- United States

- /

- Food

- /

- NYSE:LW

Does the Recent 22.5% Slide Signal Opportunity in Lamb Weston Holdings for 2025?

Reviewed by Bailey Pemberton

- Wondering if Lamb Weston Holdings might be a hidden value play, or if the recent stock swoon is justified? You are definitely not alone in wanting clarity on whether this stock's price reflects real opportunity or risk.

- The stock has seen a lot of movement lately, with shares dropping by 8.7% over the past week and posting a 22.5% slide over the last year. This hints at shifting investor sentiment and the potential for a rebound or further downside.

- Recent headlines have increased the focus on the stock, as analysts and market watchers react to shifting trends in the food industry and changing demand signals for Lamb Weston's core products. Conversations around global supply chain adjustments and commodity pricing have further amplified the spotlight on what is driving these sharp moves.

- With only a 2 out of 6 valuation score, there is real debate over how attractively priced Lamb Weston is today. We'll explore what those valuation metrics mean and, by the end, show you an even deeper way to assess if the value story stacks up.

Lamb Weston Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lamb Weston Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future free cash flows and discounting them back to today's dollars. This approach gives investors a sense of what the business is fundamentally worth, independent of short-term market swings.

For Lamb Weston Holdings, the latest reported Free Cash Flow is $136.7 Million. Analysts forecast strong growth in cash generation, projecting annual free cash flow to climb to $939 Million by 2030. These projections begin with direct analyst estimates for the next five years and extend further using extrapolation methods. All values are considered in US Dollars ($).

