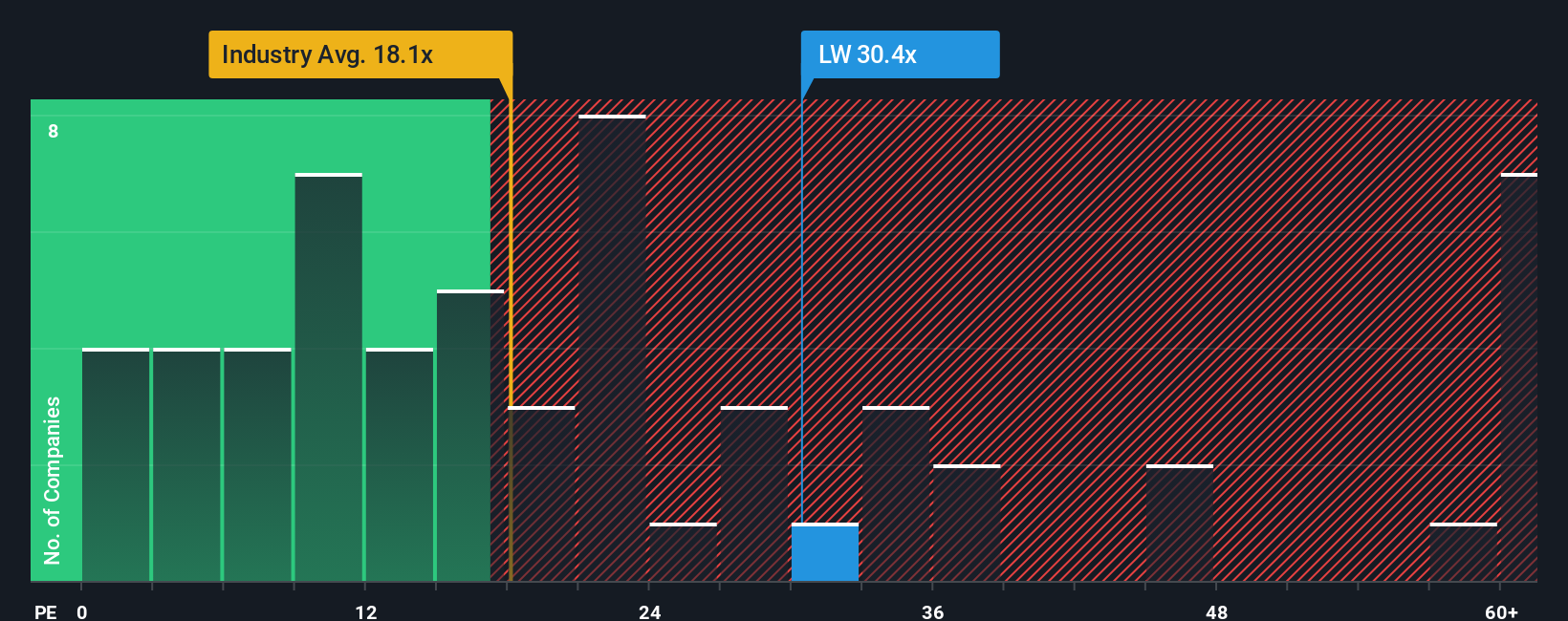

Switching perspectives, Lamb Weston’s price-to-earnings ratio stands at 28.2x. That is well above its industry peers at 12.1x and higher than a fair ratio of 23.1x. When a stock trades at a premium like this, it can raise questions about overvaluation risks or the possibility that the business may eventually align with its higher pricing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lamb Weston Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your strategy and supercharge your portfolio by checking out unique stocks curated for real potential. Don’t risk missing out on what could be your next big winner.

- Target steady growth and strong yields when you scan these 15 dividend stocks with yields > 3%, which deliver reliable income above 3%.

- Spot game-changing potential and transformative innovation as you browse through these 25 AI penny stocks, which are shaking up the AI sector.

- Unlock exciting opportunities built on real value by searching for these 925 undervalued stocks based on cash flows, which could be trading below fair worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success