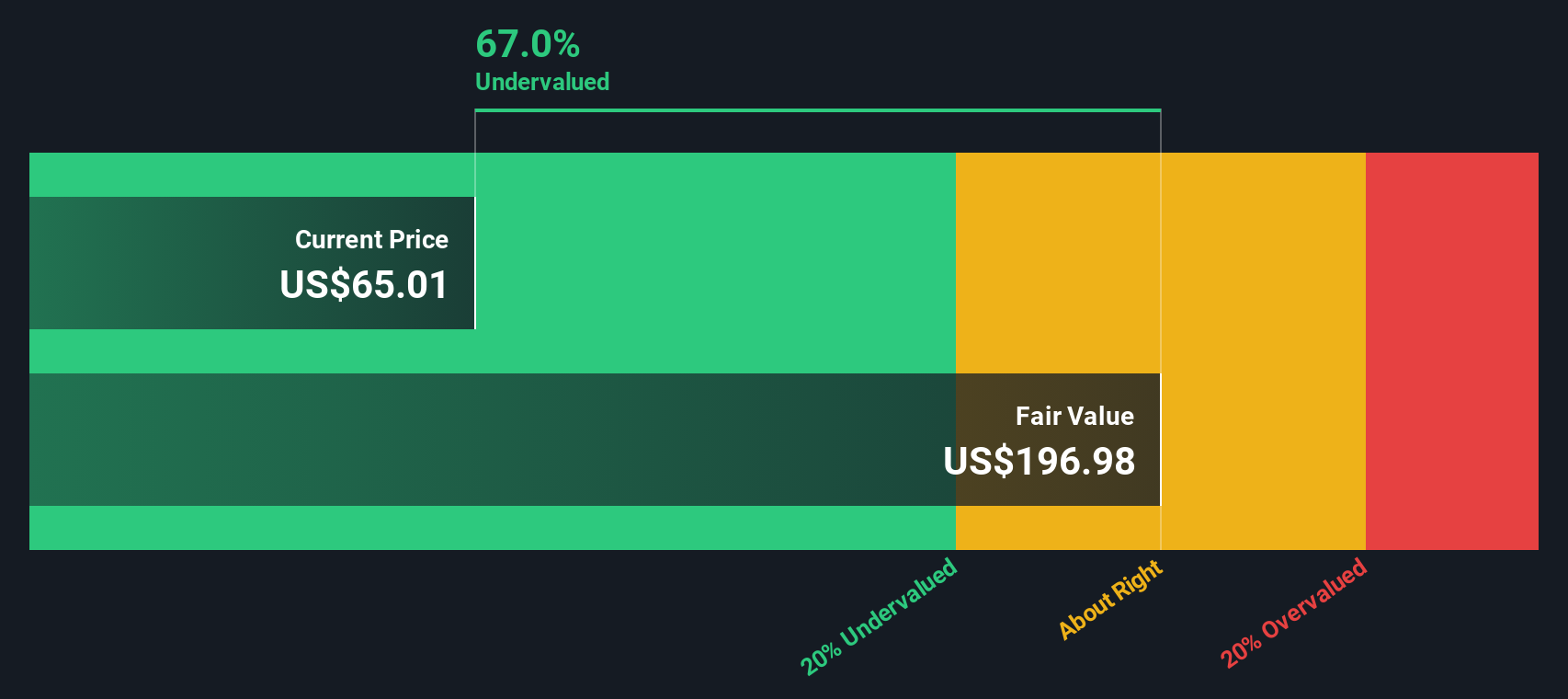

By discounting these projected cash flows using the 2 Stage Free Cash Flow to Equity model, the estimated fair intrinsic value of Lamb Weston Holdings stands at $195.07 per share. Compared to the company's recent market price, this valuation suggests the shares are currently trading at a 70.8% discount to their intrinsic value. This may indicate that the stock is significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lamb Weston Holdings is undervalued by 70.8%. Track this in your watchlist or portfolio, or discover 877 more undervalued stocks based on cash flows.

Approach 2: Lamb Weston Holdings Price vs Earnings

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is one of the most widely used and effective valuation metrics. It relates a company’s share price to its earnings per share, giving investors a quick gauge of how much they’re paying for each dollar of profit generated by the business.

The “right” or “fair” PE ratio for a stock is shaped by a mix of factors, including earnings growth expectations, perceived business risk, and overall market sentiment. Faster-growing or lower-risk companies typically command higher PE ratios, while slower-growing or riskier firms tend to trade at lower multiples.

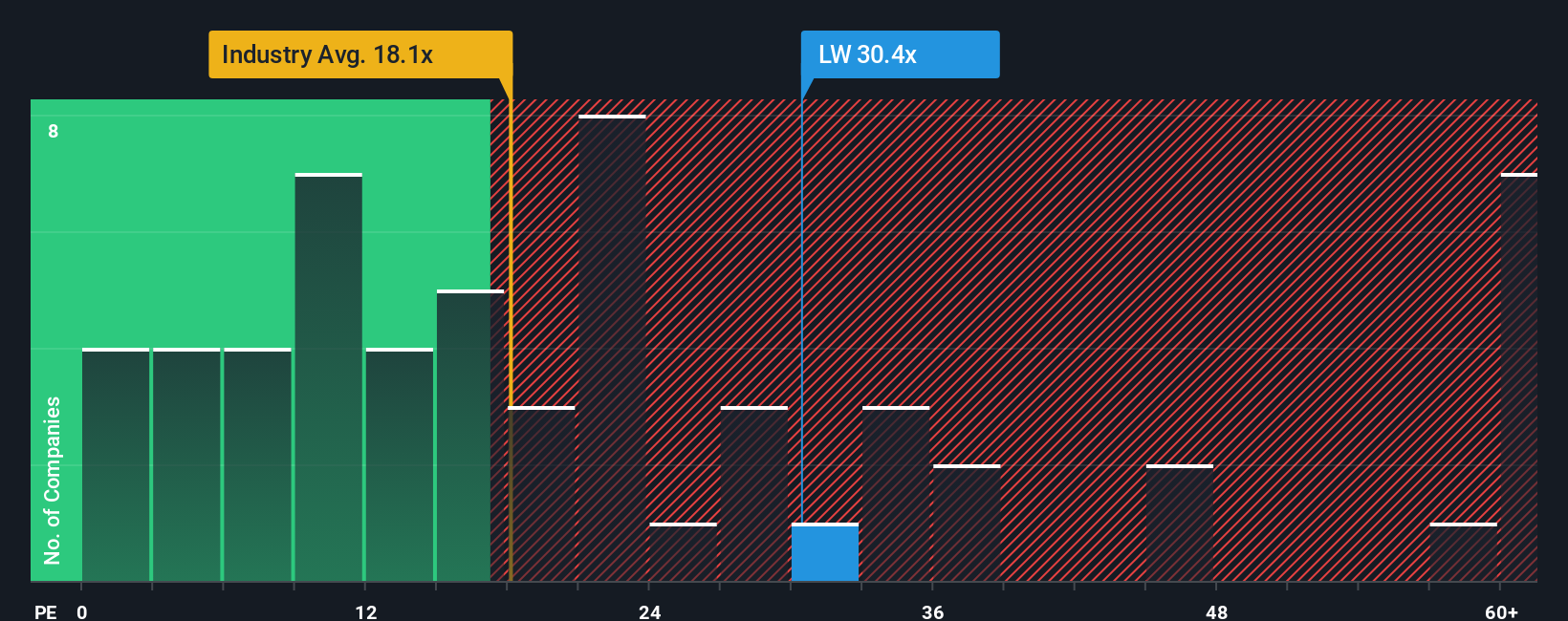

Lamb Weston Holdings currently trades at a PE ratio of 27.0x, which sits above both the food industry average of 18.5x and the peer average of 10.6x. At first glance, this premium might seem to signal overvaluation. However, headline comparisons like these often miss subtle but important factors unique to each business. That is where Simply Wall St’s “Fair Ratio” comes in. It incorporates not just growth and profitability but also the company’s industry, market capitalization, profit margins, and risk profile to determine what a truly reasonable multiple should be for Lamb Weston.

According to this methodology, Lamb Weston’s Fair PE Ratio is calculated at 23.0x. Since the company’s actual PE is only moderately higher than its Fair Ratio by less than a 0.10 absolute difference, it suggests the valuation is largely in line with what would be expected given its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lamb Weston Holdings Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful concept that allows you to tell your story about a company by setting your own expectations for future revenue growth, profit margins, and fair value, backing up your perspective with numbers instead of just opinions.

With Narratives, you link the company’s real-world story, such as new product launches, industry dynamics, or leadership changes, to your financial forecasts and then see how that translates into a fair value and investment decision. Narratives are accessible to everyone on Simply Wall St’s platform in the Community page, empowering millions of investors to analyze stocks on their own terms.

Thanks to their dynamic nature, Narratives automatically update when new insights, news, or results are posted, so your analysis stays relevant as fresh information emerges. Narratives help you decide when to buy or sell by comparing your own Fair Value to the current Price, so you are always investing in line with your convictions.

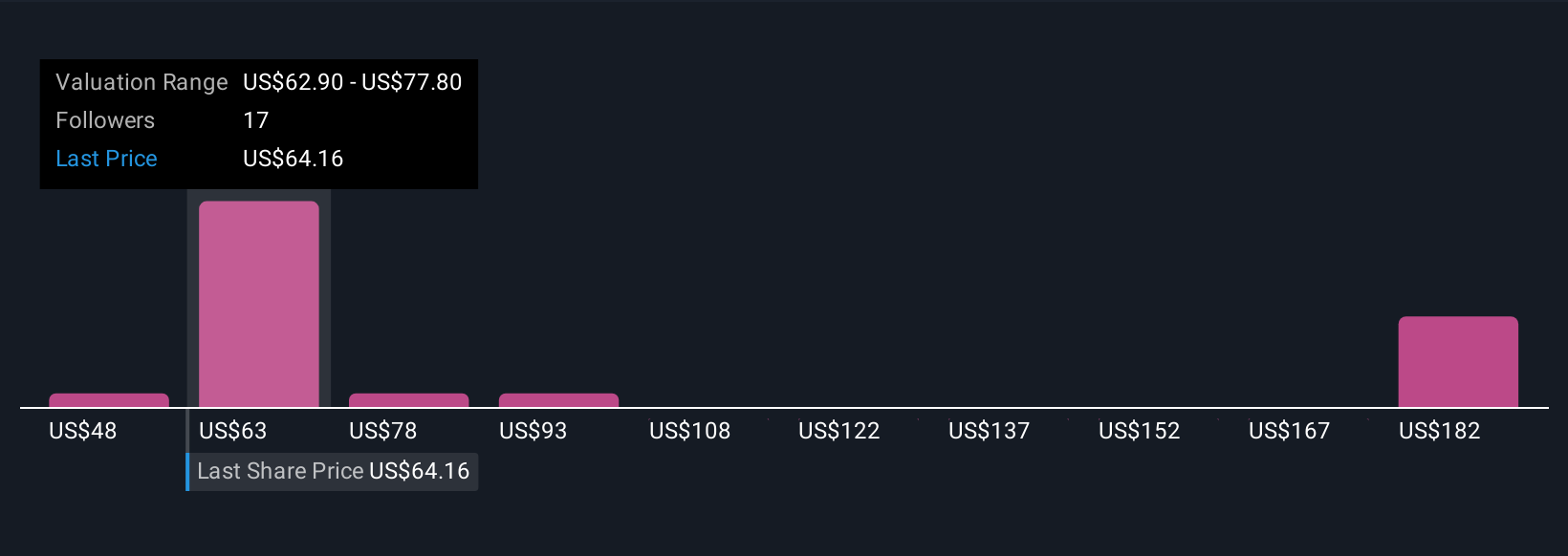

For example, one Lamb Weston Holdings Narrative might forecast robust recovery in revenue and margin expansion, justifying an $80 fair value, while another might project lower long-term demand and margin pressure, resulting in a $57 target. This lets you evaluate and learn from the full spectrum of investor perspectives.

Do you think there's more to the story for Lamb Weston Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LW

Lamb Weston Holdings

Engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives